Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

A Line of Credit is a type of revolving credit product that lets you borrow money up to a maximum credit limit, pay it back over time and borrow again as needed. With FlexiCredit, you're only charged interest on the amounts you draw down from your credit limit.

Jacaranda's FlexiCredit product is different to our loan products for several reasons:

If, for example, you applied for a $2,000 line of credit and initially only needed to use $500, you wouldn't be charged interest on the remaining balance ($1,500).

With loan products like a personal loan, however, you can borrow up to the following loan limits and pay interest on the outstanding balance in instalments from the beginning:

Personal loans also have set loan terms, but a Line of Credit is a revolving credit product, so there is no specific loan term. Read more: Line of Credit pros and cons.

For detailed information about who our products are designed for, please review our Target Market Determinations.

Note: FlexiCredit is currently in early access and only available for invited Jacaranda Finance customers.

FlexiCredit could be suitable for anyone looking for funds to help pay those smaller recurring or one-off expenses.

If you need fast, simple access to finance online, but don’t want a larger amount that often comes with a personal loan, then FlexiCredit could be the right product for you.

See our FlexiCredit Target Market Determination for more information on who our products are designed for.

Our FlexiCredit product is unsecured only, so you won’t need to attach an asset as security, such as your car.

FlexiCredit is meant to be a fast finance solution for smaller expenses: Check out our Secured Loans if you wish to borrow a larger amount with security attached to the loan.

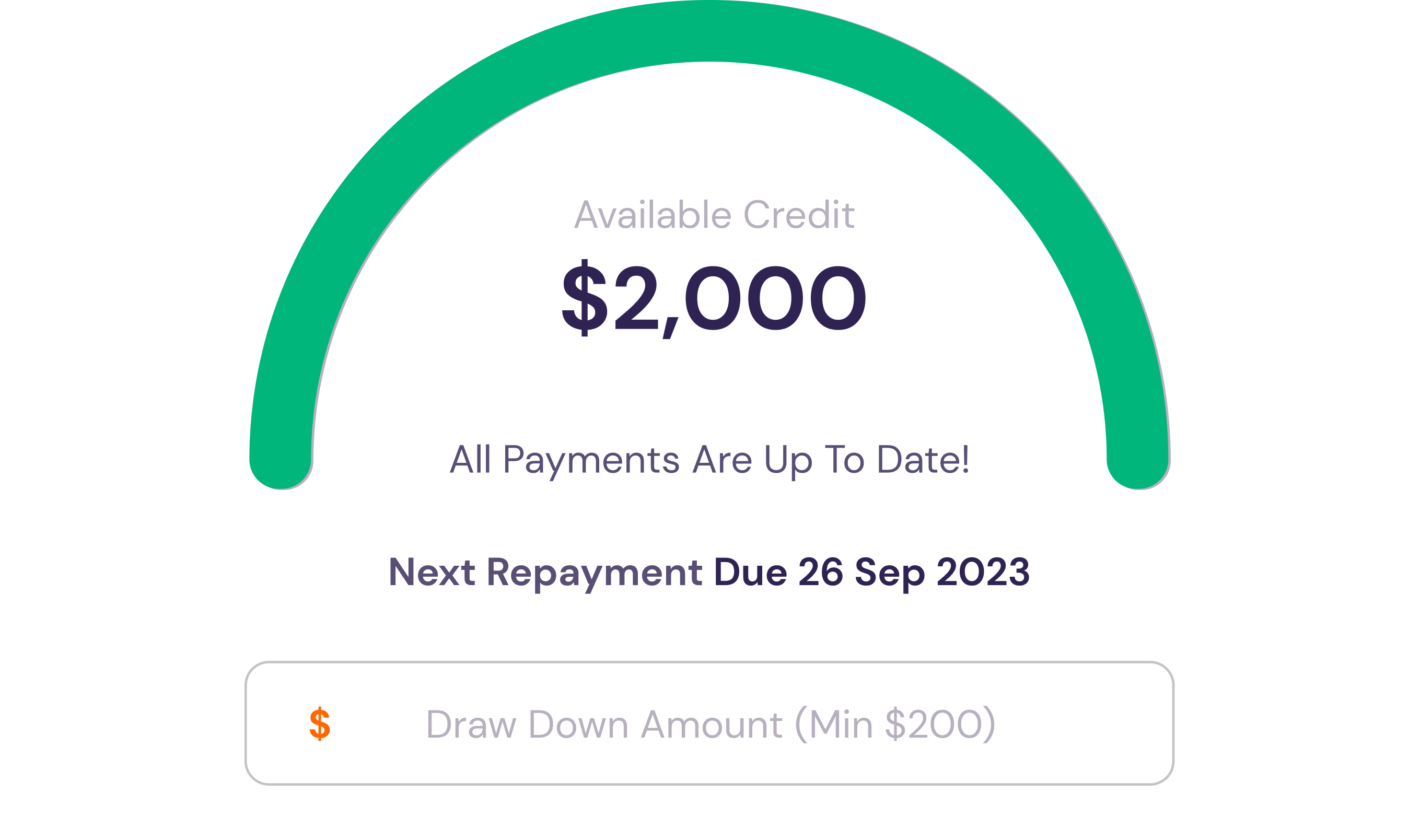

With FlexiCredit, you could be eligible for a credit limit between $1,000 and $2,000, depending on your circumstances.

This will be your maximum credit limit, however. You don’t have to use that all at once. You can draw down on your credit limit in smaller increments as you need them, starting from $200.

You’ll only be charged interest on the balance you draw down, not the full credit limit.

The interest rate on our Line of Credit is 27.90% p.a. and will only be charged on your outstanding balance.

There will also be a monthly fee of 1% of your maximum credit limit, which will only be charged if you have an outstanding balance on the loan.

Other fees and charges may apply: See our rates and fees page for more details on what FlexiCredit may cost.

To apply for FlexiCredit, log in to your Jacaranda account in the online portal or Better Credit app.

Our application process has been designed to be as simple and quick as possible, as we know how important it is to receive your funds in a timely manner:

Once you've been approved and have accepted our offer by signing your digital contract, most customers can draw down their funds within 60 seconds3

Note: FlexiCredit is currently only available for existing Jacaranda Finance customers.

The basic eligibility criteria you must meet before submitting an application for one of our loans are:

We accept a wider range of credit history than a bank or a prime lender, but we do not recommend submitting an application if:

Your minimum repayment amount is determined by your approved credit limit. This will be specified in your loan contract before you receive your funds, so make sure you read this.

You will be charged interest on your FlexiCredit loan, but only on the amount you draw down. For example, if you're approved for a $2,000 credit limit but only decide to use $1,000 to cover your expenses, you will be charged interest on $1,000.