Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

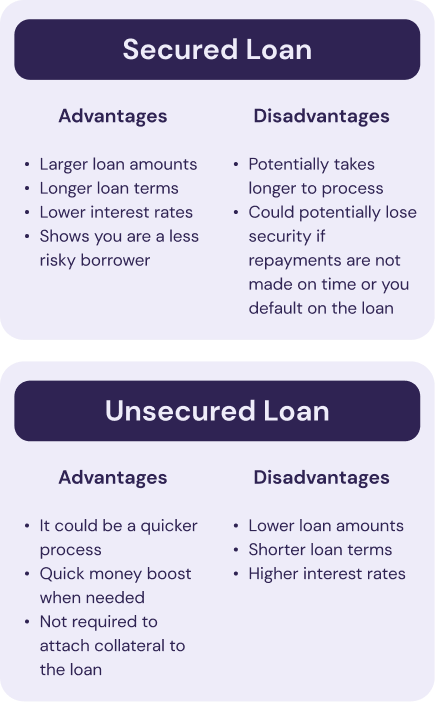

A Secured loan is a type of loan that requires collateral, aka security. This means that you'll need an asset - usually a vehicle - to attach to the loan. If you cannot repay the loan, the lender can possess the asset and sell it to compensate for its loss.

By adding security to your loan, you will generally be considered a less risky borrower and could be considered for a larger loan amount and more competitive loan terms as a result.

At Jacaranda Finance, we offer Secured Loans for amounts between $3,000 and $25,000.

Our Express Personal Loan is a fast finance solution to help everyday working Australians with large-sized expenses. Even though securing your loan will require slightly more information, we'll only ask for the necessities. With loan terms of up to 36 months and flexible repayment options, we make it easy to pay for life's big costs.

Let Jacaranda unlock the new financial you!

A Secured Loan with Jacaranda is a safe way to borrow for some of life’s key expenses, such as:

Get in the driver's seat with a Jacaranda Finance Secured Car Loan. Apply today and access up to $25,000 for your next set of wheels.

Our loans are designed to be fast, fair, and, above all, affordable, with no hidden fees. See the table below for a quick guide to our charges, or visit our fees page to learn more. For detailed information about who our products are designed for, please review our Target Market Determinations.

We offer both Secured and Unsecured Loans, which are loans that don’t require an asset to be attached for security. This means you won't have anything repossessed if you can't pay off the loan, but you might have a smaller loan limit.

At Jacaranda Finance, you can borrow between $3,000 and $25,000 with an Unsecured Loan.

Read more: 5 Differences Between Secured and Unsecured Loans

Applying for a Secured Loan with Jacaranda is as simple and quick as possible, as we know how important it is to receive your funds in a timely manner.

You can easily apply online now or download the Jacaranda Better Credit app and get started today!

Before you apply for a loan, we think it's important to review your budget and be certain that you can comfortably repay it.

Once you know what you can afford in your budget, use our three-step loan repayment calculator to estimate your repayments before you apply.

Ready to Apply? You can get started now.We Make Applying Easy

We know how important it is to receive your funds in a timely manner. As a hard-working Australian, you don’t have time to waste on needless paperwork.

That’s why our loan application process has been perfected over time to be as simple and quick as possible.

Want to know more? Here are some of our most frequently asked questions about our Secured Loans.