Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

With so many money apps available in Australia, knowing which ones are worth downloading can be difficult. Whether you're looking to save money, track your spending, or invest for the future, there's almost certainly an app for you.

Because we like to do things a little differently here at Jacaranda, we'll explore Australia's top 11 - not 10 - money apps that can help you manage your finances.

On this page:

Before jumping into the top money apps, it’s useful to know what kinds of apps exist in the realm of personal finance. Each type of app will help you with something different.

Spending tracker apps usually connect to your bank accounts and collate all your transactions and deposits into those accounts. They can then automatically (or manually) provide breakdowns of how much you spend in a given time period and what you spend it on, so you can decide where you need to make changes.

Rather than going into the minutia of every dollar you spend, budgeting apps can give you a broader overview of your financial situation and provide tips and tricks to improve it.

Investing is a way of saving for your future, and there are plenty of apps for that now. One kind of investing app that has recently emerged is the micro-investing app.

These micro-investing apps simplify the investment process by enabling users to invest small amounts of money periodically, whether through savings ‘roundups’ or scheduled transfers to an investment portfolio.

Many of these apps also double up as budgeting and savings apps as well!

Some of the apps in this list will be tailored to a specific purpose, such as saving on fuel or groceries. Others might help you make the most of your tax return.

Chances are one of the best money management apps available to you could be your own banking app. Banks have had to up their game in this space recently, meaning many of them don’t just display the money in your account anymore. According to Forrester’s 2023 Consumer Asia Pacific Survey, 52% of Australians want to do all of their banking on a mobile app on their smartphone.

That number jumps to 76% for millennials and 69% for Gen Z. Overall, Forrester’s research revealed Westpac had the best banking app in Australia, followed closely by Commonwealth Bank.

A good banking app should also provide some of the features discussed below.

If you’re an existing customer with us, you can now do just that for free with the Jacaranda Better Credit app! Monitor your score and know where you stand to unlock new financial opportunities in the future.

Download the Better Credit app and follow the prompts to check your credit score today.

In no particular order!

Information accurate as of April 2024.

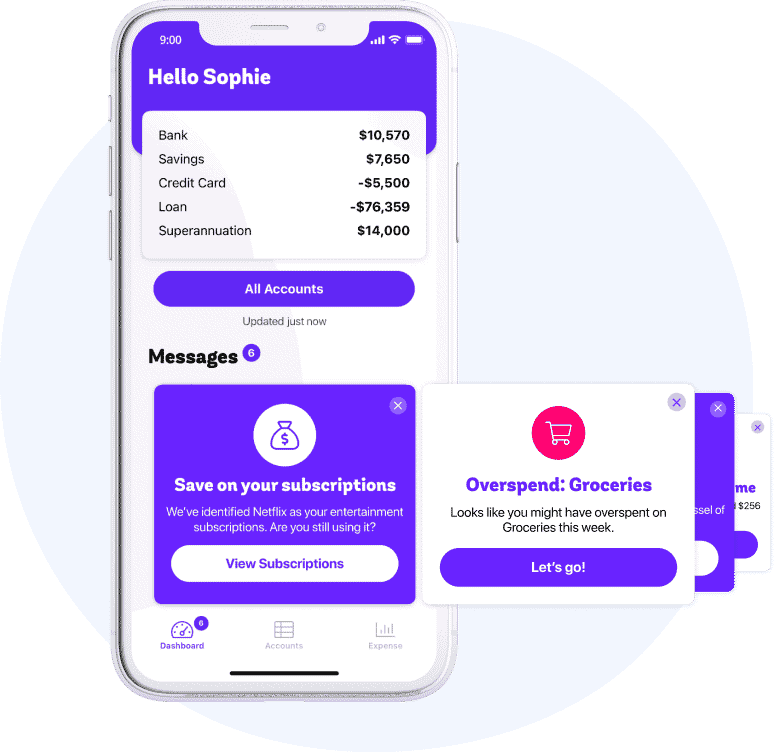

Frollo is a personal finance fintech designed to give Australians a complete view of their finances. Founded in 2016 and known for providing open banking services to other major finance businesses, Frollo’s app allows you to track your spending, set budgets and more by automatically syncing to your financial accounts. That includes your bank accounts, credit cards, personal loans, superannuation, investments and more from over 100 financial institutions.

Frollo also provides users with personalised insights and alerts to help them stay on track with their financial goals. A key feature it introduced recently is the ‘Financial Passport’, which provides an easy overview of your finances over the past 12 months that can easily be shared with brokers when applying for a loan.

Frollo key features:

Founded in 2019, WeMoney is a personal finance app that aims to help users take control of their finances by providing a complete view of their financial situation. WeMoney’s 500,000+ users can link their bank accounts, credit cards, and other financial accounts to the app to track their spending and income automatically and see their overall wealth (assets minus their liabilities).

