Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

Facing financial hardship can be difficult, but there’s no shame in seeking help. In fact, many people seek help for financial hardship daily, and your bank will likely welcome you reaching out to discuss your situation.

This guide on financial hardship should encourage you to do just that and arm you with the knowledge you need to understand financial hardship in Australia.

On this page:

There are several different definitions of financial hardship, but according to the Australian Financial Complaints Authority (AFCA):

“Financial hardship is when you are temporarily unable to make a repayment on a debt, such as a credit card, home loan or personal loan”.

So essentially, it’s when you don’t have enough money or resources to cover your existing debts and repayments, and it can be either a short-term or a longer-lasting problem.

When you’re in financial hardship, your bank, lender, credit card provider, insurer, etc., can offer you a temporary alternative arrangement to help you get back on track and resume regular repayments.

Hardship often occurs because there’s been a change of circumstance in your life that can impact your ability to meet financial obligations.

These causes of financial hardship can vary, but common ones include:

One of the primary causes of financial hardship is the loss of a job or a significant reduction in income. Unemployment can quickly deplete savings and make it challenging to meet daily expenses.

Rental and mortgage stress occurs when a significant portion of income - generally 30% or more - is spent on housing costs, leaving little for other necessities. This has become increasingly common with the rise in property prices and rental rates.

As of January 2024, Australia has been experiencing significant rental stress, particularly among lower-income renters. Finder’s Consumer Sentiment Tracker shows that 42% of renters are currently struggling to pay their rent, which is higher than the 37% of mortgage holders in the same position.

According to Roy Morgan, over 1.57 million Australians are now at risk of mortgage stress, which is nearly one-third of all homeowners with a mortgage.

Life events such as divorce, the death of a family member, or a relationship breakdown can lead to sudden financial strain. Such things often can’t be predicted, which makes them a common contributor to financial hardship and stress.

Unexpected medical issues can lead to significant expenses and loss of income, especially if it leads to an inability to work.

Read more:

Natural disasters like bushfires or floods can lead to immediate financial distress due to loss of property and income sources. In events such as these, banks and lenders will often provide specialised assistance packages.

Victims of domestic violence and abuse often face financial hardship, as they may have to leave their homes suddenly or may have been prevented from working or earning money by their abusers.

⚠️ If you or someone you know is experiencing domestic violence, abuse or mental health concerns, please call triple zero (000) or contact the following:

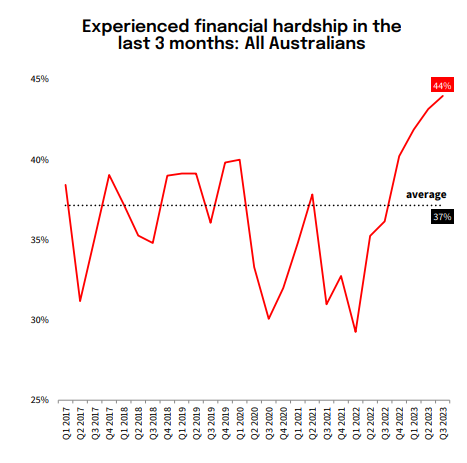

NAB’s Financial Hardship Report found the number of Australians experiencing some form of hardship rose for the sixth consecutive quarter in September 2023 to 44%. Nearly half! That’s more than the long-term average of 37% and well above the series-low of 29% from March 2022.

The major bank’s support centre also received 61% more calls relating to hardship assistance in 2023 compared to 2022.

“The overall increase in cost of living is hurting, and some customers are feeling it more than others,” NAB CEO Ross McEwan said.

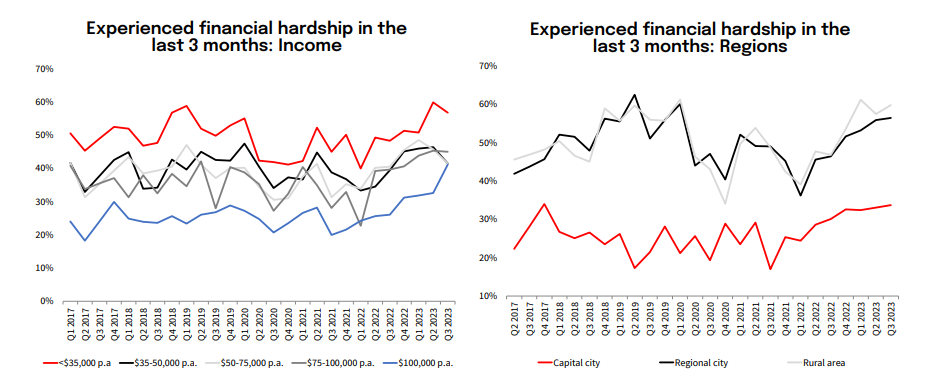

While a much higher number of people on lower incomes continue to experience hardship, it is becoming more prominent among higher-income groups as well:

Financial hardship is also most widespread in rural areas, with 6 in 10 people impacted. Meanwhile, in capital cities, only 34% said the same.

