Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

Have you checked your credit score recently? Do you even know how?

The importance of knowing your credit score has never been higher. With the cost of living rising, being in control of your finances is becoming increasingly essential. Knowing your credit score and checking it regularly could end up saving you thousands of dollars over the long term.

There are several different ways to check your credit score. In this article, we’ll explain how and where you can do just that.

On this page:

Did you know that 6% of Australians aren’t even sure what a credit score is? Of those who do, more than one-third don’t know what a good credit score is.

A credit score, also known as a credit rating, is a score given to you based on your borrowing history from credit providers. Generally ranging from 0 to 1,200, it acts as a numerical representation of your reliability as a borrower.

Studies show there are many different factors as to why people don’t check or know their credit, most of which include them just not thinking it’s important. Here’s a list of things that can be affected by your credit score:

And more! So, if you’re planning on making any credit or loan applications soon, it’s vital to know and keep track of your credit history so that you’re in the best position when the time comes.

It’s essential to regularly check and maintain your credit score because, generally speaking, the higher your score, the more likely you are to be approved for any of the previously listed credit products. In addition, a high score could grant you access to loans with lower rates and fees, which can lead to thousands of dollars in savings over the years.

Not knowing your credit score and applying for loans is a lot like jumping into a swimming pool without knowing the depth or how to swim! It's a risky game!

There are many different factors to take into consideration when looking at your credit score and usage.

There are many behaviours you could be engaging in without even realising that could be negatively affecting your credit score. These include:

There’s no need to panic with all the negatives; there are plenty of positive factors that can influence your credit score too! These include:

There are many different credit reporting agencies; however, in Australia, the main three are Equifax, Experian, & Illion. You should be able to check your credit score online as regularly as you would like from these credit bureaus; they also provide credit information to other third-party websites and businesses.

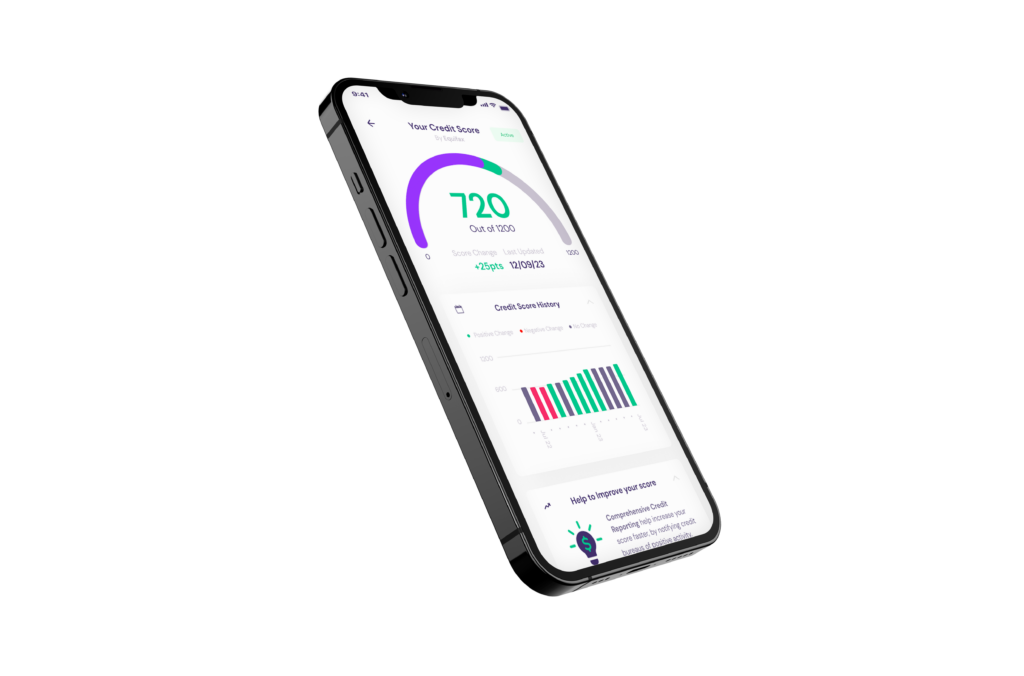

At Jacaranda Finance, we recently added the ability to check and track your credit score through our Better Credit mobile app. Within our app, we’ve partnered with Equifax to create a quick and easy process designed to get your score as seamlessly as possible. You can create an account and provide some super simple information for us to show you your score.

