Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

*Subject to lending criteria, T's and C's'

*Subject to lending criteria, T's and C's'

Most lenders are closed on the weekend, but not Jacaranda Finance! We're 100% online and are open until midday most Saturdays. We're available to help you in a flash when life gets in the way.

You can check out our contact details and opening hours here.

Pretty quickly! As a hard-working Aussie, you don’t have time to waste on needless paperwork. That’s why our loan application process has been perfected over time to be as simple and fast as possible.

With a Jacaranda Weekend Loan, you can:

What’s more, you can check if you qualify for one of our loans without impacting your credit score at all!

Check if you qualify for one of our Personal Loans today!

Our loans are designed to be fast, fair, and, above all, affordable, with no hidden fees. See the table below for a quick guide to our charges, or visit our fees page to learn more. For detailed information about who our products are designed for, please review our Target Market Determinations.

With fixed repayments and both secured and unsecured loan options, you could use one of our loans for any of these common reasons and more:

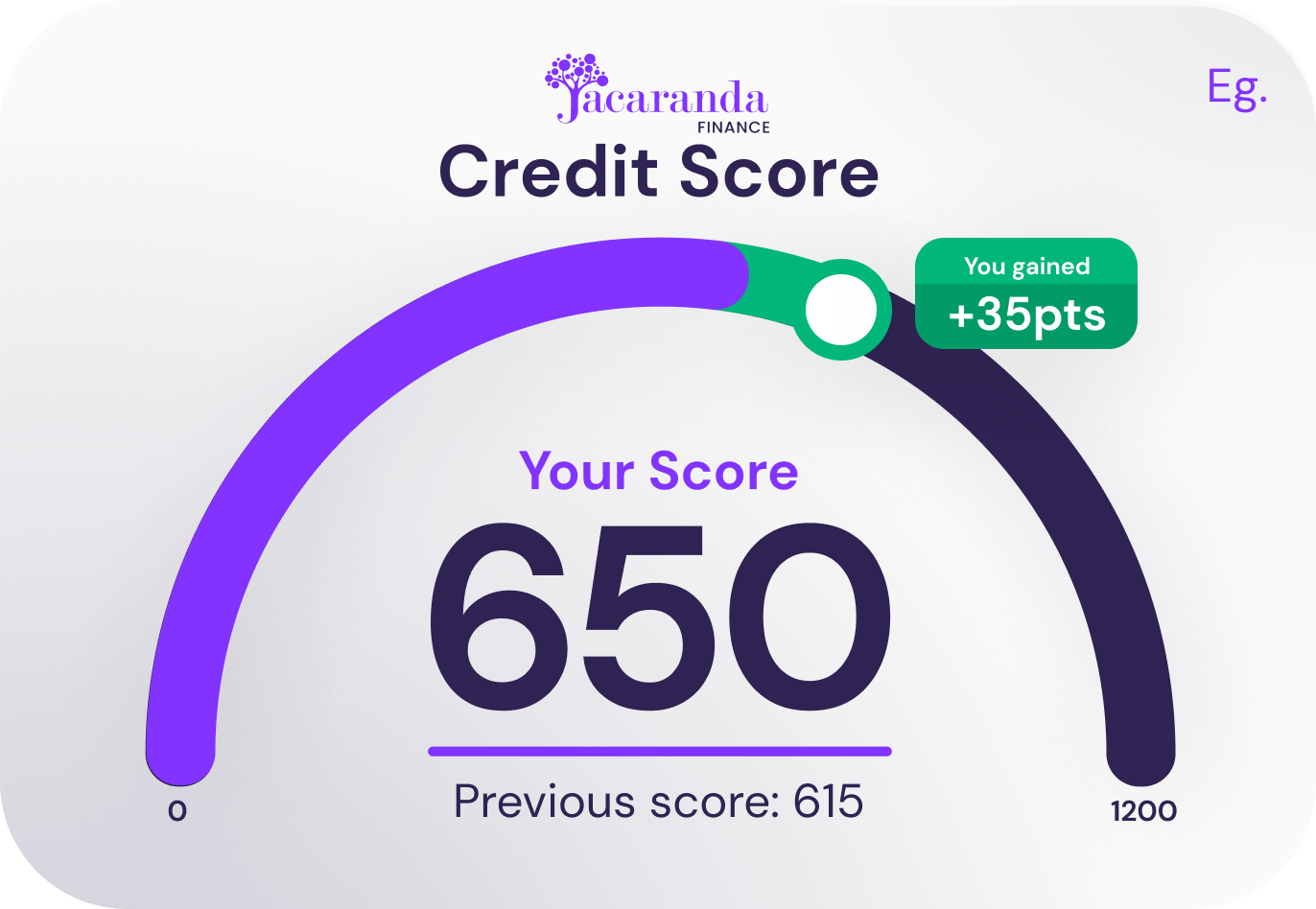

Check your credit score for free with Jacaranda. Monitor your score every month and know where you stand to unlock new financial opportunities in the future.'

Download the Better Credit app using the links below and follow the prompts to check your credit score today.

Jacaranda Finance is reporting data under the Comprehensive Credit Reporting (CCR) regime.

With CCR, we will now provide a more detailed and comprehensive view of your credit history to credit bureaus.

This means that your credit behaviour, such as making timely repayments and managing your loans responsibly, will be reported, potentially strengthening your credit profile.

You may also have improved access to more competitive loan products, better loan terms and increased transparency in your credit information.

Want to learn more about our Personal Loans and how they work? Find out all the answers to our most common questions here.

Your credit score, also known as a credit rating, is a score given to you based on your borrowing history from credit providers, ranging from 0 to 1,200.

When you apply for a credit product (such as a home loan, car loan or credit card), your credit score can essentially act as a numerical representation of your trustworthiness and reliability as a borrower.

Yes, you can check your credit score for free with the Better Credit app. The app allows you to sign up and check your score in just a few minutes, whether you're a customer of Jacaranda Finance or not. It's designed to be an easy and secure way to monitor your financial health.

If you prefer, you can also log in to your online customer portal and check your credit score there.

For detailed information about who our products are designed for, please review our Target Market Determinations.

Use our loan repayment estimate calculator to get a guide on what your repayments could be. To get an idea of what rates, fees and charges are associated with our loans, visit our rates and fees page.We only accept loan applications online via our online application form on our website or the Better Credit app. We're 100% online, so there are no other ways to submit an application.

If you're considering applying for a loan with Jacaranda, you can first check if you qualify in a way that does not affect your credit score.Before you formally apply with Jacaranda, you can check if you qualify for a loan in a way that does not impact your credit score. We do this by performing a 'soft' credit check that is only visible to you.

If you don't meet our initial criteria, your credit score won't be affected.

Once you've checked your eligibility and we've let you know that you do qualify for a loan, you have the option to move forward with a full application.

We will perform a credit assessment during this process, which involves checking your credit report. By submitting a full application, you authorise Jacaranda Finance to obtain a copy of your full credit file, referred to as a 'hard' credit check.

Other lenders will be able to see that you applied for a loan with Jacaranda.

This might impact your credit score.

Review our Privacy Policy for more information.

Repayments on your loan are automatically set up to be deducted via direct debit from your bank account in line with your pay cycle.

You can view your repayments from either the Better Credit app or online portal and contact our friendly customer service team to request any changes that you need.

Download the app on the Google or Apple store today.

Read more: Personal Loan Repayments 101.