Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

How many Australians use a credit card? How do they compare to debit cards? And how much interest do we pay in total on those pieces of plastic?

This comprehensive guide delves into the latest statistics and trends surrounding credit and debit card use, providing valuable insights into the average Australian's spending habits, debt levels, and more.

On this page:

According to the latest credit card data from the Reserve Bank of Australia (RBA), there are more than 16 million active credit cards in the country as of September 2023. Interestingly, there are 13.4 million active credit card accounts, suggesting some people have more than one card on the same account.

This is a noticeable 29% drop from September 2016, when the number of credit cards in circulation hit a record high of nearly 23 million. That’s more than the adult population of Australia!

The current number of credit cards in Australia is also down 11% compared to the historical average of more than 18 million. Clearly, Aussies have started closing down their credit cards in favour of other payment options. According to the RBA:

“The perceived attractiveness of credit card reward schemes has fallen in recent years, and higher surcharges for using credit cards at some merchants may be driving consumers to use debit cards instead.”

There are far more debit cards than credit cards, which makes sense when you consider that most Australian adults have a bank account, which usually comes with a spending (debit) card. The latest RBA figures from September 2023 show a whopping 45.6 million active debit cards.

This is a 6% annual increase and is nearly double the number of debit cards in 2002 when the RBA first started recording this data.

The graph below shows how the number of debit and credit cards has fluctuated over time in Australia.

The number of monthly transactions for both credit and debit cards reached their highest ever point in September 2023: 937 million purchases were made with debit cards, while more than 308 million were made with credit cards.

Monthly credit and debit card transactions are up about 6% annually each and almost precisely mirror the decline in cash transactions.

“This trend has been driven in recent years by the development of more convenient and seamless payment technology as well as changes in consumer payment behaviour brought on by the COVID-19 pandemic,” The RBA said.

“Card payments now offer convenient contactless payments that speed up transactions; they have reduced the need for consumers to top up cash, have wide merchant acceptance facilitated by new payment providers, and have allowed for innovation in the payments space (such as storing cards in mobile wallets).

“As a result, three-quarters of payments were made with cards in 2022 – an increase of 13 percentage points from 2019 and three times the share in 2007.”

Based on the RBA’s figures and Australian population data, each Aussie adult has 1.3 credit cards on average (and 2.2 debit cards).

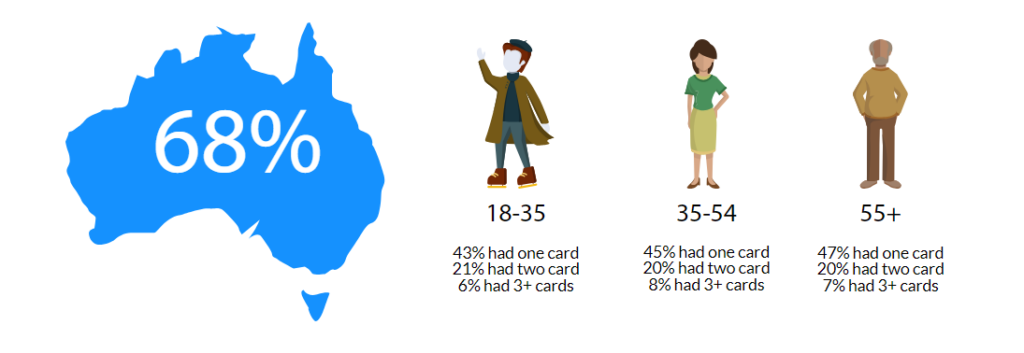

According to Finder’s Consumer Sentiment Tracker data, 68% of Australians say they have a credit card, and around 20% have at least two. Younger generations are slightly more likely to have additional cards.

Credit used to dominate debit cards in terms of spending, but that all changed during the COVID-19 pandemic. As the graph below shows, monthly debit card spending first overtook credit card spending in May 2019, as Aussies took advantage of lockdowns and stay-at-home orders to save and pay down some debts.

