Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

Every year, the banks fail millions of Aussies who need to borrow money. This is often purely because they don't have a high credit score, even if they've been good with money lately.

We think that's unfair, as your credit score doesn't define you. So, when that happens to you, come and talk to us.

We're an Australian-owned, operated, fully online digital lender providing fast and flexible loans.

Click here to learn more about what makes Jacaranda great!

Comprehensive Credit Reporting (CCR for short) refers to sharing more comprehensive customer information between credit providers and credit reporting bodies. Sometimes known as Positive Credit Reporting, it means someone's positive credit behaviour can now be seen on their credit report, such as:

And more. Previously, credit reports only flagged negative credit behaviours, such as missed repayments, hard credit inquiries, payment defaults, infringements, and more. This was sometimes called 'Negative' Credit Reporting and wasn't as thorough.

Positive information being available to credit providers can result in more accurate assessments of your suitability for finance products and give them more insight into your creditworthiness, as they'll have a better picture of your repayment history and ability to manage your finances.

Jacaranda Finance is reporting data under the Comprehensive Credit Reporting regime.

With CCR, we will now provide a more detailed and comprehensive view of your credit history to credit bureaus.

This means that your credit behaviour, such as making timely repayments and managing your loans responsibly, will be reported, which could potentially strengthen your credit profile.

You may also have improved access to more competitive loan products, better loan terms and increased transparency in your credit information.

If you've been rejected by a bank, we have a range of tools and features that could help you improve your credit score and increase your chances of getting approved next time.

CCR could help you in a number of ways, which we’ve summarised below.

For a more detailed overview of both the pros and cons of CCR, see our article here.

Here are the answers to some of our most frequently asked questions.

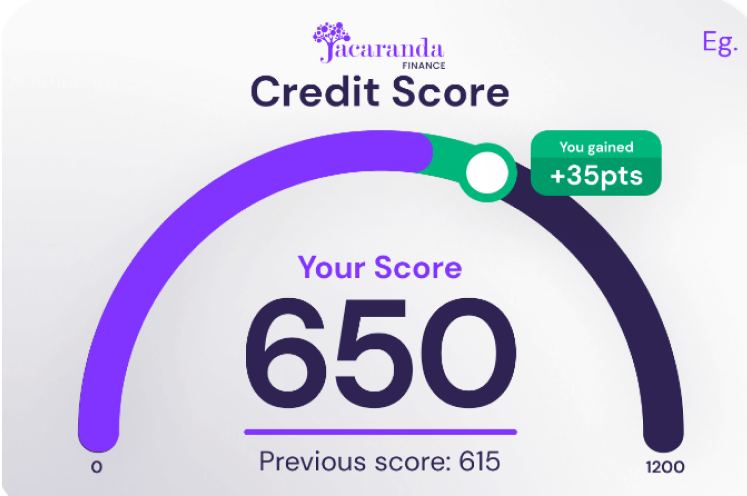

Your credit score, also known as a credit rating, is a score given to you based on your borrowing history from credit providers, ranging from 0 to 1,200.

When you apply for a credit product (such as a home loan, car loan or credit card), your credit score can essentially act as a numerical representation of your trustworthiness and reliability as a borrower.

The key difference between a credit score and a credit report lies in the detail and purpose of the information provided.

A credit score is a single number, typically ranging from 0 to 1200, which summarises your creditworthiness based on your credit history. On the other hand, a credit report provides a detailed history of your credit activities, including personal information, credit accounts, repayment histories, and more.

While your credit score gives a quick snapshot of your financial reliability, your credit report offers a comprehensive look at your credit behaviour over time.

Yes, you can check your credit score for free with the Better Credit app. The app allows you to sign up and check your score in just a few minutes, whether you're a customer of Jacaranda Finance or not. It's designed to be an easy and secure way to monitor your financial health.

If you prefer, you can also log in to your online customer portal and check your credit score there.

Nothing! Checking your credit score with us is entirely free!

Checking your credit score with us will not affect it in any way. We use a 'file access' to retrieve your credit information from Equifax, which is different from a 'full credit enquiry' and will not appear on your credit report.

You can apply for varying loan amounts with Jacaranda, depending on your needs:

For detailed information about who our products are designed for, please review our Target Market Determinations.

Use our loan repayment estimate calculator to get a guide on what your repayments could be. To get an idea of what rates, fees and charges are associated with our loans, visit our rates and fees page.

You must meet the following basic eligibility criteria before submitting an application:

If you are unsure whether you're eligible, you can check if you qualify initially. This will not impact your credit score.

We accept a wider range of credit history than a bank or a prime lender, but we do not recommend submitting an application if:

Visit our rates and fees page to get an idea of the costs associated with our loan products.

The interest rate, fees and charges applied to your loan will depend on your individual circumstances and the information verified during the loan assessment. It will also depend on our assessment criteria, loan amount, and loan term for which you qualify.

Use our loan repayment estimate calculator to get a guide on what your repayments could be.

We only accept loan applications online via our online application form on our website or the Better Credit app. We're 100% online, so there are no other ways to submit an application.

If you're considering applying for a loan with Jacaranda, you can first check if you qualify in a way that does not affect your credit score.Yes, you can cancel your loan application at any point. Simply contact our application concierge team, and they will be able to assist you. Alternatively, reply to any SMS or email we have sent you to withdraw your application.

If you've already received your funds, we offer a 48-hour cooling-off period for all loan products. Anyone unsatisfied with their loan for any reason can return the total principal funds, including any payments made to third parties on your behalf, within a 48-hour cooling-off period and cancel their loan.4