The Cost of Living Explained

Last modified: 13th February 2024

William Jolly |

According to research by major bank NAB, the cost of living is the largest cause of stress among a majority (57%) of Aussies. One in three Australians identify money as a ‘significant’ cause of stress, and 25% say they’re concerned about how they’re going to make ends meet.

But what exactly is the ‘cost of living’? Is there an exact definition? How do we measure it? And what expenses have risen in cost the most in recent months?

Take a deep dive into the cost of living in our latest article.

On this page:

- What is the cost of living?

- How do we measure the cost of living?

- What is inflation?

- The cost of living in Australia

- How does Australia’s cost of living compare to other countries?

- What are the biggest living expenses in 2023?

- Have our wages increased?

- How much money are Aussies saving?

- Tips to reduce your expenses

- Resources for debt & financial assistance

What is the cost of living?

There’s no set definition for it, but the cost of living is generally how much it costs to afford the essentials needed to live comfortably. While it isn’t literally paying to be alive, it can indirectly mean that: things like food, shelter, and medical treatment aren’t really optional but still cost money, after all, and not having them can have dire consequences.

At the time of writing, the cost of living has increased quite sharply, and there’s little respite on the horizon. “Non-discretionary” items - that’s the essentials - like fruit and vegetables, medications, petrol for your car and energy for your home have seen significant price rises, while the discretionary (non-essential) items like entertainment, restaurants and nice clothing also cost a lot more than they used to.

Essentially, the cost of living is the minimum expenditure needed to maintain a certain standard of living.

How do we measure the cost of living in Australia?

According to the Australian Bureau of Statistics (ABS), “no statistical agencies compile true cost of living or purchasing power measures as it is too difficult to do so”. The cost of living for one person could be very different to the next, so we don’t officially measure it. However, we come pretty close.

While different sources compile data on the changing costs of certain types of expenses (we’ll showcase some of these further down), the main source of data used to describe our rising cost of living is the Consumer Price Index (CPI), also known as inflation.

What is inflation?

At its most basic level, inflation is the rate of increase in prices over a period of time. It measures our buying power: the faster inflation increases, the less our money is worth.

Some level of inflation is good. For example, the boffins at the Reserve Bank of Australia (RBA) generally try to keep inflation within a target range of about 2-3%. Unfortunately, that hasn’t been going too well lately.

According to our latest CPI figures, inflation rose 5.6% in the year to September 2023 and peaked at 8.4% over the 12 months to December 2022. The last couple of years have seen some of the largest increases ever recorded.

“High inflation is damaging and corrosive,” the former head of the RBA, Philip Lowe, said.

“It hurts people, puts pressure on household budgets and erodes the value of people’s savings. It increases inequality and hurts people on low incomes the most.”

How do we measure inflation?

The CPI measures the costs of 11 categories of necessary goods and services (known as a ‘basket’) month-to-month and tracks their price movements, with different weights given to different types of expenses based on their importance:

When the cost of the overall basket goes up, the monthly CPI has officially increased. This can also mean the cost of living has indirectly gone up.

What is the cost of living in Australia?

The cost of living in Australia is generally quite high and climbing, although the true cost will be relative to where each person lives and the income they earn. Someone living in a capital city, for example, won’t have the same cost of living as someone in regional Australia.

However, two sources - collaborative databases Expatisan and Numbeo, which collect data from real people - have listed the typical monthly expenses in Australia for both families and singles.

The numbers don’t make for good reading, with even a single person expected to require several thousand dollars each month just to pay for the necessities:

How does Australia’s cost of living compare to other countries?

Multiple sources have found Australia to have one of the highest costs of living in the world, although our standard of living is also very high. Expatisan research shows that as of 2024, the cost of living in Australia is more expensive than 87% of countries in the world!

Meanwhile, global research by Economic Intelligence in 2022 placed Sydney as the 10th most expensive city in the world, sitting just behind major cities like Paris, San Francisco, Los Angeles and Hong Kong.

What are the biggest living expenses in 2024?

The high cost of living has influenced nearly everyone, so there’s a good chance you’re acutely aware of at least some of these expenses. Below, we’ve broken down the costs that are affecting Aussies the most in 2023 and how much they’ve increased overall.