The latest figures show a mammoth $34.7 billion was spent on credit cards in September 2023 and $47.9 billion on debit cards. So far in 2023, credit and debit cards have seen a total of $347 billion and $419 billion spent, respectively!

Amid the cost-of-living crunch, the value of credit and debit card purchases in 2023 rose by about 7% compared to 2022.

One of the more interesting stats around credit cards in Australia is the decline in both balances (the amounts on our cards) and our balances accruing interest, aka debt.

As of September 2023, the latest total credit card balance was $41.1 billion, or about $2,558 per card. The amount of this balance accruing interest is around $18.6 billion, or $1,157 per person.

While the amount of credit card debt rose by about 2% year-on-year, that’s nowhere near enough to reach pre-COVID levels. As Aussies started paying off their debts in lockdowns, driven by a lack of spending opportunities and stimulus checks (among other factors), the amount of monthly credit card debt has fallen by almost precisely one-third (33.5%) from $27.9 billion in March 2020.

At its peak, credit card debt in Australia reached as high as $37 billion back in October 2011, twice as much as we have now!

The total monthly value of credit card repayments in September 2023 was $35.1 billion, which is about 85% of the total balance accrued that month. The rest is charged interest.

Per person, the average Aussie with a credit card pays off $2,186 a month.

Your credit limit is the maximum amount of debt you can have on a credit card at any one time. The average Australian credit limit as of September 2023 is $7,935, which is $127.5 billion all up. Given the typical Aussie carries a monthly balance of $2,558 (see above), we typically use about 33% of our available credit limits.

Our average credit limit peaked in April 2018 at roughly $9,500 per person.

Credit card interest rates can vary significantly depending on a number of factors. But unlike other products like home and personal loans, they’ve remained relatively stagnant in recent years. While the rapidly declining - and more recently, rising - cash rate has seen interest rates on loan products fluctuate, credit card rates have barely changed over the past several years.

According to the Reserve Bank of Australia, the average ‘standard’ credit card rate is 19.87% in 2023. For low-rate cards, this average is around 13%, while cards accruing interest currently attract an average interest rate of 17.98%.

In addition to the interest rate, credit cards also charge several standard fees, which can vary significantly depending on the card itself.

The most common credit card fee is the annual fee, also known as the account servicing fee. According to the Reserve Bank, the average annual fee charged by credit cards in 2023 is $83.

While some credit cards have a $0 annual fee, Canstar’s research reveals credit card annual fees can range from $29 to as high as $700+. Cards with higher credit limits and a range of extra perks, such as rewards points for spending, airline benefits, travel insurance, etc, are more likely to have higher fees than low-rate, ‘no-frills’ cards.

In total, Australians paid $1.15 billion in credit card fees in 2022, according to the RBA - a 6% increase in just one year!

As Australia transitions to a mostly cashless society, the number and value of ATM cash withdrawals have plummeted. In 2023, nearly 30 million ATM cash withdrawals are made per month, worth about $8.7 billion.

That might seem like a lot, but not when you consider that ATM withdrawals peaked at nearly 78 million per month ($11.3 billion) in December 2008. That’s a 62% drop in ATM use in less than 20 years.

When was the last time you successfully asked a cashier if they did cash out? About 8.3 million cash out transactions took place each month on average in 2023, to the tune of $807 million per month.

That’s still a 65% decline in cash outs since peaking in 2014.

A credit card cash advance is when you withdraw cash using your credit card, and it is usually a very expensive way of accessing money.

Cash advances typically attract a fee that's worth 2% - 3.5% of the transaction, plus an interest rate higher than that of your actual credit card purchase rate. There are no interest-free days on cash advance transactions, so you’ll pay this interest rate every time.

Thankfully, this expensive way of accessing cash has also declined in recent years. The RBA’s data shows an average of 1.1 million cash advances made each month in 2023, which is a huge 66% decrease from their highest point in 2006.