Key features of WeMoney include transaction categorisation, budgeting tools, savings goals, credit score tracking, bill reminders, and personalised insights. WeMoney can also compare your spending to others in your demographic group.

Using WeMoney, you can also access a range of deals and discounts on key financial products and services, such as energy bills and insurance.

WeMoney key features:

If you hate it when friends and family owe you money and have to keep track of who owes what, this could be the app for you. Initially founded in 2017 as ‘Beem It’, Beem’s core feature is the ability to track and split expenses within a group easily.

Whether it’s for a holiday, family, friends, or housemates, Beem lets you immediately add an expense that tracks who owes who and how much they owe. It will then keep a running total for each person, simplifying overall debts based on how much you might owe other people in the same group.

Users can automatically link their bank accounts, credit cards, and other financial accounts to the app to track their spending and income. When it's time to settle those debts, Beem provides instant payments without ever having actually to leave the app! You can even nudge your friends with reminders if they’re being slack when settling up.

Beem key features:

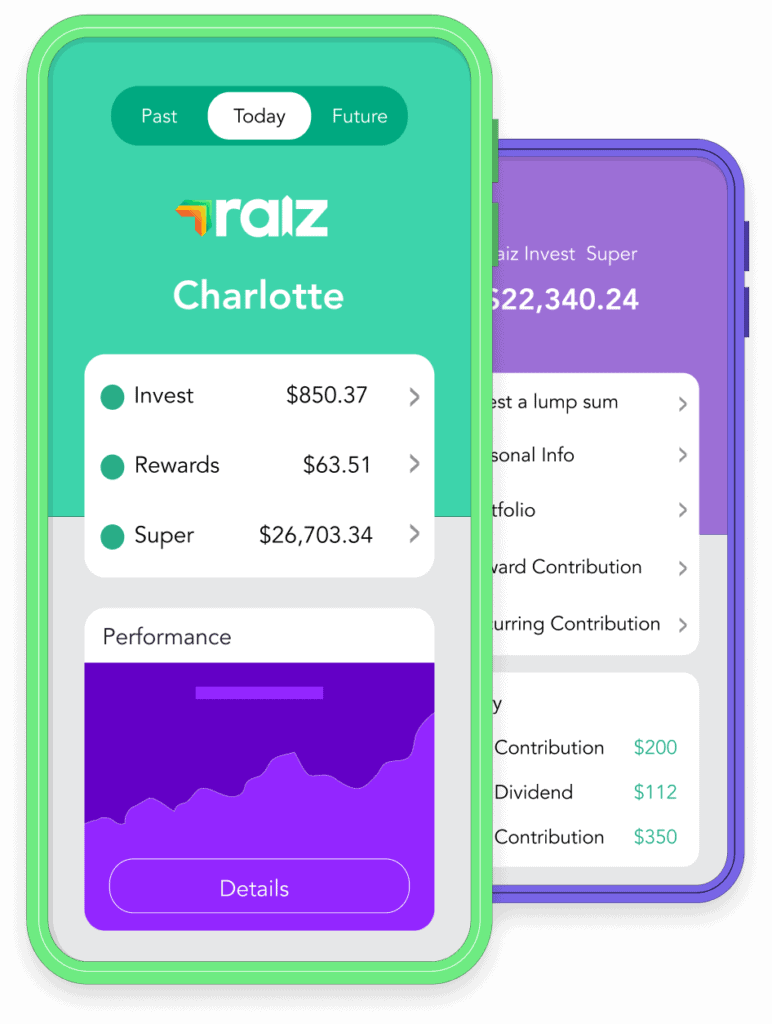

Originally named ‘Acorns’, Raiz was the trendsetter for micro-investing in Australia when it launched here in 2015. The core feature of Raiz is simple: by connecting your bank account or card to an investment portfolio, you can:

Raiz offers a range of diversified portfolios that can be customised to match the user's investment goals and risk tolerance. It also has an in-app ‘My Finance’ feature that provides spend tracking and categorisation, which are turned into personalised insights.

Raiz users can also earn reward points for using the app, redeem them for cash, or transfer them to their investment account.

Raiz key features:

Similar to Raiz, Spaceship is an investment and savings platform designed to make investing simple and accessible, particularly for those new to investing.

The Spaceship Voyager app lets users invest in up to five diversified portfolios with no minimum investments. Additionally, Spaceship Super allows users to manage their superannuation with a focus on growth or ethical investments, giving you more control over your retirement savings.

The app also provides educational content, making investing less intimidating for beginners. An exciting feature Spaceship has is its 'deep dives', which are comprehensive company profiles on all the companies in each of its portfolios!

