Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

*Subject to lending criteria, T's and C's'

*Subject to lending criteria, T's and C's'

Quick find topics on this page.

Every year, the banks fail millions of Aussies who need to borrow money. This is often purely because they don't have a high credit score, even if they've been good with money lately.

We think that's unfair, as your credit score doesn't define you. So, when that happens to you, come and talk to us.

We're an Australian-owned, operated, fully online digital lender providing fast and flexible loans.

Click here to learn more about what makes Jacaranda great!

We know how important it is to receive your funds in a timely manner. As a hard-working Australian, you don’t have time to waste on needless paperwork.

That’s why our loan application process has been perfected over time to be as simple and quick as possible. Have a read of how our easy loan application process works from start to finish to see how quickly you could get the funds you need.

Before you apply for a loan, we think it's important to review your budget and be certain that you can comfortably repay it.

Once you know what you can afford in your budget, use our three-step loan repayment calculator to estimate your repayments before you apply.

Ready to Apply? You can get started now.If you're looking to apply for a loan but you’re worried about how it'll affect your credit score, no stress! At Jacaranda Finance, you can check if you qualify first, and your credit score won't be impacted.

If you meet our eligibility criteria, we'll let you know on the spot. You can then choose to submit an application, which will involve a hard credit check and may impact your credit score.

If you don't qualify, your application will be declined without a hard credit check being conducted.

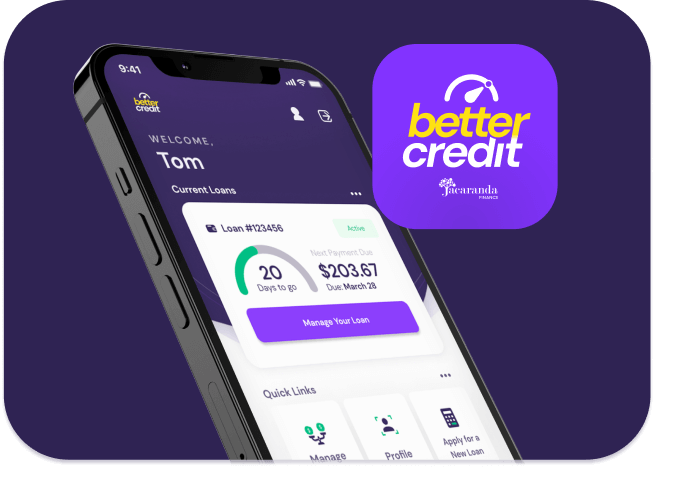

Learn more about this feature.As an exclusively online lender, we only accept loan applications via our Better Credit mobile app or our online application form. We do not accept applications over the phone or in person.

But the good news is we make it super easy in both.

Click the links above to download our app from either the App Store or Google Play. Alternatively, click 'Get Started' to begin your application on our website.

An initial application with Jacaranda can be completed in as little as 5-12 minutes1. But if you’d prefer to take your time, you can fill in the application at your own pace from anywhere in Australia on any device as long as you have internet.

Being a 100% online lender, you may submit an application with Jacaranda 24/7, 365 days a year.

Looking to find out if you’ve been approved quickly?

After applying, most customers get an outcome on their loan application on the same day during normal business hours once we have received all of the supporting information we require. We do not guarantee same-day outcomes for all customers.2

If we need any further information from you, we’ll be in touch promptly. Most customers get a same-day outcome if they provide the required documentation by 3pm Australian Eastern Standard Time (AEST).

Once you've been approved and accepted our offer by signing your digital contract, we will automatically attempt to release the money to your bank account. Most customers have a New Payments Platform (NPP) bank account and receive the money within 60 seconds.3

You must have an NPP-enabled bank account. For customers without an NPP-enabled bank account (or the instant payment fails), the money will be available overnight on weekdays and overnight the following business day if approved on a weekend or public holiday.