Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

With rental markets extremely tight across Australia right now, not getting some - or all - of your bond back could be catastrophic, both to your finances and your ability to secure future rentals. And yet, tenants not getting their bonds back is a common occurrence.

According to NSW Fair Trading, approximately 25% of tenants in Australia do not get their full bond back when moving out of a rental property. A 2020 survey by Rent.com.au meanwhile found that 30% failed to get their full bond reimbursed, with the most common reasons being cleaning issues, damage to the property and unpaid rent.

While there are plenty of legitimate reasons to withhold a bond from a tenant, there are plenty of ways you could feel hard done by if you’re moving out of a rental property. However, there are steps you can take to avoid this from happening.

In this article, we’ll discuss our top 10 tips for getting your rental bond back and what you can do if you don’t.

On this page:

A rental bond is a lump sum security deposit paid by renters to either the property manager or the landlord at the start of a tenancy agreement. It acts as a financial security net for the landlord in the event of damaged property, missed rental payments, or any other breaches of the lease agreement.

The typical rental bond can be pretty expensive, even when split between several tenants. Paying for a rental bond can be a big ask, particularly during a cost-of-living crisis.

“Many Australian households are really feeling the squeeze right now, particularly with the rental crisis we’re experiencing here in Australia,” Compare the Market’s Natasha Innes told Jacaranda Finance.

“There’s no doubt that if Aussies are struggling to pay rent and other bills, they would also be struggling to pay their bonds. If you’re moving into a new rental property, you have to cover moving costs, fuel and then pay the bond on top of all of that.”

Rental bonds increased across NSW, Victoria and Queensland by an average of 27% in 2022, according to MyBond. The cost of a rental bond will vary depending on several factors, primarily:

As of 2024, rental bond costs will have gone up even more due to the sheer size of rent increases in that time.

Our analysis of Domain’s latest quarterly rental figures shows that the average weekly cost of renting across the capital cities rose by more than 10% in just 12 months from March 2023 to March 2024.

In the past two years (since March 2022), average rents have risen by nearly 25%!

The standard maximum that can be charged for a bond is four weeks’ rent upfront, with two weeks extra rent sometimes able to be requested depending on the state or territory. Given these soaring rental prices, you could expect to pay the following for the typical rental bond as of 2024:

| Capital City | March-2024 | Rental bond (4 weeks' rent) | +2 weeks rent |

|---|---|---|---|

| Sydney | $725 | $3,000 | $4,500 |

| Melbourne | $560 | $2,240 | $3,360 |

| Brisbane | $605 | $2,420 | $3,630 |

| Adelaide | $525 | $2,100 | $3,150 |

| Perth | $600 | $2,400 | $3,600 |

| Hobart | $505 | $2,020 | $3,030 |

| Canberra | $628 | $2,512 | $3,768 |

| Darwin | $600 | $2,400 | $3,600 |

| Combined Capitals | $593.5 | $2,374 | $3,561 |

Based on these figures, the typical rental bond per property could cost over $3,500. That’s before you even factor in moving costs.

Landlords are legally required to provide a reason for any deductions made from the bond, and tenants have the right to dispute any deductions they believe are unfair.

According to Domain, the main reasons tenants lose part or all of their rental bonds are:

However, your landlord generally will not be able to make legitimate claims for the following:

“Most of the time when someone hasn’t received their bond refund it’s because they haven’t left the property in the same condition as when they moved in,” Ms Innes said.

“If you’ve punched a hole in the wall after a night out or fell asleep in the bathtub and flooded the apartment, chances are you can kiss your bond goodbye.

“If you didn’t clean the property before leaving or pay for a cleaner, then the landlord might withhold some of your bond to pay for that cleaner.

“In a time where you’ve got to line up three blocks away to see a rental property, you need to be on your best behaviour to ensure you have a squeaky-clean rental history.”

Whether this is your first time moving into a rental property, or you’re a seasoned renter who’s been through the bond process several times, here are our top 10 tips you can follow to help ensure you get your bond fully refunded each time.

