Loans for a range of credit scores

Check If You Qualify

With no impact on your credit score!

Check If You Qualify with no impact on your credit score!

*Subject to lending criteria, T's and C's'

*Subject to lending criteria, T's and C's'

Funds in 60s

to PAYID Enabled Banks

Not all banks or bank accounts are PayID enabled. To find out more information about PayID and how it works, please visit https://payid.com.au/ or contact your bank.

Why Jacaranda Finance

Jacaranda Finance is the savvy lender that can meet your personal loan needs even if you don't have a perfect credit score. So be savvy with your time and apply now so we can get you an outcome.

No matter what life throws your way, a Jacaranda Finance personal loan can help get you through it.

Whether you're after $5,000 to buy new white goods or $25,000 for home improvements, taking out a secured or unsecured personal loan can help you out. We've made our application process as straightforward as possible and, if your application is approved, our 60-second3 transfers mean you can use your cash almost instantly.

3. You must have an NPP-enabled bank account to receive the money within 60-seconds. For customers without an NPP-enabled bank account (or the instant payment fails), the money will be available overnight on weekdays and overnight the following business day if approved on a weekend or public holiday.

$5,000 to $25,000

24 months to 48 months

Fixed

Weekly, fortnightly or monthly

Customers who pay their loan out early do not incur any additional fees or charges for doing so. Fixed fees that have already been incurred are due and payable.

We Make Applying Easy

We know how important it is to receive your funds in a timely manner. As a hard-working Australian, you don’t have time to waste on needless paperwork.

That’s why our loan application process has been perfected over time to be as simple and quick as possible.

Award-winning lender

Why choose a Jacaranda Loan?

We’re a fast, reliable and fair lender that’s been helping Aussies since 2014 - here's why we think you should choose us.