You might find your spending on some of these has gone up by more or less than the average Australian.

Click here to jump to each section:

- The cost of mortgages

- The cost of rent

- The cost of energy

- The cost of groceries

- The cost of fuel/petrol

Mortgages

Mortgages are the cost you might’ve heard about the most in recent months, and if you’re one of the ~33% of Australians with an active mortgage, you’re living it right now.

To combat rising inflation, the RBA has increased the cash rate - essentially the cost of borrowing between banks - from its record low of 0.10% in April 2022 to 4.35% as of February 2024. That’s an increase of 425 basis points, or 4.25% p.a., in less than two years!

These increases are almost always passed on to mortgage holders in the form of interest rate rises on their home loans. According to an analysis by AMP in 2023:

“The average household in Australia has a mortgage of around $600,000 (across variable and fixed loans). As a rough guide, monthly mortgage repayments are due to increase by around $13,000 per year if we account for the full increase in the cash rate so far.”

So for the average household with a mortgage, their monthly costs on their house alone could have increased by more than $1,000!

The chart below shows just how sharply the average variable home loan rate has increased in line with the increase in the RBA cash rate.

Rent

Roughly one-third of the population rents their home, and rents have also increased quite sharply. Research by Compare the Market in February 2023 found more than half (53.9%) of renters had seen their rent increase over 12 months and were forking out an extra $1,932 a year on rent alone on average.

“These aren’t small increases that Australian renters are experiencing,” Compare the Market’s Natasha Innes said.

“Over a year, it’s enough to pay for a return trip overseas, fill up a 50-litre tank car around 22 times or potentially pay for more than a year’s worth of electricity.”

That was about one year ago - the figures make for even bleaker reading now. According to Domain’s quarterly rental report for December 2023, last year was another record-breaking year for rental prices:

“Australia’s highly competitive rental market was on full display in 2023,” the report said.

“The perilous conditions saw the year hit a record-low vacancy rate driving the longest continuous stretch of rising asking rents (also at a record). At the end of 2023, asking rents sat at record highs across the combined capitals and all cities, apart from Canberra houses and Darwin and Hobart unit rents.

“Despite the records and consecutive rises, extreme rent hikes are losing traction as rental gains continue to slow across most of the capital cities.”

Our analysis of Domain’s rental figures shows the average weekly cost of renting across the capital cities has increased by almost one-third in the past two years, up from $453 per week in December 2021 to $600 per week in December 2023.

Combined weekly rents: Units and Houses

|

Capital City |

DEC-2023 |

DEC-2021 |

Two-Year Growth |

|---|---|---|---|

|

Sydney |

$705 |

$533 |

32.27% |

|

Melbourne |

$535 |

$410 |

30.49% |

|

Brisbane |

$580 |

$450 |

28.89% |

|

Canberra |

$620 |

$600 |

3.33% |

|

Adelaide |

$505 |

$400 |

26.25% |

|

Perth |

$570 |

$425 |

34.12% |

|

Combined Capitals |

$600 |

$453 |

32.45% |

Source: Domain.

Energy

The cost of powering our homes through electricity and gas has increased dramatically in the last several years. The quarterly inflation figures for December 2022, for example, show:

- Electricity prices rose 11.7% in 12 months across Australia;

- Gas and other household fuels rose 17.4%

- Other utilities rose 10.4%

More recently, The Australian Energy Regulator (AER) released its Default Market Offer (DMO) for 2023/24, which stated that standard electricity prices will go up by the following amounts for residential households starting from 1 July 2023:

- New South Wales: +21-22%

- Queensland: +19.5%

- South Australia: +21-22%

Oil, gas and coal prices around the world have risen sharply following the Russian invasion of Ukraine, and energy companies in Australia have passed on these costs accordingly. The Federal Government has forecast electricity prices to rise by as much as 50% over the next couple of years and gas prices by 40%.

In February 2023, one of Australia’s biggest energy companies, EnergyAustralia, announced major price increases for electricity and gas customers, just to name one example.

"We know these price rises won't be welcomed by households already experiencing cost of living pressures," EnergyAustralia Chief Customer Officer Mark Brownfield said.

