Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

To make things even more challenging, moving can also be really expensive!

With the cost of living as high as it is, finding a way to save when moving is crucial, regardless of whether you’re a renter or homeowner.

If you’re soon to be one of the 1.14 million Aussies who move every year, this guide will discuss the key costs and expenses you might need to consider when moving house and some tips and resources for moving smoothly.

Originally published 22 June 2021.

On this page:

According to the Muval Movers Index, the average Australian spends approximately $3,000 each time they shift. Movers budget $1,581 on removalist costs and $1,451 for additional expenses such as boxes, cleaning and packing services.

This is similar to the quote by HiPages, which found that national moving costs typically average around $1,400 and range from $700 to $2,500.

Unsurprisingly, those moving interstate spend even more on moving costs. According to Muval, people moving to an entirely new state spend upward of $4,180 on average, while HiPages recommends budgeting anywhere between $2,600 - $5,850 (for a three-bedroom house).

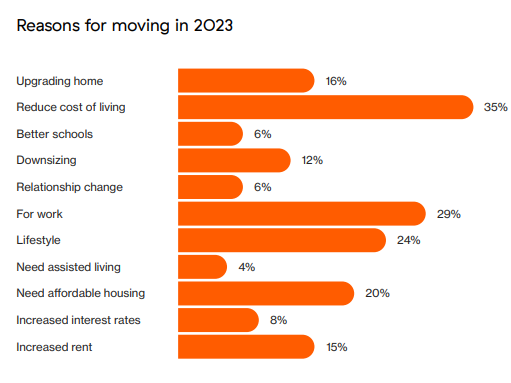

Nearly 40% of Aussies change their main place of residence every five years or less. Muval found that reducing the cost of living (35%) was the main reason for finding new digs, followed by moving for work (29%), for lifestyle changes (24%) and to find more affordable housing (20%).

Fun fact: Around two-thirds (66%) of all moves take place between October and March.

Image source: Muval

Moving costs can be pretty complicated and vary wildly based on several different factors:

And much more. We’ve broken down the average costs you’ll need to consider below. Remember that your exact costs will likely differ based on the above factors.

The most common expense when moving is paying for removalists. The cost of hiring a removalist can vary depending on which of their services you decide to use. Typically, removalists offer the following:

Removalists sometimes offer specialised services, including moving large, delicate items (e.g. pianos) or even transporting pets.

According to Muval, Australians spend an average of $1,581 on removalists.

Removalists typically charge hourly, ranging from $75 to $300 per hour. Freelance removalists from Airtasker can cost a bit less, at around $100 - $250 per hour.

To find the best deal, you can use comparison websites like Muval, Airtasker, Find a Mover, etc.

If you decide to forego the removalists and transport everything yourself, there are obvious financial benefits. The only costs you’ll need to consider are hiring a van/truck for yourself and paying your friends, who will inevitably need to help you.

However, there’s a lot to think about when doing it yourself. You’ll need:

A hybrid approach could be a better option than full DIY moving: pack up all the more minor things yourself, and allocate a few of your biggest items for removalists to take.

Nearly two-thirds (63%) of Aussies say packing is among the top three most loathed tasks when moving house. You'll need somewhere to store and transport all your clothes, plates, personal possessions, electronics, wall paintings, and everything in between.

If you know someone who recently moved, you could message them and see if they have any packing boxes you could borrow or buy. If not, you can purchase packing boxes from Storage King, Officeworks, and National Storage.

When budgeting for boxes, bubble wrap, tape, etc., a general rule is to set aside at least $100 for these.

Did you know that half of all movers end up buying new furniture? Muval’s Index shows furniture was the number one purchase triggered by moving (50%), ahead of kitchen appliances (40%) and entertainment appliances (39%).

A new abode is often the perfect time to replace those old couches you’ve meant to throw out. Here’s how much you’ll generally need to spend on new pieces of furniture, from the low-end to the high-end of the market:

| Furniture type | Typical cost |

|---|---|

| Couches and lounges | $500 - $2,000 |

| Bed frames and mattresses | $300 - $2,000 |

| Dining sets | $200 - $2,000 |

| Office furniture | $100 - $800 |

| TVs | $200 - $10,000 |

| Outdoor settings | $500 - $2,500 |

| Kitchen Appliances | $300 - $1,500 |

While this will generally only apply if you’re renting, ensuring the home is clean is essential, as your property agent/landlord will conduct an end-of-lease inspection. Failing to have the property appropriately clean and free of damage could result in you losing your bond (see above).

The easiest way to ensure the property is in good condition is to hire a professional cleaner. A handy tip is to use one that the agent recommends. But if you decide to compare your options, Airtasker quotes the median bond cleaner cost at $319, with typical prices ranging from $250 - $400.

Costs can fluctuate depending on the size of the home, the services included (e.g. if they will also be doing carpet cleaning or pest control), and the property's condition. Typically, smaller properties are cheaper to clean; a bond clean will be relatively inexpensive if the property is already generally clean.

While you should check your tenancy agreement for the exact requirements for your property, the general rule is that the home only needs to be as clean as it was when you moved in. ‘General wear and tear’, such as light scratches or worn carpets, is also usually acceptable.

The rental bond also applies to renters only. Depending on your state, the bond is usually equivalent to four weeks' rent, and if the property is in good condition, it will be returned to you at the end of your tenancy.

However, if you continue to rent, you’ll likely need to pay a new rental bond to secure your next property. At four weeks’ rent, plus an extra two weeks’ rent in advance as a deposit, this could cost more than $3,500 for the median rental property in Australia!

Congratulations if you’re transitioning from a renter to a homeowner! Here are some of the fees and charges you may have to pay:

When you move into a new home, you'll need to set up utility services such as electricity, gas, water, and internet. Alternatively, you can transfer them across from your previous property.

You might be charged for setting up these utilities in your new home or disconnecting them from your previous one.

According to Finder, here are the connection and disconnection fees for electricity in Australia as an example (natural gas has separate fees):

| State/Territory | Connection & Disconnection Fees: Electricity | Connection & Disconnection Fees: Gas |

|---|---|---|

| NSW | $14.60 - $63.61 | $15.07 - $63.81 |

| VIC | $43.27 - $88.25 | $7.68 - $15.62 |

| QLD | $14.45 | $13.20 - $24.83 |

| SA | $58.07 | $13.64 |

| ACT | $102.40 | $13.20 |

| WA | $6.52 - $30.95 | $16.71 - $64.05 |

| TAS | $58.07 | $13.64 |

There’s no shortage of other expenses that you might need to pay for when moving house. Some notable extra costs that can rear their head might include the following:

And much more. While often not directly related to your move, these costs can add up if you’re not careful, and not paying them can sometimes lead to even bigger expenses later on.

Want more savings tips?

It’s almost impossible to move 100% stress-free, nor is it really possible to move without spending a cent. It can be an incredibly lengthy and difficult process, but to make things a bit easier on yourself, here are some tips for a more cost-effective (and time-effective) move.

If all these costs seem daunting and you’d rather not tap your savings for the big move, Jacaranda Finance can help. At Jacaranda Finance, we offer fast, flexible and affordable Rental Bond Loans starting from $3,000, with loan terms as short as 25 months.

If you need funds quickly to secure your next rental property, you can apply in as little as 5-12 minutes1 and receive an outcome

on the same day

2. Even better, you can check if you qualify beforehand without impacting your credit score at all.