See the ten tips below:

Ensure you provide sufficient notice to your landlord or real estate agent before moving out. This will help them find new tenants, prepare the property for inspection, and keep you in their good books when the time comes to hand over the keys.

Each state/territory’s rental legislation will specify a timeframe both owners and tenants must provide when deciding not to renew the lease.

The condition report is one of the most important documents to have as a tenant. At the beginning of your tenancy, the property manager will complete a report detailing the property's condition, inside and outside. After they finish the report, it is sent to you, and you will have a certain number of days to add your comments and photos.

Be as detailed as possible; the condition report can be used as evidence in a dispute regarding your rental bond. After you complete and sign the report, keep a copy for your records.

This is one of the most important things you can do and should be done during your entry condition report and regularly throughout your time living there.

There is no such thing as too many photos and notes regarding a rental property. Take the report with you, go to every room in the property, make notes, and take pictures of any marks, damage, cracks, or dents. For example, note cracked ceilings, dirty walls, broken bathroom tiles, and peeling paint.

Take photos of any issues as they appear throughout your lease, and keep digital and physical records of all communications you’ve had with your landlord or property manager. A good strategy is to ensure each lease member has their own version: you don’t want the person with all the photos on their phone to leave, especially if it’s on bad terms.

Don’t just skim it: it’s vital that you thoroughly read every line in your lease agreement before you sign it. This will let you know what you can or can’t do and what the owner is responsible for compared to you.

For example, tenants commonly trip up by bringing pets into the home when they aren’t allowed, or they try to alter the property without permission. Whether you want to replace blinds or put in hooks, the landlord should approve any alterations (no matter how minor) first.

If they have approved it, make sure you receive written permission. This can be useful if the property manager claims they didn’t approve the change.

One of the most critical parts of getting your rental bond back is ensuring the property is clean. The landlord can claim your bond if the property isn’t near the same condition as when you moved in.

Your first step should be to check the tenancy agreement for a complete list from your property manager of what needs to be cleaned. For example, many lease agreements require the tenant to get the carpets professionally steam cleaned.

While you could employ some elbow grease, giving your place a thorough clean yourself can often be time-consuming and may not even guarantee you get your bond back anyway.

The easiest way to ensure the property is in good condition is to hire a professional cleaner. While it comes at an extra cost, a bond cleaner knows precisely what the agent expects and requires. Plus, most bond cleaners guarantee their work, so they can go back to the property and amend it for free if there's an issue.

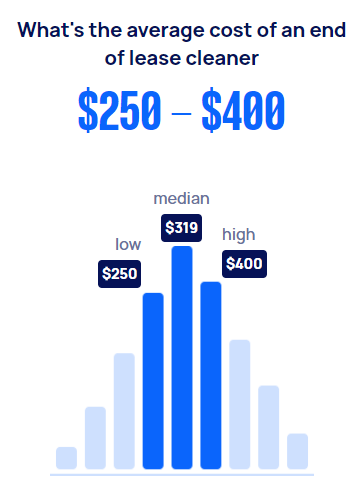

A handy tip is to use one that the agent recommends. But if you decide to compare your options, Airtasker quotes the median bond cleaner cost at $319, with typical prices ranging from $250 - $400.

Take note of any property damage, and if possible, fix them before leaving. This includes repairing broken appliances, wall holes, or cracked tiles. This way, you can increase the likelihood of getting your rental bond back.

It’s reasonable that a home lived in will have some fair wear and tear. As a tenant, you aren’t responsible for fair wear and tear, but unexpected damage to the property can make you liable. For example, faded or cracked paint is generally deemed fair wear and tear, but an unapproved paint job can be considered damage.

