Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

But you might not be aware of just how much each application you make could be impacting your credit score.

If you want to maintain a good credit score and keep your credit profile in tip-top shape, you should know exactly how applying for credit can impact you.

On this page:

Your credit score is a numerical representation of your creditworthiness, typically ranging from 0 to 1,200. The higher your score, the better your credit profile. Lenders use this score to determine how likely you are to repay borrowed money.

There are several leading credit reporting agencies in Australia (Equifax, Experian, and illion), and each uses a different formula to calculate your credit score. Depending on the credit agency, your score will also be classed as a specific category, which currently look like this:

| Equifax | Experian | Illion | |

|---|---|---|---|

| Below Average | 0 - 459 | 0 - 549 | 1 - 299 |

| Average | 460 - 660 | 550 - 624 | 300 - 499 |

| Good | 661 - 734 | 625 - 699 | 500 - 699 |

| Very good | 735 - 852 | 700 - 799 | 700 - 799 |

| Excellent | 853 - 1,200 | 800 - 1,000 | 800 - 1,000 |

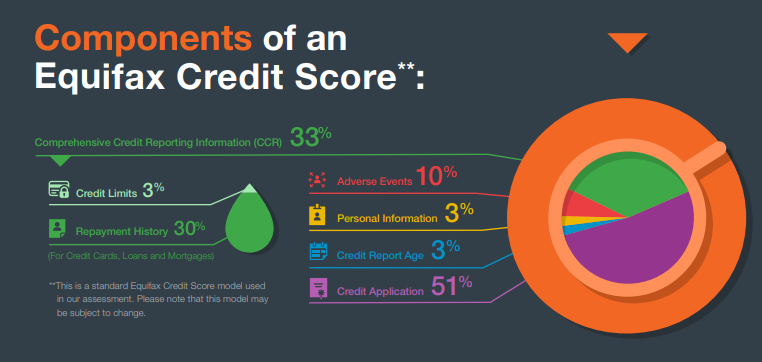

These leading credit reporting bodies, such as Equifax, will calculate your credit score based on the following information that sits within your credit report:

And more! It can get pretty complicated, which is why it’s worth checking and tracking your credit score on an ongoing basis to see whether it’s going up or down.

Checking your credit score or report won’t hurt it in any way. That’s actually a common credit score myth. There may, however, be limits on the number of times you can get a copy of your credit report each year.

Credit enquiries occur when someone requests to view your credit report and are synonymous with loan and credit applications.

There are two main types of credit enquiries – hard enquiries and soft enquiries, or credit checks. Hard enquiries can impact your credit score, while soft enquiries do not.

A hard enquiry involves a bank, lender, or financial institution specifically checking your credit score and credit report before they make a lending decision. Examples of hard enquiries include:

When you apply, you grant these institutions, known as access seekers, permission to leave a hard enquiry against your credit report.

Examples of soft credit checks, on the other hand, can include things like:

Soft credit checks are only visible to you when you view your credit report. Since they aren’t connected to a credit application in any way, they aren’t visible to anyone else and don’t leave any lasting impact on your profile.

Credit applications (hard enquiries) have the most impact on your credit score. According to Equifax, they account for more than half (51%) of the standard credit score!

As a general rule, each hard enquiry you make for a credit product can cause your credit score to instantly drop by a small amount, usually around 5 - 10 points. That’s less than 1% of the maximum credit score available (up to 1,200).

This might not sound like a lot, but they can really add up, as we’ll explain below. If your application is unsuccessful, not only will your credit score go down slightly, but you could harm your chances of approval with another lender.

Too many applications in a short space of time can indicate a lack of financial stability when a lender is assessing your suitability for a loan.

If you’re concerned about the number of credit enquiries listed on your credit report, request a copy of it from one of the major credit bureaus.

While you may not be able to formally apply for a loan or credit product without affecting your credit score, you can check your eligibility without leaving a hard enquiry. This is essentially what pre-approval is.

At Jacaranda Finance, you can check if you qualify for one of our loans without impacting your credit score at all.

When you check if you qualify, we can access your credit file in a way that doesn’t impact your credit score and is not disclosed to anyone other than yourself.

If you meet our eligibility criteria, we'll let you know on the spot. You can then choose to move forward with submitting an application, which may then impact your credit score.

Your credit score is comprised of both public and private information. We’ve already mentioned that more than half (51%) of an Equifax credit score is purely from credit applications. The rest of it is comprised of:

While some pieces of personal info can and do influence your credit score, such as your address or age, it does not consider the following:

A credit bureau can only hold data permitted under the Privacy Act. This means the data used to calculate a bureau credit score must meet strict guidelines.

According to the Office of the Australian Information Commissioner (OAIC), credit enquiries stay on your credit report for five years. Your repayment history stays there for two years, while defaults and serious credit infringements stay there for five and seven years, respectively.

Credit enquiries will stay on your report for a long time. While their effect on your credit score can often be shorter than this, and lenders will generally only look at your recent financial history, it just goes to show that any applications you make will be visible for quite a while.

Unfortunately, you can’t remove these enquiries from your credit report unless they are incorrect or fraudulent. It’s actually pretty straightforward to have these incorrect enquiries removed, which is why it’s worth checking your credit report every 6 - 12 months or so.

In Australia, you should be able to check your credit score online as regularly as you would like from the main three credit reporting bodies: Equifax, Experian, & Illion. They also provide credit information to other third-party websites and businesses.

It usually only takes a few minutes to check your credit score online, and A standard 100-point ID check is all that’s usually required to check your credit score in Australia, including:

At Jacaranda Finance, we recently added the ability to check and track your credit score through our Better Credit mobile app! Download our app today and see how easy it is to do so.

Having a below-average credit score in Australia can significantly limit your financial opportunities, as lenders may see you as a bigger risk. This can lead to a pretty vicious spiral where you keep applying for loans and lowering your credit score, making it harder to get a loan each time.

But remember: A below-average credit score isn't a permanent stain on your financial record, and there are numerous steps you can take to improve your score steadily.

You can read all about our top tips for improving a low credit score here, or check out our fast, affordable Personal Loans that can help put you on the right path.

With Comprehensive Credit Reporting (CCR), you could steadily improve your credit score by repaying one of our Personal Loans on time. Once you have one of our loans up to $25,000, download our Better Credit app (or log in to your online customer portal) to check your credit score for free! With monthly updates via Equifax, it’s easy to monitor your credit score’s progress.