Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

Need funds to help manage your day-to-day cash flow? We've got you covered with our FlexiCredit Line of Credit Product! Before applying for one, it's a good idea to understand how they work.

Our flexible FlexiCredit product ranges from $1,000 to $2,000. As you pay down your outstanding balance, you can drawdown up to your credit limit as you need to.

As an existing Jacaranda Finance customer, you have exclusive early access to this exciting new product! Simply log in to the Better Credit app or your online account to apply.

Quick find topics on this page.

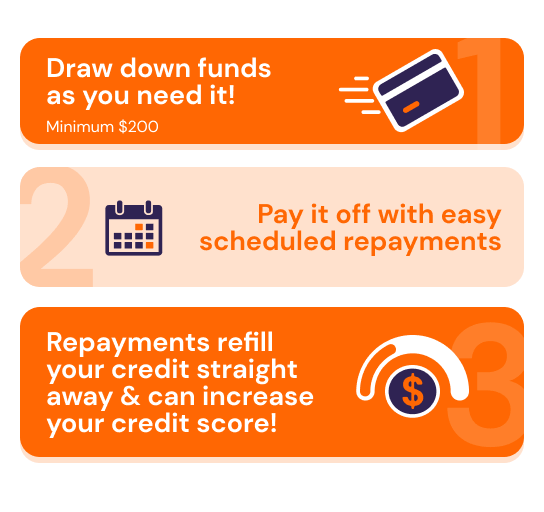

A line of credit is a flexible product that allows you to access funds up to a predetermined credit limit as needed. Like a credit card, you don't have to borrow the full amount you're approved for all at once. Instead, you can drawdown on this amount in smaller increments starting from $200: interest and fees are only charged on your outstanding balance.

A line of credit offers you flexibility in what you choose to borrow and how much you need to repay.

A Jacaranda FlexiCredit Line of Credit comes with a maximum loan amount of $2,000: you can drawdown on this amount in smaller increments starting from $200, all the way up to your approved credit limit. Using the Better Credit app, funds are paid into your nominated bank account whenever you need them.

Our Line of Credit is an unsecured loan with no set loan term. However, once you drawdown from your Line of Credit, you must repay a set repayment amount, which will be stated in your contract. These repayments will include interest - see the 'rates and fees' section below - but any unused funds will not.

FlexiCredit is a flexible credit product and an effective tool for making purchases, simplifying your finances and even smoothing out your cash flow. You can use it for just about anything in your day-to-day life. If you need quick funds to pay for key everyday expenses, a line of credit with Jacaranda Finance can provide the funds you need, when you need them.

The interest rate on our Line of Credit is 27.90% p.a. and will only be charged on your outstanding balance.

There will also be a monthly fee of 1% of your maximum credit limit, which will only be charged if you have an outstanding balance on the loan.

Other fees and charges may apply: See our rates and fees page for more details on what FlexiCredit may cost.

See here for some of our most frequently asked questions about our FlexiCredit product.