“A perfect storm of issues during 2022 meant it is costing us more both to generate and purchase wholesale electricity for our customers.

“These issues include the sustained impact of the war in Ukraine on energy prices, extreme weather conditions and coal supply issues, along with some increases in market administration costs.”

Fuel/petrol and transport

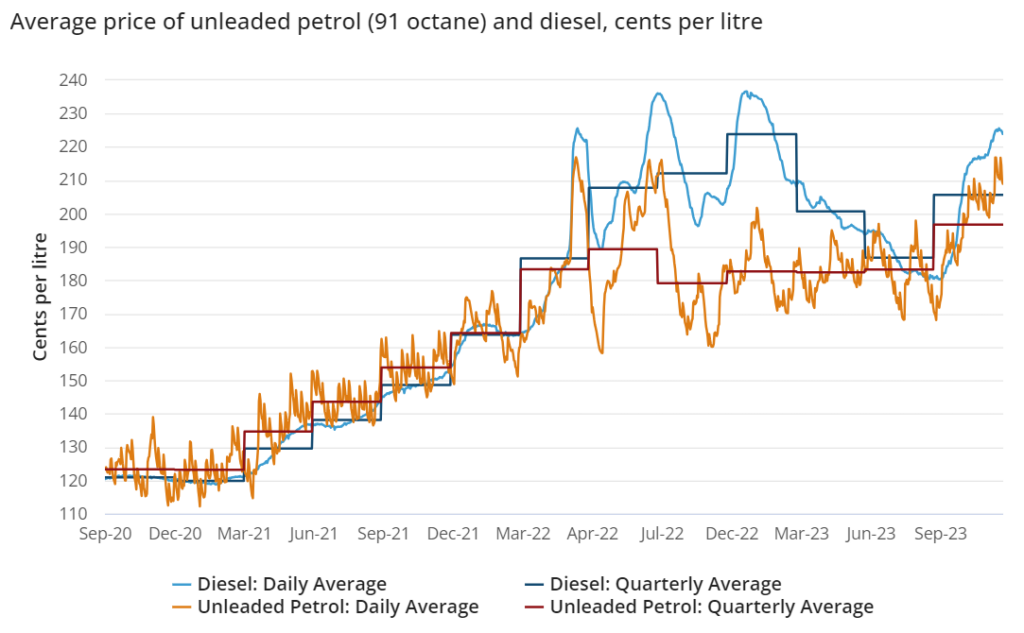

Those global factors mentioned above also contributed to a dramatic rise in the cost of fuel. Petrol prices, for example, saw a CPI increase of 11% in the three months to March 2022 alone, which is the highest single increase since the Gulf War in 1990.

The latest inflation figures for the September 2023 quarter show an average daily unleaded fuel price of $2.10 per litre!

To combat this, the Federal Government halved the fuel excise - a tax levied on petrol and diesel bought at the bowser - from 46 cents per litre to 22 cents per litre, but this was quickly restored by September 2022. For the December quarter, automotive fuel prices remained 13.2% higher compared to 12 months prior.

“We saw an increase in oil prices following the Russian invasion of Ukraine and subsequent international sanctions against Russia," The RACQ’s Ian Jeffreys said.

“Without the excise cut, prices on the most expensive days in June would have been about 24cpl higher, and the daily average in Brisbane may have spiked at about 246cpl for regular unleaded.”

