Swipe Right on Financial Health: How Your Credit Score Can Affect Your Love Life

William Jolly |

When it comes to credit scores, you probably think of things like home loans and credit cards. This would be fair enough, as having a better credit score can certainly go a long way to helping you access better financial opportunities.

But we bet you didn’t know that improved relationships are one of the more unexpected benefits of having a high credit score.

In a heavily digitised world of dating apps and joint bank accounts on your smartphones, it’s not that surprising to learn that a credit score can be crucial in multiple different aspects of your life.

So whether it’s a first date or 20 years of marriage, here’s how your credit score can play a surprisingly significant role in your love life.

On this page:

- What is a good credit score?

- What your credit score says about you

- How important is money in relationships?

- How a credit score can help or hurt your love life

- Should you put your credit score on a dating app?

- How to improve your credit score game

Before we begin: What is a good credit score?

In Australia, credit scores can range between zero and 1,000 to 1,200 depending on the Credit Reporting Body you’re using: Equifax, Experian, or illion.

As you can see in the table below, a ‘good’ credit score can be a broad term. For Equifax, a ‘good’ score is 661 - 734, a ‘very good’ score is 735 - 852, and an ‘excellent’ score is 853 up to 1,200.

The average credit score, according to the Equifax Australian Credit Scorecard 2023, is 855, an increase from 846 the previous year and enough to land someone in the ‘excellent’ category (853 – 1,200).

However, millions of people do not have a credit score that high. Finder’s research, for example, found that 21% of people have an average or below-average score.

What your credit score says about you

You may not realise how important a credit score actually is. A credit score is essentially a ‘rating’ of your creditworthiness when you apply for a financial product like a personal loan or credit card.

Each of the three main credit reporting agencies in Australia uses its own internal formula, but generally speaking, your credit score will be calculated using all of the following factors combined:

- Your repayment history, both timely and late

- Your number of recent credit applications (aka enquiries)

- The type of lender you’ve applied with, like short-term lenders or wage advance companies

- The amount of money you’ve borrowed and your credit limits

- Any defaults, bankruptcies and court judgements

And much more.

Your credit score doesn’t define you as a person, and it’s possible to be good with money and still have a low credit score. As an example, bankruptcies can stay on your credit report for up to seven years. So, even if you’ve had exceptional finances in the last couple of years, an adverse event in the past can hold you back.

However, a low credit score can also indicate a history of behaviours such as missing repayment deadlines, defaulting on loans, applying for too many credit products, and generally being a bit irresponsible with money.

A below-average credit score can make it harder to get approved for any finance you might need. Alternatively, it might leave you ineligible for cheaper or more competitive lending products.

How important is money in relationships?

It might not be the sexiest topic of conversation, but money and finances are some of the most important aspects of a relationship, both new and ongoing. Financial compatibility often serves as the foundation of a healthy relationship, as it plays a significant role in how couples manage their lives together, from daily expenses to long-term financial planning.

There’s plenty of research to back this up. Westpac recently found that money-related issues cause arguments for 91% of couples at some point, with frivolous purchases (62%) being the top catalyst for a disagreement. A 2023 survey by financial adviser Jessica Brady found that more than one-third (36%) of couples argue about money monthly or even more frequently.

Money.com.au’s survey of over 1,000 Australians found that financial stress negatively impacts relationships for nearly half (45%) of people, which is why it’s important to have open and honest conversations about finances with a current or potential partner.

Two-thirds (65%) of Aussies agree that couples who regularly talk about money are more likely to be in a healthy relationship, yet one in five (22%) rarely discuss it together.

“Respectful, honest and open conversations are critical in relationships; however, it appears Aussies still have room to grow when it comes to building confidence around holding discussions about money,” Westpac’s Annabel Fribence said.

“In healthy relationships, it’s important both parties know how much money they have and where it is going with an equal contribution to money decisions.

“This may help alleviate concerns, manage expectations with one another and better set yourselves up for success in achieving your individual and joint aspirations.”

How a credit score can help or hurt your love life

Given money management is one of the biggest things that can make or break a relationship, a good credit history can make a person more attractive not just to credit providers but to potential partners as well.

