QualifyCheck by Jacaranda Finance

At Jacaranda Finance, we’re all about making your life easier and don’t want to waste your time if you're looking for a loan. We think it's fair to give you the ability to check if you qualify for one of our products without impacting your credit history.

That’s why we’ve introduced our new ‘QualifyCheck’ feature as a part of our application process.

What is QualifyCheck?

QualifyCheck is one of our key application features and is a part of our application process when you get started. When you're considering applying with Jacaranda, QualifyCheck lets you check if you qualify for one of our loans in a way that does not impact your credit score.

If you meet our eligibility criteria, we'll let you know on the spot. You can then choose to move forward with submitting an application.

How is this different to other lenders?

Generally speaking, in Australia, applying for a loan often does impact your credit score. When you submit an application, a lender or credit provider will almost certainly conduct a hard credit check automatically as part of their application process.

This will result in a credit enquiry appearing on your credit report. As each lender has its own different eligibility requirements, this can be a real pain if all you're trying to do is find out if you can get the loan in the first place.

While making an application here and there generally won't impact your credit score, doing so too often could result in it dropping.

How to apply with Jacaranda Finance

Already checked if you qualify? If you're ready to apply, our loan application process has been perfected over time to be as simple and quick as possible. You can:

- Apply in just 5-12 minutes1 (depending on your circumstances)

- Receive a same-day outcome2 on your application

- If approved, get your money within 60 seconds3 (NPP-enabled bank accounts only)

How does QualifyCheck work?

QualifyCheck is a part of our application process, and lets you check your eligibility before you formally submit an application for a loan. Once you begin an online application with Jacaranda, either through our website or FastMoney app, we'll be able to perform a quick check on whether you might qualify or not.

When you check if you qualify, we can access your credit file in a way that does not impact your credit score, and that is not disclosed to anyone other than yourself. You will get a notification if you have alerts set up on your credit file. This is called 'file access', and is different to a 'full credit enquiry'.

Once you’ve checked if you qualify, and in the case that you do qualify, you have the option to submit your application to Jacaranda to perform a credit assessment. By submitting a full application, you authorise Jacaranda Finance Pty Ltd to obtain a copy of your full credit file.

Other lenders will be able to see that you applied for a loan with Jacaranda.

Does QualifyCheck guarantee loan approval?

This eligibility assessment is not an approval. Based on the information you provide us, we can indicate that you qualify for a product based on what you have stated to us.

We will then complete an assessment and verify the information you provided, which may result in your application being unsuccessful. If you proceed with the credit assessment, we may do a hard enquiry on your credit file, which may impact your credit score.

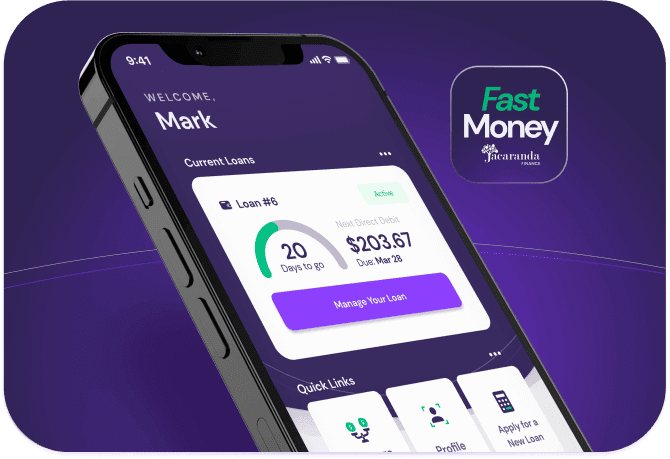

It's faster with the FastMoney App!

- Easily apply for and manage your loan in-app

- Fast same-day loan outcomes2

- Make extra repayments, check your balance & more

- Easy access to our customer service team

Check your repayments first

It’s important to be confident you can meet potential loan repayments before moving ahead with an application. Use our easy three-step loan repayment calculator to estimate your repayments before you apply.

Ready to Apply? You can get started now.

Including Interest & Fees

Ready to Apply? You can get started now.

Boost your credit score fast with Comprehensive Credit Reporting

Jacaranda Finance also reports data under the Comprehensive Credit Reporting (CCR) regime.

This is yet another way we could help build your creditworthiness: by applying for and repaying one of our loans on time, your credit score could increase faster than ever.

Learn more about how Comprehensive Credit Reporting with Jacaranda could help you.

How else can you protect your credit score when applying for a loan?

If you want to keep your credit score where it is, there are a number of ways you can make that happen when applying for a loan (besides QualifyCheck, that is).

Featured Articles

Jacaranda Finance FAQs

Read some of our most frequently asked questions below to learn more about Jacaranda and our products.

You can apply for varying loan amounts with Jacaranda, depending on your needs. With our Express Personal Loan, you can borrow between $5,000 and $25,000.

For detailed information about who our products are designed for, please review our Target Market Determinations.

Use our loan repayment estimate calculator to get a guide on what your repayments could be. To get an idea of what rates, fees and charges are associated with our loans, visit our rates and fees page.

The good news is, being a 100% online lender, you may submit an application with Jacaranda 24/7, 365 days a year. You can apply in as little as 5-12 minutes1 via our online application form or FastMoney app.

If you need assistance or can't find the answers to your questions before you decide to apply, simply contact our customer service team during normal business hours, and they will be happy to assist you.

The basic eligibility criteria you must meet before submitting an application:

- Be at least 19 years of age.

- Be employed on a permanent or casual basis.

- Have a consistent income going into your own bank account for the last 90 days.

- Be in control of your finances and be handling existing financial commitments comfortably.

- Be an Australian citizen or permanent resident with a fixed address.

- Have an active email address, phone number, and online banking account in your name that belongs to you.

We accept a wider range of credit history than a bank or a prime lender, but we do not recommend submitting an application if:

- You are currently or recently bankrupt (you must be three years discharged and in control of your finances)

- You are not comfortably repaying your existing financial obligations

The interest rate, fees and charges applied to your loan will depend on your individual circumstances and the information verified during the loan assessment. It will also depend on our assessment criteria, loan amount, and loan term for which you qualify.

Use our loan repayment estimate calculator to get a guide on what your repayments could be. To get an idea of what rates, fees and charges are associated with our loan products, visit our rates and fees page.

Yes, you can cancel your loan application at any point. Simply contact our application concierge team, and they will be able to assist you. Alternatively, reply to any SMS or email we have sent you to withdraw your application.

If you've already received your funds, we offer a 48-hour cooling-off period for all loan products. Anyone unsatisfied with their loan for any reason can return the total principal funds, including any payments made to third parties on your behalf, within a 48-hour cooling-off period and cancel their loan.4