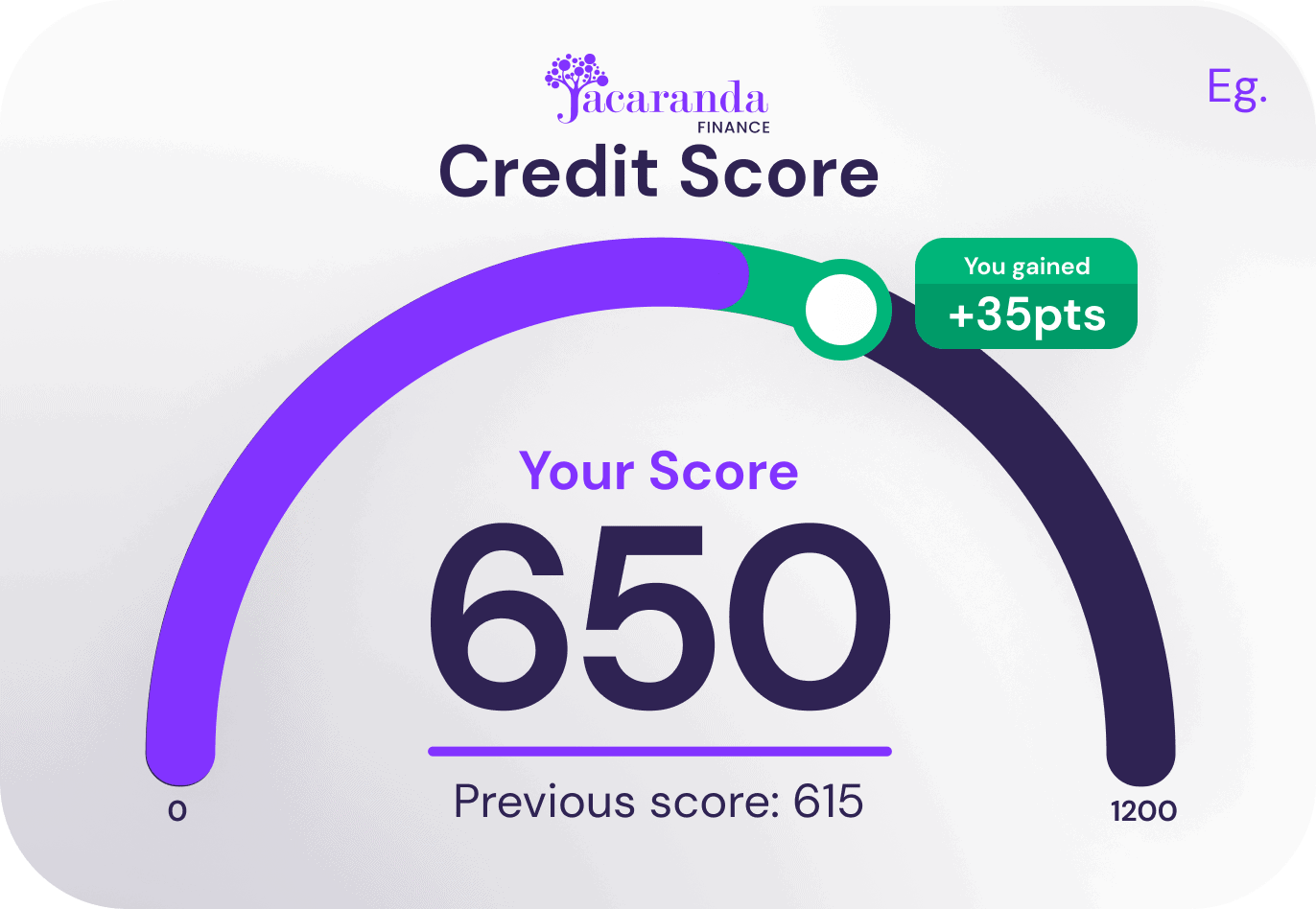

We could help your credit score improve

We’re a part of the Comprehensive Credit Reporting (CCR) regime, which makes it much easier to build your credit history and credit score. By making your loan repayments on time and in full, we can communicate this positive repayment information to the credit bureaus, which could help improve your credit score over time.

Find out more about how Comprehensive Credit Reporting works here.

Trusted by 1,000s

Personal Loans Online Up To $25,000

Money in your bank account and ready to use in 60-seconds3 once approved.

Most customers have a New Payments Platform (NPP) bank account and receive the money in their bank account within 60 seconds. For other customers, the money will be available overnight on weekdays and overnight the following business day if approved on a weekend or public holiday.

Frequently Asked Questions

Want to know more? Find out the answers to the most common queries about our loans here.

It's possible to receive a loan offer from us if you have 'bad credit'. We offer fast and reliable personal loans for applicants with varying credit histories. If you're in a good financial position and handling your existing financial commitments comfortably, check if you're eligible and submit an application.

We accept a wider range of credit history than a bank or a prime lender. But we do not recommend submitting an application if you're currently or recently bankrupt (you must be three years discharged and in control of your finances) or if you are not comfortably repaying your existing financial obligations.

A loan with Jacaranda Finance is a flexible option you can use to pay for some of life's biggest expenses: planned or unexpected.

Here are some of the most common reasons our customers take out a loan:

Once you've been approved and have accepted our offer by signing your digital contract, we automatically attempt to release the money to your bank account. Most customers have a New Payments Platform (NPP) bank account and receive the money within 60 seconds.3

You must have an NPP-enabled bank account. For customers without an NPP-enabled bank account (or the instant payment fails), the money will be available overnight on weekdays and overnight the following business day if approved on a weekend or public holiday.

We require bank statements from you to get an insight into your spending habits and to verify your income and expenses. We want to ensure that you can comfortably afford our loan repayments.

Need a hand?

Our customer service team are here to help.

If you have any questions, whether you're a new customer or an existing one - our friendly customer service team will be happy to help you. Our customer service team is 100% Australian-based in Brisbane: at Jacaranda, you speak to a real human being every time.