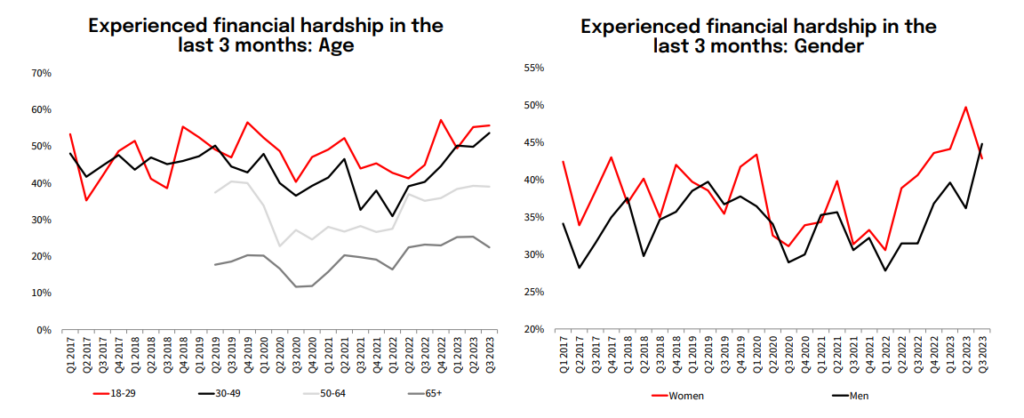

In terms of age, the incidence of financial hardship in Q3 increased and was highest in the 18-29 group (56% vs. 55% in Q2), followed by the 30-49 group, where it also increased to 54% (50% in Q2). Men, in general, were also more likely to experience financial hardship than women, at 45% and 43%, respectively.

Banks and lenders can help you with financial hardship. In fact, it is often in their best interests to do so, as well as yours. The sooner they can get you back on track, the sooner you can resume repaying your debts, which is the best-case scenario.

A hardship variation is a temporary arrangement with the lender to help you out in the short term. The aim is to return you to your regular repayment schedule as soon as possible.

Standard hardship arrangements made by banks include, but are not limited to:

Banks/lenders don’t have to say yes to any hardship request, but they are required by law to respond to it within a reasonable timeframe, and if they say no, they must provide a reason why.

Applying for financial hardship typically involves contacting your creditor or service provider directly. Depending on the institution, they may have a dedicated hub or contact for financial hardship. Commonwealth Bank is one such example.

You will need to provide details about your financial situation and a proposed payment plan. For example, they may request you provide them with the following:

And more. The more detail you provide in your application, the more likely your hardship request is to be approved. So keep receipts, provide numbers and dollar amounts, and describe your situation clearly.

Resources such as the Financial Rights Legal Centre (FRLC) have some sample letters you can use to write to your lender.

Eligibility for financial hardship assistance usually depends on your circumstances and the policies of the specific lender or service provider. The bank or lender will usually assess each application on a case-by-case basis.

There’s no one threshold for being eligible for financial hardship. According to the National Debt Helpline, you should be eligible if:

Your lender must give a reason for declining your hardship application. If they don’t provide one, or you disagree with it, you can submit a complaint directly to AFCA.

Financial hardship itself, applying for financial hardship or being approved for a hardship variation, does not directly impact your credit score. If a hardship variation is approved, a Financial Hardship Indicator (FHI) will appear on your credit report and remain there for one year, but this won’t impact your score.

However, missed payments or defaults that occur while under a hardship arrangement might have an effect on your score, just as they would normally.

Check out Financial Rights Legal Centre’s (FRLC) fact sheet for more information on how your credit may or may not be affected by financial hardship.

You may also find the following financial hardship resources helpful if you’re experiencing hardship or struggling with money in general:

While it can be tempting in times of financial hardship to turn to financial ‘quick fixes’ like wage advances or payday loans, these generally aren’t a good idea and can often make your situation worse.

According to 2022 NAB research, one in 10 Australians facing financial hardship accessed a payday loan within three months. Payday loans were also the third-most common method of managing hardship debts, behind credit cards and borrowing from family or friends.

These short-term loans are the most stress-inducing of all loan types. Technically called ‘short-term loans’ or small-amount credit contracts (SACCs), payday loans typically let you borrow up to $2,000 and have loan terms that can range from 16 days to one year.

On average, Australians owed $6,200 on payday loans.

“Payday loans can seem an attractive option, as they are often instant and have low credit controls in place, making them more accessible to people in desperate situations,” NAB Head of Customer Vulnerability Mike Chambers said.

“What people don’t realise is there are often many hidden costs associated with the loans, on top of higher interest and late payment fees.”

“A call to your bank is the best first step to discuss the possibility of a loan payment pause, reduced payment plan or access to an independent financial counsellor.

“Our NAB Assist team recently spoke with a customer who had nine different payday loans and was struggling to keep up with debt repayments. We were able to tailor a solution and are confident we can help them through to the other side.”

As a licensed lender and credit provider, we have financial hardship support available in line with our responsible lending obligations. If you’re a current Jacaranda Finance customer and you've had a change in circumstances or you're experiencing financial hardship, you must contact us or advise us to contact you as soon as possible.

Since financial hardship can take many forms, each request is assessed on a case-by-case basis, and the assistance offered will vary on the needs of each applicant, which is why there are numerous different types of financial hardship assistance available.

Common examples we may offer you include the following:

See our FAQs on financial hardship or ask one of our friendly team members for more information on how this process works.