However, what’s considered ‘fair wear and tear’ instead of damage is often a source of dispute between the landlord or property manager and the tenant. Here are some examples from NSW Fair Trading:

| Fair wear and tear | Damage |

|---|---|

| Faded curtains or frayed cords | Missing or torn curtains |

| Furniture indentations and traffic marks on the carpet | Stains or burn marks on the carpet |

| Scuffed up wooden floors | Badly scratched or gouged wooden floors |

| Faded, chipped, or cracked paint | Unapproved, poor-quality paint job |

| Worn kitchen benchtop | Burns or cuts in the bench top |

| Loose hinges or handles on doors or windows and worn sliding tracks | Broken glass |

| Water stains on the carpet from rain through leaking roof or nasty plumbing | Water stains on carpet caused by overflowing bath or indoor pot plants |

| Paint worn off the wall near light switches | Damage to paint caused by removing posters stuck with blu-tack or sticky tape |

A pre-vacate (or pre-exit) inspection is when the real estate agent or property manager inspects the property before the tenants move out. This allows them to discuss and address any areas of concern so that you can receive your bond back.

It’s a handy way to clarify the agent’s interpretation of ‘good condition’. Ask if you can obtain a checklist that outlines what they expect you to do when you vacate.

It’s also worth considering attending the final inspection, where you can address issues as they come up and hand over all relevant keys and household items. Bring those copies of your records and entry reports with you and have them ready.

After you vacate the property for the last time, you must hand over all the keys, security devices, and any other items you were given.

If you don’t do this, the house can be deemed unsecured, and you might have to pay to replace the keys or locks. If you lose a key during your tenancy, tell your landlord and property manager immediately.

Before you move out, ensure all rental payments and relevant invoices are settled. This will be the final step in getting your rental bond back. If you were paying a water bill as part of your lease agreement, you should expect to receive a bill that will either need to be paid directly or deducted from your bond.

If you don’t complete all rental payments, you can risk being put on a blacklist on the tenancy database. This can significantly affect your ability to be approved for future rental applications.

As a tenant, you have rights and responsibilities that you need to understand. Ensure you read and understand your lease agreement, including any terms and conditions related to returning your rental bond. This will help avoid misunderstandings or disputes with your landlord or real estate agent.

See our section below on ‘rental bond loans by state’ to find the appropriate links to your rights and responsibilities as legislated.

If your landlord claims part or all of your bond, the general process is as follows. Bear in mind that these may vary slightly depending on where you live.

Your landlord will claim your bond through the relevant government authority in your state or territory. They will need to provide evidence and a reason for the claim.

You will receive notification of the claim, usually via email or mail. The notification will include details of the claim, the amount being claimed, and the reason for the claim.

You will need to respond to the claim within a specified time frame, usually 14 days. You can dispute the claim by providing evidence to support your case or negotiate with your landlord to reach a settlement.

The first step here is to contact your property manager or landlord to try and resolve the dispute. Ideally, you want to negotiate with them to avoid going to a tribunal.

If both parties agree, a Refund of Rental Bond form should be provided. After this is signed, the bond can be returned.

If you and your landlord cannot come to an agreement, you may need to attend a hearing at the relevant tribunal or court. You will be able to present your case and provide evidence to support your claim.

Generally, the information you’ll need handy if your dispute goes to the tribunal includes:

Here’s a quick rundown of each state or territory’s organisation that deals with bond disputes:

A decision will be made by the tribunal or court based on the evidence provided by both parties. If the decision is in your favour, you will receive your full bond back. If not, the bond money will be paid to the landlord to cover the claimed amount.

If you disagree with the decision made by the tribunal or court, you may have the option to appeal the decision.

If you’re experiencing issues with your rental bond and need advice or advocacy, each state or territory has a tenants’ support service available. Here’s a list of who you can go to in each state or territory:

See below for more detailed information on rental bonds in each state/territory. You can also check out our Rental Bond Loans if you need to borrow funds to repay your rental bond payment in affordable instalments.

At Jacaranda Finance, we offer fast, flexible and affordable Rental Bond Loans starting from $3,000, with loan terms as short as 25 months.

If you need funds quickly to secure your next rental property, you can apply in as little as 5-12 minutes1 and receive an outcome

on the same day

2 . Even better, you can check if you qualify beforehand without impacting your credit score at all.