Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

*Subject to lending criteria, T's and C's'

*Subject to lending criteria, T's and C's'

When you consider the pitfalls of a payday loan, taking out a personal loan might be a safer alternative if you’re in need of quick cash. Jacaranda Finance offers fast cash loans from $3,000 to $25,000 with loan terms up to 36 months. With a simple online application form, same-day outcomes2, and 60-second transfers3, Jacaranda Finance is a quick and easy way to get your hands on the funds you need fast.

Money in your bank account and ready to use in 60-seconds3 once approved.

We’re a fast, reliable and fair lender that’s been helping Aussies since 2014 - here's why we think you should choose us.

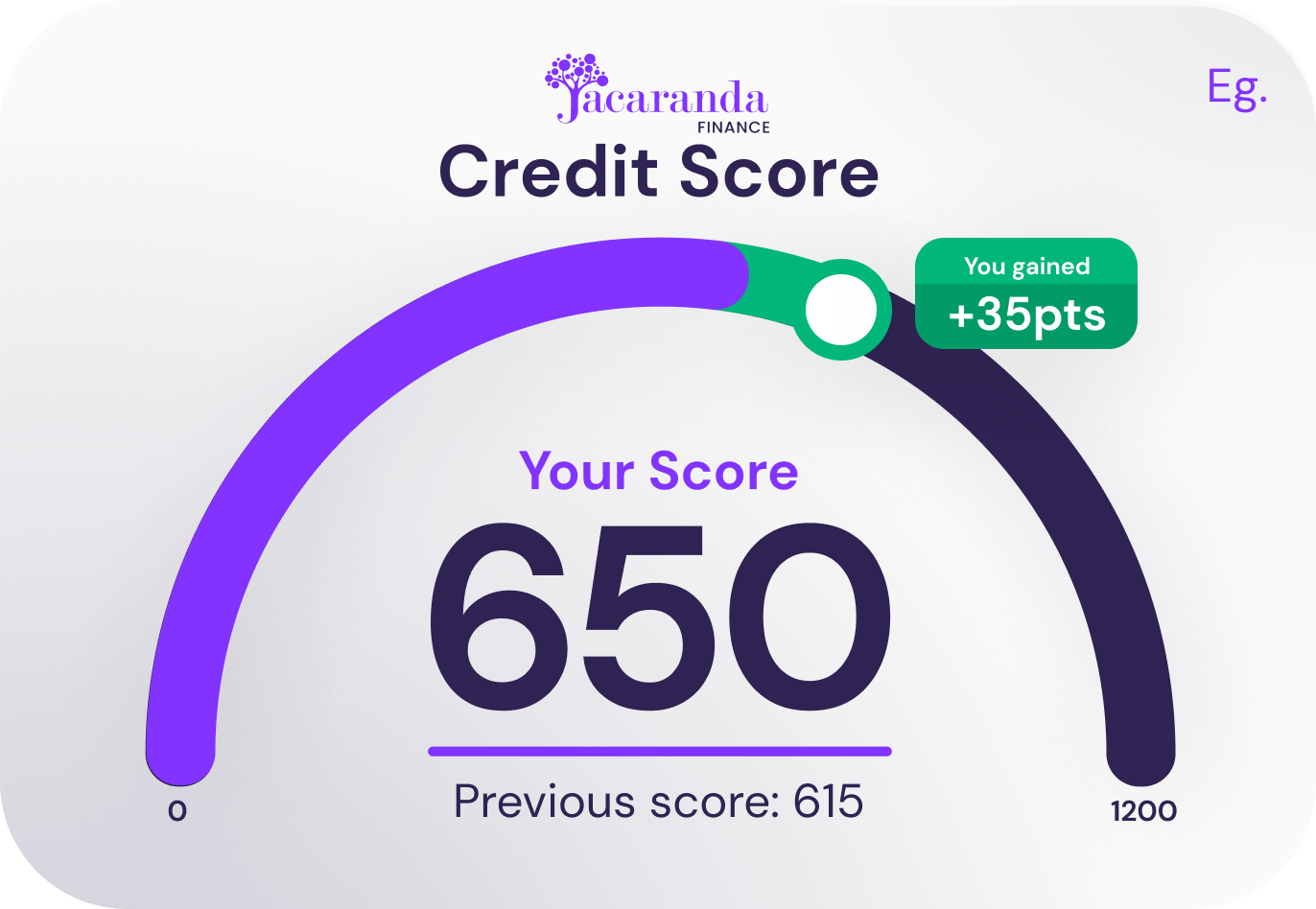

We’re a part of the Comprehensive Credit Reporting (CCR) regime, which makes it much easier to build your credit history and credit score. By making your loan repayments on time and in full, we can communicate this positive repayment information to the credit bureaus, which could help improve your credit score over time.

Find out more about how Comprehensive Credit Reporting works here.

If you’re in need of some extra cash for unexpected expenses, car repairs, or to help you manage vet bills, a personal loan with Jacaranda Finance could have you covered.

Our loans are designed to be fast, fair, and, above all, affordable, with no hidden fees. See the table below for a quick guide to our charges, or visit our fees page to learn more. For detailed information about who our products are designed for, please review our Target Market Determinations.

If you're ready to apply, our loan application process has been perfected over time to be as simple and quick as possible. You can:

Check if you qualify for one of our Personal Loans today!

Am I eligible for a Loan with Jacaranda?

You must meet the following basic eligibility criteria before submitting an application:

Find out all the answers to the most common questions about our personal loans.

A personal loan can be a handy way to access finance online. Jacaranda Finance offers personal loans from $3,000 to $25,000 with flexible repayments and no hidden fees or charges. So whether you need a bit of extra cash to sort out car repairs, or to cover an unexpected expense, we might have a loan option for you.

Visit our rates and fees page to get an idea of the costs associated with our loan products.

The interest rate, fees and charges applied to your loan will depend on your individual circumstances and the information verified during the loan assessment. It will also depend on our assessment criteria, loan amount, and loan term for which you qualify.