Monthly cash advances peaked at more than $1.1 billion in value in 2008. Now, cash advances are worth about $431 million each month. Even though that’s a fall of more than 60%, it’s still a lot of interest to be paying to withdraw cash.

Buy now, pay later (BNPL) is a payment option that allows customers to buy something straight away but pay for it in instalments, usually four.

Billed as an alternative to credit cards, here’s a collection of key statistics about BNPL in Australia:

Other payment options used by some Australians are short-term loans (also known as payday loans) and wage advances, among others. These loans offer quick money fixes for smaller amounts over shorter periods but are usually much more expensive as a result.

You can read more about how these high-cost debts work and why you should try to avoid them in the links below. In the meantime, here are some key statistics on wage advances and payday loans in Australia:

Read more:

Finder’s research shows that paying for emergencies (41%), rewards points (38%) and making big-ticket purchases (21%) are the main reasons Australians took out their credit card(s):

While credit cards are often used for significant expenses, many people also use them for day-to-day spending, particularly if they’re looking to maximise their rewards benefits.

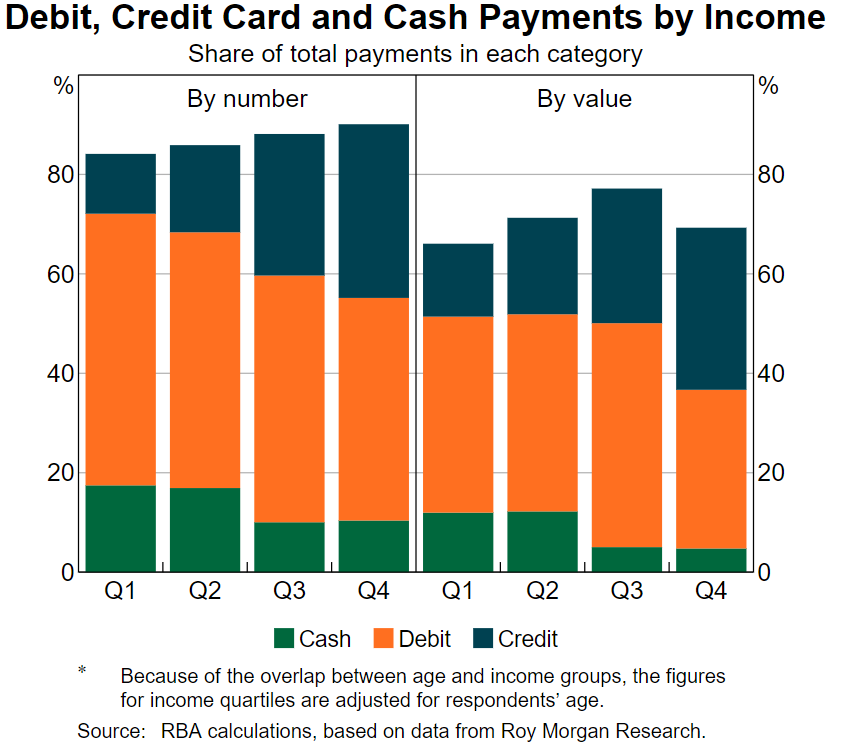

Debit cards are used for just about anything and everything, as they account for the majority of everyday spending. According to the Reserve Bank, lower-income and younger people use debit cards more frequently than older and weather people.

“Lower-income households use debit cards and cash more frequently than higher-income households. Consumers in the lowest income quartile made 55 per cent of their transactions with debit cards, compared with 45 per cent for those in the highest income quartile.

Conversely, higher-income households use credit cards more intensively than other households. Consumers in the highest income quartile use credit cards for around one-third of their payments, which is three times the share for lowest income households.

“This may reflect higher-income households being more likely to meet the lending standards for a credit card, as well as debit cards and cash being used as budgeting tools for lower-income households.”

Globally, there are three main credit card issuers to choose between: Visa, Mastercard and American Express, or Amex for short.