Groceries

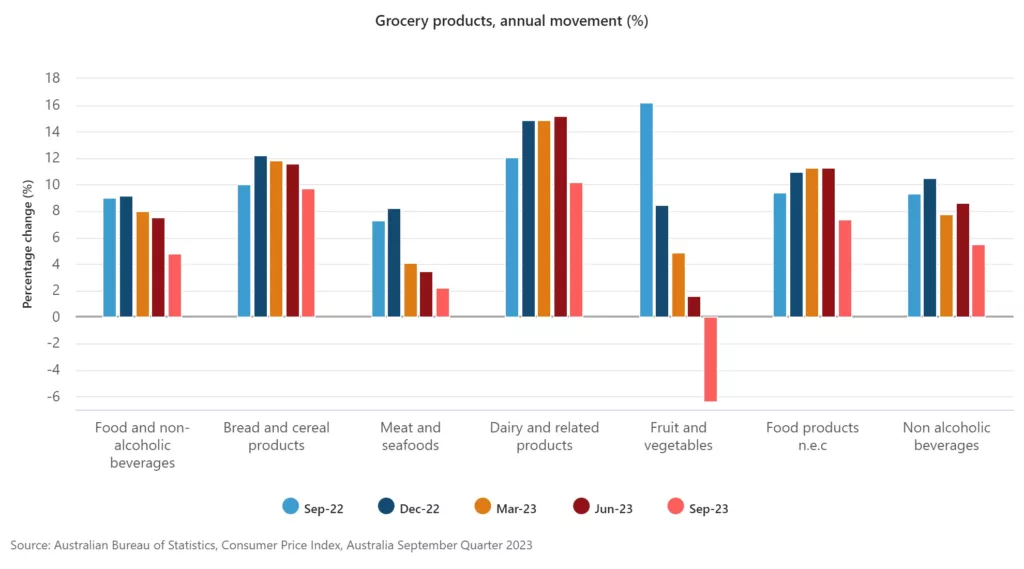

You would no doubt have noticed your typical shopping bill has looked a lot bigger in recent years. According to Grocery app Frugl’s latest Grocery Price Index (GPI), food prices had risen nearly 10% annually in October 2022.

More recently, Compare the Market research identified groceries as the biggest household financial burden (32%) in 2023/24, ahead of mortgage repayments (24.1%), rent (15.2%) and energy costs (7.7%). The average weekly grocery spend for households jumped from $170 in September 2021 to just shy of $200 mid-way through 2023.

But the official figures are the most telling. Overall, the ABS CPI numbers show that ‘food and non-alcoholic beverages’ increased in price by 9.2% annually in 2022, which reflects ‘elevated input costs for farmers and producers of packaged goods, as well as strong Christmas’.

In 2023, food inflation slowed slightly to 4.8% in the September quarter.

But at least our wages are increasing…right?

The best way for households to keep pace with the rising cost of living is for the money they receive to go up as well. If household income does not increase in line with inflation, then wages are said to be decreasing in real terms.

The official figures collected by the ABS’ Wage Price Index (WPI) make for a pretty grim reading on that front too. The most recent annual WPI data shows wages rose 3.3% in the 12 months to December 2022. But CPI rose 7.8% in the same period – the biggest gap between wages and inflation since the ABS began gathering this data in 1997.

While there was a temporary spike in real wages due to COVID-19 lockdowns, the overall trend of the last few years is an absolute decline in Australians’ wages compared to the cost of living. While prices have gone up, the wages we make from our jobs haven’t increased since 2009…

How much money are Aussies saving?

You’ve probably guessed by now that Australians are saving less money as a result of higher costs and lower wages. And you’d be correct!

The ABS also collects data on Australia’s household savings ratio, which measures how much of a household’s income is saved over a period of time.

The highest savings ratio in Australia was 23.6% in June 2020, right in the middle of COVID-19-enforced lockdowns. Back then, the combination of a lack of spending due to being inside, increased government benefits like JobKeeper and JobSeeker, withdrawals from superannuation accounts, pauses on mortgage and loan payments, and more led to a massive increase in the ability of many Australians to save money.

As the country re-opened, this number fell back towards a more typical level in the ~10% and below range, but the latest figures show household savings dropping to a level that could be considered dangerous. In September 2023, the household saving ratio declined from 7.1% to just 1.1%, the lowest level since December 2007.

"The removal of the Low and Middle Income Tax Offset in the 2022-23 financial year meant many households had a higher income tax bill this quarter, which has contributed to the fall in the household saving ratio,” Katherine Keenan, ABS head of national accounts, said.

“Increased interest paid on home loans and inflationary pressure on households were also likely factors behind the fall in the household savings ratio.”

PRD Chief Economist Dr Asti Mardiasmo told Savings.com.au that a savings rate below 5% was cause for concern.

"At the moment it’s even more of an issue due to the fact that our costs are still increasing – rate rises, mortgage repayments, and just day-to-day costs," Dr Mardiasmo said.

"What this means for households, is that there is now even more segregation between those who do have a higher income and savings account than those who don’t - particularly as we ride out the next three-to-six months."