Use our loan repayment estimate calculator to get a guide on what your repayments could be.

Repayments on your loan are automatically set up to be deducted via direct debit from your bank account in line with your pay cycle.

You can view your repayments from either the Better Credit app or online portal and contact our friendly customer service team to request any changes that you need.

Download the app on the Google or Apple store today.

Read more: Personal Loan Repayments 101.

Your repayments will vary depending on several factors, such as the amount you borrow, your loan term, interest rate, and more.

If you're approved, the loan contract will include all of the loan details, including the repayments, terms, interest rate, and fees, for you to review before signing.

Use our loan repayment estimate calculator to get a guide on what your repayments could be based on some of these factors. Visit our rates and fees page to get an idea of the rates, fees, and charges associated with our loan products.

It's possible to receive a loan offer from us if you have less-than-perfect credit, as we believe a credit score doesn’t tell someone’s whole financial story.

We offer fast and reliable personal loans for applicants with varying credit histories. If you're in a good financial position and handling your existing financial commitments comfortably, check if you're eligible and submit an application.

We accept a wider range of credit histories than banks or prime lenders. But we do not recommend submitting an application if you're currently or recently bankrupt (you must be three years discharged and in control of your finances) or if you are not comfortably repaying your existing financial obligations.

No. As a responsible lending body, Jacaranda Finance is required to complete a credit check on all applications. Before you formally apply with Jacaranda, you can check if you qualify for a loan in a way that does not impact your credit score. We do this by performing a 'soft' credit check that is only visible to you.

If you don't meet our initial criteria, your credit score won't be affected.

Once you've checked your eligibility and we've let you know that you do qualify for a loan, you have the option to move forward with a full application.

We will perform a credit assessment during this process, which involves checking your credit report. By submitting a full application, you authorise Jacaranda Finance to obtain a copy of your full credit file, referred to as a 'hard' credit check.

Other lenders will be able to see that you applied for a loan with Jacaranda.

This might impact your credit score.

Review our Privacy Policy for more information.