Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

And yet, many Australians are playing Russian roulette with their finances. Research from Finder shows 70% of Australians - more than two-thirds! - don’t have an emergency savings fund of any kind!

This article will explore emergency savings: how much you should have, and how to build an emergency savings fund.

On this page:

The figure in the typical Aussie’s bank account will vary significantly depending on who you ask. The Household Savings Ratio - how much of our take-home pay we manage to save - fell to 3.7% from 4.4% in March 2023 as the cost-of-living crunch continues.

According to data from NAB, the average Australian had around $34,000 tucked away in a savings account as of late 2022. That might seem like a lot, depending on your circumstances. Still, there were significant differences in the savings held by different demographics.

| Age | Average savings for men | Average savings for women |

|---|---|---|

| 18-29 | $18,712 | $11,153 |

| 30-49 | $27,005 | $24,081 |

| 50-64 | $106,236 | $22,759 |

| 65+ | $98,312 | $46,044 |

However, Westpac says a “more realistic figure” is $3,559 once you account for larger deposit holders.

An emergency savings fund is money you’ve set aside over time (or all in one go) to use in adverse situations when you might not have your usual access to cash.

Also known as a ‘rainy day’ fund, emergency savings should be separate from your regular savings and bank account more difficult to access, as you don’t want to be able to withdraw from this fund for non-emergencies.

Did you know that, according to UBank, 20% of households said they couldn’t raise $3,000 in an emergency, and 11% have less than $100 in cash savings? Emergency savings are essential as they can provide a vital safety net during unexpected events, like:

You get the idea. Having an emergency savings fund is a hallmark of prudent financial planning, ensuring that when life throws curveballs, you're well-prepared to handle them without jeopardising your financial health.

There’s no hard and fast rule for how much you should have in your emergency savings fund, as everyone’s circumstances differ. Things like your monthly expenses and assets, number of household income sources, number of dependents, your lifestyle, debts and the current economic situation can all determine how deep your emergency savings pool should be.

However, a good rule of thumb is generally having three to six months' worth of living expenses. According to Seek, that’s how long it takes the typical job-hunter to find new employment.

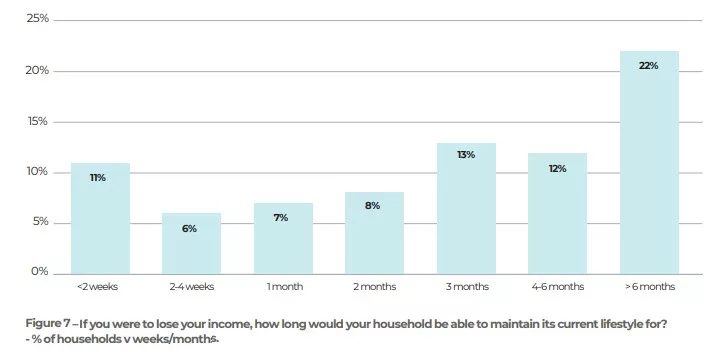

When asked, ‘If you were to lose your income, how long would your household be able to maintain its current lifestyle for?’, three and six months were also the most common responses in UBank’s Household Financial Comfort report.

If you find yourself without an income suddenly, being able to sustain yourself on emergency savings for a few months is ideal.

If you’re ready to begin your journey to building an appropriate emergency savings fund, just follow these eight steps!

Before setting out on your savings journey, understand where you stand financially. Review all your assets, debts, and ongoing financial obligations. This clarifies how much you can save each month and where adjustments are needed.

If possible, pay off any manageable debts or consolidate them into one easier-to-manage loan.

Keep a record of every expense, whether small or big. The most obvious ones include:

By understanding where your money goes each month, you can identify areas to cut back and redirect those funds into savings.

There are various apps and tools available that can help you categorise and track your spending. We’ve covered some of the best ones here:

Using the above two factors and your income, determine how much you want to have in your emergency fund based on a set amount or a few months' worth of expenses. Having a specific target will motivate you and give your savings journey direction.

Your emergency savings should be distinct from your regular savings account (which you should also have!). This minimises the temptation to dip into the fund for non-emergencies and helps mentally earmark the money for its intended purpose.

Your bank should let you easily create a separate savings account without paying any fees. But don’t necessarily stick with the same bank you currently have…

Maximise the growth of your emergency fund by placing it in a high-interest savings account. Not only will your money be safe, but it will also earn interest over time, allowing your savings to accumulate faster.

To get the most out of your savings account, compare your options and find an account with a high interest rate and less restrictive conditions. Comparison sites like Canstar, Rate City, Finder, etc., are valuable resources for finding a good-value savings account.

A quick market search reveals that the highest interest rate you can receive on a savings account as of August 2023 is 5.65% p.a. Note that this account requires you to deposit $2,000 monthly to avoid the base interest rate of just 0.55% p.a.

According to CHOICE, over 45% of people said they had missed out on receiving the full interest rate on savings accounts due to these types of restrictive conditions.

Set up automatic transfers from your main account to your emergency savings account. Doing this ensures that a portion of your income goes directly into monthly savings, removing the need to remember or the temptation to spend it elsewhere.

Aiming for around 10% of each paycheck is a good rule of thumb.

Don't be disheartened if you can't save large amounts immediately. Start with what you can, even if it's a small percentage of your income or a fixed amount. As your financial situation improves or you find more ways to save, steadily increase the transfer sizes to the designated account.

Many banks and apps now offer a feature where every purchase you make is rounded up to the nearest dollar, with the difference transferred to a savings account. This "spare change" approach can surprisingly accumulate significant savings over time without you noticing a difference.

Mozo's research says most people need anywhere between $7,000 and $10,000 to build a safety net of three to six months, with the average person needing around $9,000. Per month, that could be anywhere between $1,500 and $3,000 in emergency funds.

Let’s say you’re aiming to save $9,000. You’ve picked a good, high-interest savings account with a rate of 5.50% p.a. Here’s how long it would take you to reach that goal based on various savings schedules:

| Monthly deposit | Time taken to reach $9,000 |

|---|---|

| $100 | 76 months |

| $250 | 34 months |

| $500 | 18 months |

| $1,000 | 9 months |

| Calculations made via Moneysmart’s savings goals calculator. |

There are tonnes of ways you can make it easier to build your emergency savings buffer right now! In fact, we’ve compiled 75 of them (yes, 75!) in our ultimate list of money-saving tips and tricks.

Have a read of the article in the link below to make saving money a bit easier.

It’s in the name: only dip into this fund for emergencies! A holiday isn’t an emergency, nor is buying a new car or making some nice bathroom renovations. If any of the following apply, then don’t use your emergency funds:

Ultimately, whether something is an emergency or not will vary from person to person. A fridge breaking down might be an emergency to one person, but a car breaking down suddenly might not.

If you do access your emergency savings, remember to resume adding to it as soon as it’s responsible to do so, as you never know when the next financial emergency will be.

At Jacaranda, we offer three different types of loans to help you pay for life’s major expenses, expected or unexpected:

Download our Better Credit app or apply online, and you could have the funds you need in your account on the same day2.