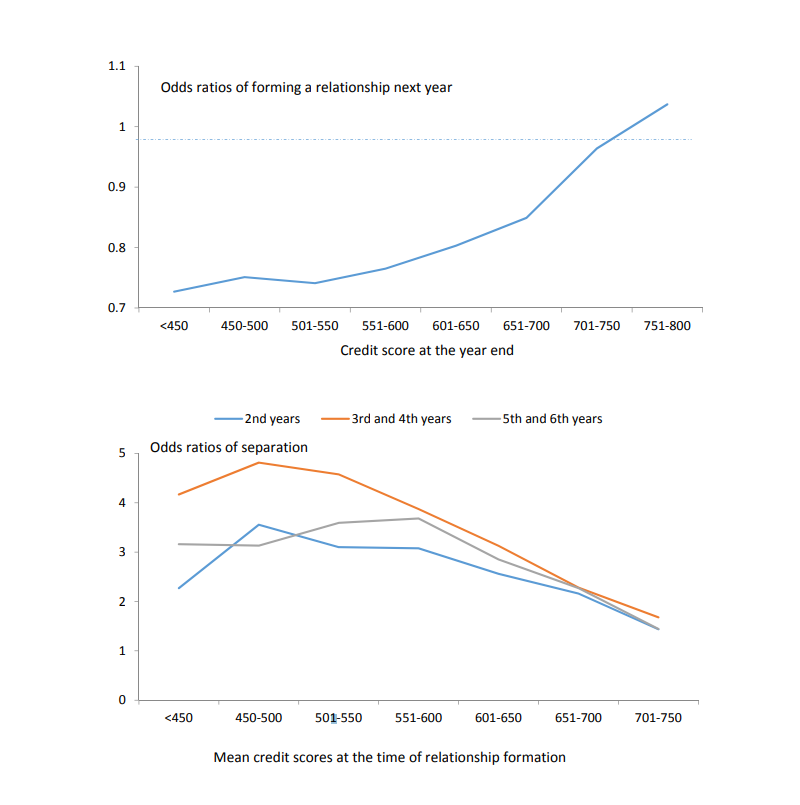

Multiple studies out of the US support this notion. A 2015 paper from the Federal Reserve tracked 15 years' worth of credit score data and found that people with higher credit scores are far more likely to enter a committed relationship with a similar ‘credit-scored’ person within a year.

It also found more significant mismatches in credit scores increase the likelihood of the relationship not working out.

Another survey from Discover Financial Services in 2017 found that 58% of online daters say having a good credit score is more attractive than driving a nice car; 50% found a good score more attractive than an impressive job title, and 40% preferred a high score to physical fitness.

Credit scores were found to be significantly more important to women (75%) than men (57%) in relationships; 30% of women and 20% of men would not marry someone with a poor credit score.

“If you have a good credit score, flaunt it,” said Dr. Helen Fisher, chief scientific advisor for Match.com.

“When it comes to dating, a good credit score ups your mate value, helping you win a responsible, long-term partner, more so than some other qualities that online daters might highlight on their profile.

“Money talks, but your credit score can speak more about who you are as a person, and singles agree that those with good credit tend to be conscientious and reliable.”

Should you put your credit score on a dating app?

You might’ve seen a viral article last year from Fortune where a US woman went viral for putting her credit score on her dating app profiles. Thanks to her ‘exceptional’ credit score of 811, she was able to get 17 dates in one month!

That might sound crazy, but it might not be a bad idea. In fact, it’s starting to become mainstream. A new dating app called Score is available in the US, and it calls itself “the dating app for people with good credit.”

To be eligible to join Score, users must have a credit score of 675 or above, which is enough to be deemed ‘good’ in the American credit scoring system.

While such an app is yet to be available here, it might be pretty close. A Newscorp survey of nearly 1,000 people revealed that more than half (56%) wished they knew their date’s credit score from the start.

Dating apps are a major method of meeting people for singles in Australia right now. According to YouGov, three in ten (30%) Australians use one or more dating apps, with men (35%) being more likely than women (27%).

ING Research shows that we spend billions every year on subscriptions and perks for apps such as Hinge, Tinder, and Bumble.

Jacaranda Finance’s CEO, Daniel Wessels, said credit was an important consideration when dating, and given their high usage, apps should seriously consider letting users add their credit score.

“Giving people the choice to share information like this is empowering,” Mr Wessels said.

“Finance can be such a strain on a relationship, and it can feel taboo to talk about it, but you really want to make sure you’re compatible early.

“Having a bad credit score isn’t the end of the world; it doesn’t last forever, and it’s something you can take control of and improve.”

While little research currently directly proves that including your credit score can boost your matches on dating apps, nothing suggests it won’t work either.

Based on what we’ve covered so far in this article, we think it’s worth giving it a go!

Need help improving your credit score?

Your credit score is more than just a number—it’s a reflection of your financial health and responsibility. As financial stability becomes increasingly important in relationships, maintaining a good credit score could significantly impact your love life.

To help you up your credit score, we’ve prepared an article that provides you with nine key ways to improve your credit, which are:

- Check your credit report regularly

- Maintain updated details

- Avoid missing repayments

- Pay off old debts

- Lower your credit card limits

- Keep good credit accounts open

- Close bad credit accounts

- Minimise loan applications

- Create stability in your life

By taking steps to improve your credit score and being open about your finances with your partner, you could enhance both your personal financial health and your relationship success.

Try our Finance Fundamentals course

Keeping your credit score high isn’t always easy: it takes discipline and, above all, knowledge!

That’s why our free Finance Fundamentals course will provide you with the essential information you need to start improving your credit score.

Available in the Better Credit app or online in your account, Finance Fundamentals is a series of seven short video modules (about 30 to 60 seconds long) designed to make learning about credit and credit scores in Australia convenient and easy.

Each module has some multi-choice questions at the end so you can test your knowledge.

Download our app today and take the test to help boost your game!