A standard 100-point ID check is all that’s usually required to check your credit score in Australia, including:

Once you’ve provided these, you can generally look at your credit score within a few minutes.

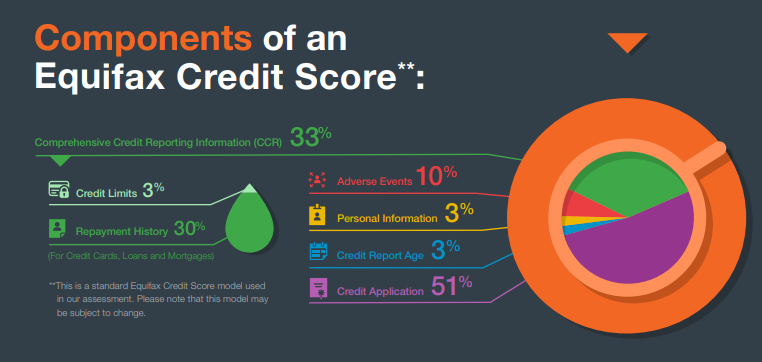

Your credit score is a multifaceted, complex number, and each major credit bureau has its own formula used to provide this one number. These factors are usually as follows:

According to Equifax, credit applications (aka inquiries) account for a massive 51% of your credit score! Your repayment history, such as timely and full repayments, accounts for another 30%, while adverse events like defaults make up 10%.

While some pieces of personal info can and do influence your credit score, such as your address or age, it does not consider the following:

A credit bureau can only hold data permitted under the Privacy Act. This means there are strict guidelines on the data used to calculate a bureau credit score.

After a few minutes of completing the initial form, you’ll see a number between 0 and 1,000 or 1,200 (depending on who you check with). Jacaranda gets your credit score from Equifax, so if you check with us, you’ll see a number between 0 and 1,200.

Most Australians sit between 600 - 800, which, as you can see below, sits mostly between ‘Average’ & ‘Good’. Across Australia, the average Equifax credit score is 855.

| Equifax | Experian | Illion | |

|---|---|---|---|

| Below Average | 0 - 459 | 0 - 549 | 1 - 299 |

| Average | 460 - 660 | 550 - 624 | 300 - 499 |

| Good | 661 - 734 | 625 - 699 | 500 - 699 |

| Very good | 735 - 852 | 700 - 799 | 700 - 799 |

| Excellent | 853 - 1,200 | 800 - 1,000 | 800 - 1,000 |

Our partnership with Equifax lets us provide you with an updated credit score every month based on the numerous factors and insights it uses. The best part is that once we have the information, you’ll be able to easily log back in and regularly check the information whenever you want - no need to fill in a form every time!

Our app features will also give you updates on your score when you log in, so you can easily see the increase or decrease.

There are many different benefits to knowing your credit score and regularly keeping on top of it. Having a below-average credit score in Australia can significantly limit your financial opportunities and create barriers to accessing low-cost finance for major expenses.

By increasing your credit score from fair to very good, you could save around 10% on your loans and credit card repayments. This could be thousands of dollars just from checking and keeping on top of your debts and bills and making sure you’re aware of just one number!

There’s no need to panic if your score is not as high as you thought it would be. With discipline and consistency, you can steadily improve your credit score over time to get it where you want it to be. See our article on how to improve your credit score for some practical tips on how to do just that!

Remember, to give yourself the best chance of success, it’s always a good idea to improve your credit score as much as possible before applying. Using our app, you’ll be able to regularly keep track of your score and easily see where you stand.

Simply download our app today and see how easy it is to check and track your credit score! Start a conversation with your friends and family about the importance of checking your credit and show them how easy it is too!