Spaceship key features:

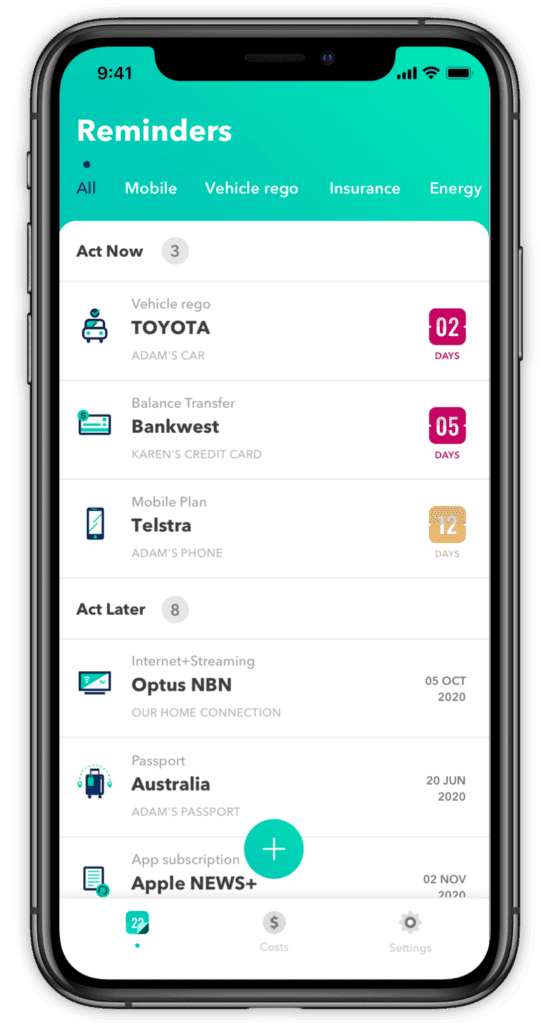

GetReminded is an app that aims to help Australians avoid late fees and missed payments by sending reminders for bills, subscriptions, and other financial obligations. Founded in 2018, GetReminded users can link a range of financial products, such as bank accounts, credit cards, and utility bills to get reminded of when everything is due.

In fact, GetReminded has a list of everything the app can set reminders for, and these include:

One of GetReminded's unique features is its customisable alerts. Users can set up alerts for specific bills or payments and custom reminder times and frequencies. The app also offers a "snooze" feature, allowing users to delay reminders for bills they are not ready to pay.

GetReminded can send offers and deals for financial products and services through the app. If you’re overpaying for a specific policy, you could find a cheaper or better deal by clicking on these offers (although not a guarantee).

Get Reminded key features:

Goodbudget is an American-made app labelled a ‘budgeting app for the modern age’. Unlike some of the other apps in this article, however, it uses more of a manual approach to budgeting and saving.

Goodbudget uses virtual ‘envelopes’ to help users budget their money and allocate funds to different categories, such as rent, groceries, and entertainment.

Users can track their expenses and savings goals using these envelopes and receive alerts when they are close to reaching their budget limits. You can also set monthly limits for certain envelopes and export your data to other platforms like Excel or other devices.

This app can break down your spending for you in nice-looking infographics, analyses, and reports. It’s free to use to start with, but the number of envelopes you can make before using the paid version is limited.

Goodbudget key features:

Spriggy is a relatively new app in Australia, and chances are it isn’t meant to be used by the person reading this article. Instead, Spriggy is a budgeting and savings app for kids (ages 6-17) to help their parents teach them about money management.

Instead of giving kids coins and notes for pocket money, Spriggy is taking pocket money into the 21st century. Parents can link their bank accounts to the app to transfer money to their child's Spriggy account, which can be used to make purchases with the prepaid debit card. Parents can also set up controls to limit their children's transactions and track their spending.

The app also offers savings goals, which can help children learn the importance of saving money and setting financial goals. It offers a tonne of educational resources and fun challenges.

Spriggy key features:

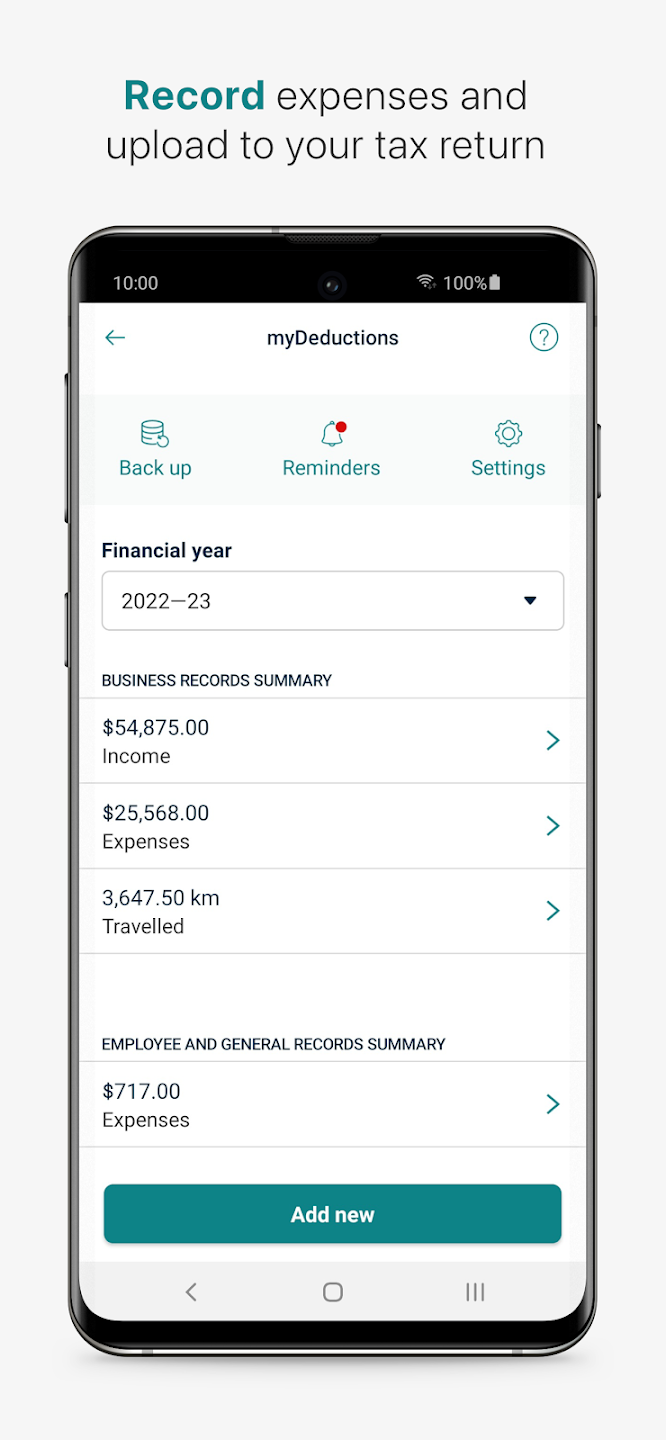

It might seem odd to include an app from the Australian Taxation Office (ATO) in this list, but it is genuinely very helpful and highly regarded when it comes to tax time.

The ATO’s app was designed to help Australians manage their tax and superannuation obligations. Key features include the ability to lodge tax returns, enter deductions and relevant receipts/documents, view and update personal details, and track the progress of refunds.

Users can also use the app to manage their superannuation, including viewing account balances and contributions. The ATO app also sends notifications and reminders for important tax deadlines.

ATO app key features:

Food and groceries have seen one of the biggest overall price increases thanks to recent sky-high inflation, stretching household budgets. That’s why Frugl Group - which tracks retail prices and data - released the Everyday Grocery App, allowing you to view and compare grocery prices to find the best deal you can.

Frugl’s app regularly updates with the best prices from Australia’s major grocery retailers across thousands of stores and tens of thousands of products. It can also send you the best coupons and deals for the week and let you create shopping lists, filter products based on your allergies and preferences, and more.

Frugl key features:

Fuel is another key household purchase that has seen massive cost increases over the last few years. That means it's crucial to compare fuel prices at a range of service stations near you. That’s where Fuel Map can help.

Created by an Australian developer and supported by user community data, Fuel Map has a map-based interface, real-time fuel price updates, and the ability to search for nearby fuel stations. Users can filter search results by fuel type, brand, and distance, helping them save money by finding the cheapest fuel in their area.

Other similar apps include PetrolSpy, the My 7-Eleven app, MotorMouth, Refueler, and more.

Fuel Map key features:

A list of 10 or so apps barely scratches the surface of what’s out there at the moment if you’re looking for a bit of help managing your money. While going old-school and doing it yourself could work, we have the technology now to give a more complete and, more importantly, unbiased view of how much you spend, what you spend it on and where you can improve.

Download a couple of these free apps and try them out for a while to see if they work for you. Taking just a few minutes out of your day to sync up your spending to an app could revolutionise your relationship with money.

Want to take matters into your own hands? Check out our ultimate list of more than 50 (75, to be exact) everyday ways to save money in 2024!

The Better Credit app from Jacaranda Finance is available on both the Google and Apple stores. With the Better Credit app, we make it easy for new or existing Jacaranda customers to:

And much more. Download the app today to see how Jacaranda could help you improve your credit score and unlock new financial opportunities.