To make matters worse, the money Aussies do manage to squirrel away isn’t earning as much in interest as it used to.

The ACCC announced in February 2023 that it would be investigating banks for failing to increase interest rates on deposits - which earn interest for customers - at the same rate as mortgages.

Australian households together hold more than $1.3 trillion in savings and deposit accounts, but based on Savings.com.au’s analysis:

- By the time of the first RBA rate increase in April 2022, the gap between the average savings account and home loan interest rate was 2.36% p.a

- But in January 2023, that gap had increased to 3.93% p.a.

Struggling with the cost of living?

While many experts agree that the current high inflation will ease off by around 2024-2025, that will come as little relief to people who are already feeling the pinch.

Tips to reduce your expenses

While these won’t always be options for everyone, here are some of the more common things you can do right now to minimise your expenses or maximise the return on the money you bring in right now…

|

1. Cut down on your energy use Cutting down on how much electricity and gas you consume could save you hundreds of dollars a year. If you haven't already, make sure you get into the habit of doing the following:

|

|

2. Compare energy & utility providers Using the above tactics to reduce your energy bills is all well and good, but doing that as well as comparing energy providers to find a cheaper one can save you even more money. The Australian Government has an energy comparison tool called Energy Made Easy, which can help you find a more affordable plan. |

|

3. Find a high-interest savings account There is a huge difference in the interest rates on offer on savings accounts right now. Among the big four banks, the average interest rate as of February 2024 is 4.70% p.a. But the highest rate on the market is 5.75% p.a according to RateCity. |

|

4. Drive less and get smart with petrol Did you know that Compare the Market analysis back in January 2023 found the average difference between the cheapest and most expensive petrol stations across the capital cities was nearly 26 cents per litre? In Sydney it was 54 cents! Our article on tips to save on fuel recommends the following strategies to cut down on costs at the bowser:

|

|

5. Reduce your grocery bills or use food boxes instead YouGov found that Australians could actually save as much as $1,360 annually by ordering groceries online and making use of promo codes, online specials and discounts. You could also try:

If you take advantage of signup offers then food boxes such as HelloFresh and YouFoodz can be more cost-effective over the short-term |

|

6. Do a subscription 'spring clean' Our article 'the real cost of subscription services' goes into detail on how much Aussies waste on things they don't use but continually pay for. The average Australian spends $105 monthly on payments for services they no longer use such as video streaming. That's nearly $1,300 a year! Comb through your finances and cancel the subscriptions you can do without. |

|

7. Look for any government benefits you're eligible for Several states and territories have announced new schemes, grants and concessions for people to help pay for the essentials or to just spend money on the local economy. These are in addition to existing schemes for vulnerable groups: check out Services Australia to find a complete list of these schemes for any benefits you can claim. |

|

8. Sell stuff around the house If you don't need it, get rid of it. You can easily sell stuff online via eBay, Gumtree and Facebook Marketplace, and given the high cost of everything these days there'll be no shortage of people who'll buy it. Have a look and see if you can sell any books, appliances, furniture or even something you’ve made. |

|

9. Find extra income Back in 2021, nearly half (48%) of Aussies either had or planned to start a 'side hustle', which is an extra-income generating activity outside of your main source of income. Common side hustles include freelancing, working in the gig economy (like Uber), dog-sitting and walking, tutoring, painting and much, much more. If you've got a particular talent or even just some free time, try making a bit of extra money on the side to get by. |

|

10. Consolidate your debts One option to eliminate your debts and get yourself back on track to financial freedom could be a debt consolidation loan. Check out our article on the pros and cons of debt consolidation loans to see if one could be right for you. |

Resources for debt & financial assistance

If you’re struggling with money or debts as a result of the cost of living crisis, you can call the free National Debt Helpline on 1800 007 007 (Monday – Friday). Aboriginal and Torres Strait Islander peoples can also call the free Mob Strong Debt Helpline on 1800 808 488.

ASIC MoneySmart also recommends doing the following:

- check your credit report for free every three months

- find free financial counselling services in your state or territory

- find free legal advice services in your state or territory

- make a repayment plan with your lender

You can get in touch with William via williamj@jacarandafinance.com.au.