Amex cards tend to be more ‘high-end’ and offer better rewards and perks. But as a result, Amex generally charges higher rates and fees to the customer as well as higher merchant fees to businesses, which is why they aren’t accepted at many places.

According to the RBA’s latest data from September 2023, Visa and Mastercard account for 91.8% of all credit card purchases, compared to 8.2% for American Express. However, Amex cards are worth 20.4% of the value of these purchases, while Mastercard and Visa account for the remaining 79.6%.

This is a clear indicator that Amex users are making larger purchases on average.

Credit cards can be a great product if used properly, but there are clearly risks associated with them.

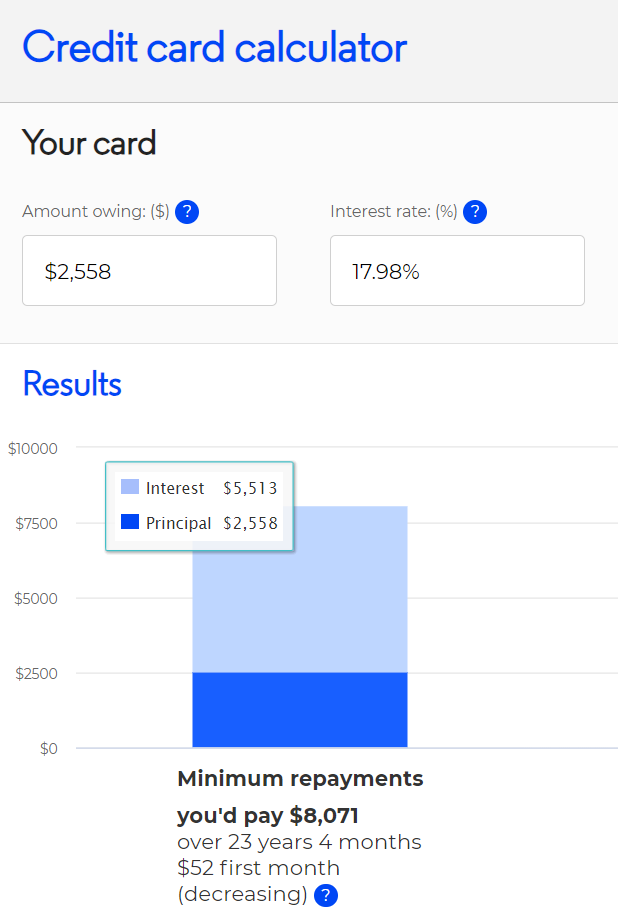

Let’s say you have an average credit card balance of $2,558 and an average interest rate of 17.98% p.a (see above). Using ASIC’s credit card calculator, if you could only make the minimum required repayment, you would end up paying an enormous $8,071 over more than 23 years!

If you find yourself struggling to pay off your credit card debts, you’re not alone. Finder research from July 2023 found 16% of Aussie credit card users were unable to meet their repayments in full. One in ten couldn’t even make the minimum required repayment.

We’re here to help at Jacaranda Finance. Our debt consolidation loans are designed to provide relief from the stress of managing multiple debts.

With a Debt Consolidation Loan from Jacaranda, you can say goodbye to the complexity of numerous bills and varying interest rates and welcome a more streamlined and manageable financial future.

Check if you qualify today using the button below to get started, or click here to learn more about the pros and cons of debt consolidation loans.

Refinancing or consolidating your current debt may result in higher total charges if the interest rate and fees are higher or the loan term is longer. You should also carefully consider the impact of increasing your debt, monthly obligations, and the length of your repayment term.

The information on this website is for general information only. It should not be considered professional advice from the website owner - Jacaranda Finance. Jacaranda Finance is not a financial adviser, and the content on this page does not consider your objectives, financial situation or needs. You should consider seeking independent legal, financial, taxation or other advice to check how the website information relates to your unique circumstances. Jacaranda Finance is not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided directly or indirectly by the use of this website.