Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

Credit report errors can negatively impact your financial health, but knowing how to identify and fix them can help you maintain a healthy credit score.

In this guide, we'll walk you through the essential steps to make sure your credit report is accurate and how to dispute any errors you find.

On this page:

A credit report is a detailed record of your credit history prepared by a credit bureau, such as Equifax, Experian and illion. It includes various types of information used by lenders to evaluate your creditworthiness. Credit reports are different from credit scores, which are single numbers contained within your credit report.

Your credit report includes a wide range of information about you and your financial behaviour, both past and present. To be more specific, this is usually:

These details help identify you uniquely and ensure that the credit information belongs to you.

Under the Privacy Act, credit bureaus are not allowed to hold data on any of the following pieces of personal information:

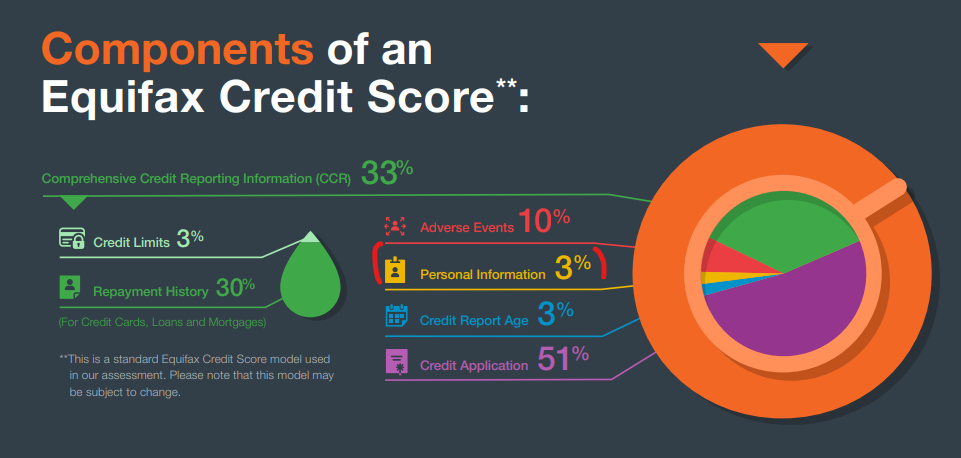

According to Equifax, the personal information within your credit report accounts for about 3% of your total credit score:

Contrary to popular belief, checking your credit report doesn’t hurt your credit score at all. It’s actually recommended that you check it semi-frequently to look for errors, which we’ll go through in more detail below.

You can freely obtain your credit report from the big three credit reporting bodies in Australia online or by written request. There are also some smaller agencies and third-party services you can get a copy from, like Talefin, CreditSavvy, and ClearScore.

Equifax says that you should have the following information on hand before you request a copy of your report:

While you can access your credit report free of charge every three months with Equifax and Experian, doing so more often might incur charges. It might take a few days to receive a copy of your credit report.

Unfortunately, the details in your credit report aren’t always 100% accurate. While credit reporting bodies must ‘take reasonable steps to ensure that the information on your credit report is accurate, up to date, and complete’, mistakes happen.

Those mistakes could’ve been made by you, your bank, or a third party. Regardless of how it happened, it’s essential to know what kind of errors to look for in your credit report and how you can fix them.

Incorrect data and information appearing in your credit report are more likely than you think. In 2019, CHOICE tested 27 credit reports, and 18 of them had some kind of mistake.

An overseas study from the United States in 2021, meanwhile, found that nearly half of consumers had spotted an error in their report.

Commonly seen mistakes on credit reports include:

While not technically a ‘mistake’, fraudulent applications for credit made in your name as a result of identity theft can also show up. Spotting these on your account means you can request a temporary freeze or ban on your credit report until it gets sorted.

Credit report errors can have a significant impact on your credit score in Australia.

Based on Equifax’s data above, credit inquiries (applications) account for 51% of your credit score, while your repayment history and credit limits are another 33%.

Each hard enquiry you make for a credit product can cause your credit score to drop by a small amount, usually around 5 - 10 points. An incorrect late payment, meanwhile, can lower your score by 22% for a single missed payment and up to 42% for multiple missed payments! Payments that were made on time can also sometimes be reported as late, even if they weren't.

If someone has fraudulently opened an account in your name, made multiple loan applications and not paid them back (why would they?), this could devastate your credit score very quickly.

Identifying mistakes early can save you from financial pitfalls later on. Even minor errors like the incorrect spelling of your name or the wrong address can snowball and have significant impacts on your credit score.

The best thing you can do to spot mistakes in your credit report is to check it regularly. By law, you are entitled to a free credit report from each of the three major credit reporting agencies - Equifax, Experian, and illion - once a year at least. With the first two (Equifax and Experian), it’s every three months.

You can also use credit monitoring services like Credit Savvy and Clearscore to monitor your credit reports and alert you to any significant changes. The credit bureaus themselves also offer tools like this, but this might come with a fee.

When checking your credit report, look for the following:

If you want to correct something on your credit report, you should do it as quickly as possible after spotting it. Disputing errors on your credit report can usually be done by following these steps:

If your request is approved, the credit bureau or your creditor should send you a letter notifying you the correction has been made. You’ll also receive an updated copy of your credit report.

None of this should cost any money.

Here's how you can get in touch with each of the major credit reporting agencies directly to correct errors on your credit report.

Always make sure to include supporting documents and an apparent reason for your dispute.

Typically, credit reporting agencies have 30 days to investigate and respond to your dispute. However, the process may take longer if they need extra info.

During this time, the agency will contact the creditor (your lender) involved to verify the information. If the creditor agrees that an error was made, the agency will correct your credit report.

If the creditor disagrees, the agency will notify you of the decision and provide instructions for further action.

If your request is rejected and you’ve already tried working it out directly with your lender, then you can file a complaint with the Australian Financial Complaints Authority (AFCA).

According to AFCA, your complaint must be acknowledged within seven days, and the credit reporting agency must make a decision about it within 30 days. The largest of Australia’s credit bureaus, Equifax, received 522 official complaints in 2023, with about half of them being resolved.

Note that you can’t remove information from your report that is actually correct.

You might see ads from companies claiming to offer credit repair services. While there are some legitimate companies that can help you fix credit report errors, ASIC says you should be cautious of scams. Some companies may promise to fix your credit quickly for a fee but fail to deliver on their promises.

Always verify the credibility of any company before sharing your personal information or paying for services. Look for reviews and check their accreditation with organizations such as the Australian Securities and Investments Commission (ASIC) to ensure you are dealing with a reputable firm.

Even when these companies are legit, there’s nothing they can offer that you can’t do yourself for free. According to ASIC, you’re unlikely to update your credit report or improve your credit score any faster by paying a high fee.

In addition to checking your credit report, you can do your future self a favour by improving your credit score, starting today.

You can read all about our top tips for improving a low credit score here, or check out our fast, affordable Personal Loans that can help put you on the right path. With Comprehensive Credit Reporting (CCR), it’s possible you could steadily improve your credit score by repaying one of our personal loans on time.

You can also download our Better Credit app (or log in to your online customer portal) to check your credit score for free! With monthly updates via Equifax, it’s easy to monitor your credit score’s progress with Jacaranda Finance.