Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

*Subject to lending criteria, T's and C's'

*Subject to lending criteria, T's and C's'

Quick find topics on this page

'Bad credit' isn't a technical term, and there is no definitive definition of it. A bad credit history is any credit history that prevents you from getting the loan you need from a particular lender.

A bad credit loan is a term used to describe a type of loan for people with a less-than-ideal recent credit history. We don’t specifically offer 'bad credit loans': we offer fast and reliable loans for applicants with varying credit histories.

When we assess your application, we do consider your credit history. However, we also take into account your current financial position by considering factors like your income, your expenses, and how you handle your current financial commitments.

Our loans are designed to be fast, fair, and, above all, affordable, with no hidden fees. See the table below for a quick guide to our charges, or visit our fees page to learn more. For detailed information about who our products are designed for, please review our Target Market Determinations.

Improving your credit score can be challenging and time-consuming. It can also be a vicious spiral. That's where we come in.

At Jacaranda, we want to help you unlock your true financial potential. You could boost your creditworthiness over time by applying for and repaying a loan with us

You can check if you qualify before officially applying using our QualifyCheck technology, which does not affect your credit score.

When you check if you qualify, we can access your credit file in a way that does not impact your credit score, and that is not disclosed to anyone other than yourself. This is called 'file access' and differs from a 'full credit enquiry'.

In the case that you do qualify, you have the option to submit your application to Jacaranda to perform a credit assessment. By submitting a full application, you authorise Jacaranda Finance to obtain a copy of your full credit file. Other lenders will be able to see that you applied for a loan with Jacaranda, and this may affect your credit score.

For more information on your credit report and credit score, visit CreditSmart's website. You can also contact our customer service team if you have any further questions about how your credit score can be impacted by applying for one of our loans.

We have also introduced Comprehensive Credit Reporting (CCR), which essentially means more positive credit information can be seen on your credit report, such as making your repayments on time.

At Jacaranda, Comprehensive Credit Reporting now makes it much easier to rebuild your credit. By applying for and repaying one of our loans on time, every time, you might find your credit score could go up faster than it ever did before.

Not only could we make it easier to improve your credit score, but we also make it easier to check and track your score to view your progress.

If you're a current Jacaranda customer, you can track your credit score's progress with monthly updates to help you monitor your credit in real time by signing into the Better Credit app and opting in.

The best part? Checking your credit score in our app is completely free for our customers.

Our interest rates are fixed for the duration of your loan contract, meaning your minimum repayments will never change. This allows you to budget more easily by knowing exactly how much you owe each time.

See also: Fixed vs variable interest rates.

As well as offering security through our fixed repayments, our loans are also highly flexible, allowing you to tailor your repayments to your needs. You can easily manage your loan to:

See also: Why you should make extra repayments on your loan.

We pride ourselves on offering what we believe to be some of the best customer service in Australia. Our friendly and helpful customer service team is 100% based in Australia, so you’ll always speak to a human being at Jacaranda.

If you need help with your loan or think you’re going to miss your next repayment, we can encourage you to get in touch with us so we can work it out.

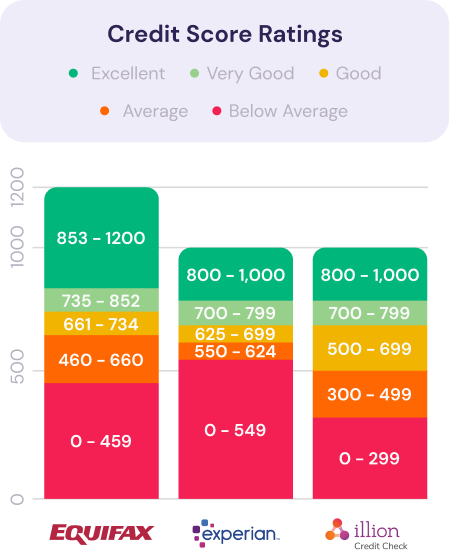

Australia has three main credit rating agencies that calculate your credit score:

Each credit agency uses different ranges for their credit scores. Here's what these currently look like:

Before you apply for a loan, we think it's important to review your budget and be certain that you can comfortably repay it.

Once you know what you can afford in your budget, use our three-step loan repayment calculator to estimate your repayments before you apply.

Ready to Apply? You can get started now.Learn more about all things credit with some of our insightful articles and guides.

We only accept loan applications online via our online application form on our website or the Better Credit app. We're 100% online, so there are no other ways to submit an application.

If you're considering applying for a loan with Jacaranda, you can first check if you qualify in a way that does not affect your credit score.If you are unsure whether you're eligible, you can check if you qualify initially. This will not impact your credit score.

We accept a wider range of credit history than a bank or a prime lender, but we do not recommend submitting an application if:

Applying for a loan with Jacaranda Finance takes most people 5-12 minutes1, but it could take longer depending on a number of factors such as but not limited to how fast you are at typing or if you have all the required information on hand.

After applying, most customers get an outcome on their loan application on the same day during normal business hours once we have received all of the supporting information we require. We do not guarantee same-day outcomes for all customers.2

Once an applicant has been approved and they have signed a contract, we automatically attempt to release the money to the applicant's bank account. Most customers have a New Payments Platform (NPP) bank account and receive the money in their bank account within 60 seconds. For other customers, the money will be available overnight on weekdays and overnight the following business day if approved on a weekend or public holiday.3You can view your repayments from either the Better Credit app or online portal and contact our friendly customer service team to request any changes that you need.

Download the app on the Google or Apple store today.

Read more: Personal Loan Repayments 101.