Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

While you’re probably aware of how a good credit score can grant you access to better car, home and personal loan rates, did you know it could also help you get a better deal on your next phone plan?

In this comprehensive guide, we’ll explore the unexpected advantages of having a good credit score in Australia, from securing your dream rental property to obtaining favourable terms on insurance premiums and even improving your love life!

On this page:

A credit score is essentially a ‘rating’ of your creditworthiness when you apply for a financial product like a home loan, personal loan or credit card. In today’s highly digitised financial world, a higher credit score can improve your chances of a successful loan application for a desirable product that meets your needs.

On the other hand, having a bad credit score can limit your options in many ways. It could not only lower your chances of being approved for loans you apply for, but it could also exclude you from being eligible for certain loans with better rates and fees.

In Australia, credit scores can range between zero and 1,000 to 1,200 depending on the Credit Reporting Body you’re using: Equifax, Experian, or illion.

Each of these companies uses a different formula when calculating your credit score, but a good credit score will generally be at least 600 (500 with illion). Data from Finty suggests the average credit score across all states and territories in Australia is about 657!

Here's what the different credit score ranges look like as of 2023:

| Equifax | Experian | Illion | |

|---|---|---|---|

| Below Average | 0 - 459 | 0 - 549 | 1 - 299 |

| Average | 460 - 660 | 550 - 624 | 300 - 499 |

| Good | 661 - 734 | 625 - 699 | 500 - 699 |

| Very good | 735 - 852 | 700 - 799 | 700 - 799 |

| Excellent | 853 - 1,200 | 800 - 1,000 | 800 - 1,000 |

In Australia, a good credit score can bring several unexpected benefits beyond just improved loan terms and easier access to credit. It can make your life easier in several ways you might not have known about. Here are five key examples:

In the competitive rental market of Australia, a good credit score can be a significant advantage. A high credit score reflects financial responsibility, indicating that the tenant is likely to pay rent on time and manage their finances effectively. This can be particularly crucial in sought-after urban areas where landlords have a large pool of applicants to choose from.

It’s important to note that, according to Australian law, real estate agents and landlords are expressly excluded from accessing a copy of your credit report. While they can access some limited information (known as public record information), they must ask for your express written consent before doing so. This public information includes things like bankruptcies or court judgements.

If you wish to do so, you can include your credit score in your rental application, alongside any rental references and financial documents, as long as you’re comfortable with the privacy implications.

In industries where financial trustworthiness is paramount, such as finance, accounting, and legal, employers often conduct credit checks as part of the hiring process.

A good credit score can be crucial in these sectors, serving as a testament to the candidate's ability to manage finances responsibly. For example, significant unpaid debts or a history of bankruptcy could lead to difficult questions during job interviews.

As with rental agencies, employers in Australia are not considered to be credit providers and, therefore, can’t access a full copy of your credit report. With your written consent, they may include a soft credit check as a part of their hiring process. Equifax’s fit2work is one service certain employers use to review this information.

High credit scores are often correlated with lower car insurance premiums and vice versa. While insurance companies are another type of business that is only allowed to access limited credit information (with your consent), your credit score, as well as other adverse events like defaults and repossessions, can influence your premiums.

“Insurers use your score, among other elements, to decide what your car insurance premiums will be,” former Credit Simple CEO David Scognamiglio said.

“A credit score around 700 or above will see you get cheaper premiums, but a score around 500 or less means you’ll pay more – or insurers may actually refuse you outright.”

A higher credit score is also correlated with a lower risk of filing claims, which has a more direct impact on lower insurance premiums.

Unlike the other organisations in this article, telco companies (phone and internet) are classed as credit providers and can check your credit if you’re buying a plan from them. They will conduct a credit check when offering you a contract, and if you miss repayments on your plan, your credit score could suffer as a result.

A good credit score increases the likelihood of securing a contract with favourable terms, such as lower deposits, better plans, and access to a broader range of smartphone models. In contrast, a lower credit score may require larger upfront deposits or restrict access to premium models and plans.

In extreme cases, individuals with poor credit scores might have to opt for pay-as-you-go or prepaid services, which can be more expensive in the long run and offer less flexibility.

Speaking of phones:

Yes, that’s right, a good credit score can make you luckier in love, no matter whether you’re living a single life or happily (or not so happily) married!

Plenty of anecdotal evidence is out there showcasing the importance of credit scores and financial responsibility when dating. For example, you might’ve seen an article from earlier in the year where a US woman posted a photo of her ‘exceptional’ 811 credit score to her Hinge profile and managed to go on 17 dates in 30 days as a direct result.

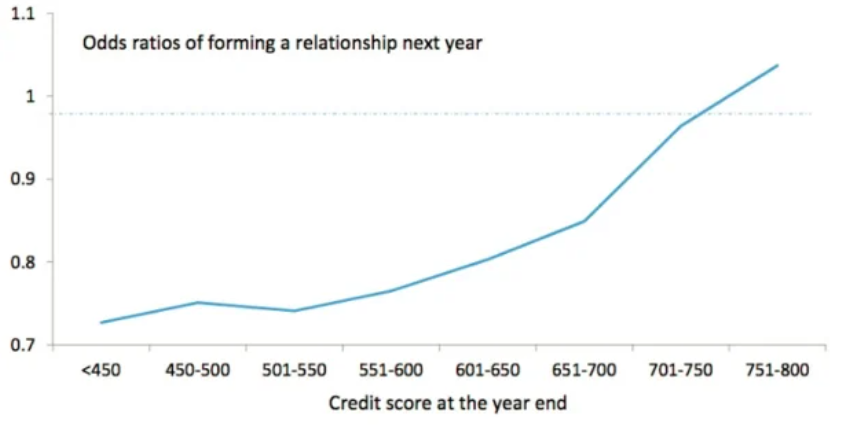

But did you know there’s long-term data to suggest this is a winning strategy? A 2015 paper called Credit Scores and Committed Relationships (by none other than the US Federal Reserve) tracked credit score data for 15 years. It found that people with higher credit scores are more likely to form committed relationships relative to other observably similar individuals" within a year and are more likely to maintain relationships.

Another study from freecreditscore.com in the US found that credit scores are significantly more important to women (75%) than men (57%) in relationships; 30% of women and 20% of men would not marry someone with a poor credit score.

Given money management is one of the biggest things that can make or break a relationship, a good credit history generally makes a person more attractive not just to credit providers but to potential partners as well.

It may take a while to show on your report, but improving your credit score is very possible. Read our article ‘Nine Ways to Improve Your Credit Score’ to learn more about the following ways to turn a bad credit score into a good one over time:

Comprehensive Credit Reporting (CCR) has changed the way credit information is reported in Australia, making it easier and faster for individuals to improve their credit scores. CCR provides a more holistic view of your credit history, including positive credit behaviours, not just negative ones.

This shift means your credit score can improve more rapidly if you consistently demonstrate good financial habits, such as timely loan repayments.

Jacaranda Finance is reporting data under Comprehensive Credit Reporting, which means we can help make it easier to rebuild your credit. Whether you’re looking to find love, find a new rental home or land that dream job, improving your credit score by repaying a Jacaranda Loan can open up a whole host of new financial opportunities.

The information on this website is for general information only. It should not be considered professional advice from the website owner - Jacaranda Finance. Jacaranda Finance is not a financial adviser, and the content on this page does not consider your objectives, financial situation or needs. You should consider seeking independent legal, financial, taxation or other advice to check how the website information relates to your unique circumstances. Jacaranda Finance is not liable for any loss caused, whether due to negligence or otherwise arising from the use of, or reliance on, the information provided directly or indirectly by the use of this website.