Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

We want to settle things once and for all: clear the air, shed light on, and bust these credit score myths!

This article contains 10 of the biggest ones.

This article was originally published by Jemima Kelly on 29 June 2022.

This myth floats around the lending scene like no other. When you have a low credit score, you are generally considered a high-risk borrower. However, that doesn’t mean you won’t be approved for a loan.

Some lenders will consider more than just your credit score when you apply for a loan. These considerations include your credit report, a history of how you spend your money, and your overall financial situation.

If a lender can see that your habits are responsible, they may look past just the poor credit score and be able to offer you finance.

One of the biggest myths around credit scores is that frequently checking your credit score will lower it. According to Equifax, one of the biggest credit bureaus in Australia, your score is not affected by the frequency of checking it or by the frequency of requesting a credit report.

Equifax instead recommends that people check their credit scores regularly to ensure all personal information is still correct.

Correlation does not equal causation. While it’s true that people with higher incomes tend to have higher credit scores on average, more money tends to make everything easier. As credit scores are based on how you handle your credit and your bills, high incomes have no impact on your credit score.

Someone who is a high-income earner and keeps missing their bill due dates could have a lower credit score than a low-income earner who is on top of their bills. Not only do credit scores not take your income into account, but your income isn’t shown on your credit report either. The only work-related information included is the details of your current employer.

Although having a large credit card debt is not an ideal situation, making repayments on time and not missing any of them will demonstrate to lenders that you are a responsible borrower. You may have a large credit card debt, but lenders will notice how you handle and manage the repayments rather than the debt itself.

Note that exceeding your credit limit or coming close to it can result in a decreased credit score.

If you have a high credit score, that doesn’t necessarily mean you are sure to snatch a low interest rate.

Most lenders will consider your credit score when offering you a rate, meaning your score will affect the rate. However, more traditional loan providers, like banks, may not consider your credit score as a factor when determining a rate. They could have a rate that they apply to any approved loan.

This could be factored in when choosing the right loan for you, depending on whether you go with a bank or with a digital lender.

Want to learn more about interest rates? Check out the following articles:

If you have never borrowed money, your credit history is limited or non-existent. Although this may seem ideal, lenders could be reluctant to approve your application if they cannot see how responsible you are with money.

Your credit history is an integral part of being approved for a loan, so it’s a good idea to check your credit score before applying for one. Who knows, maybe you do have one after all! If you’ve studied at a tertiary level in Australia, you will likely have student debt, meaning you should also have a credit score.

Every time you apply for a loan, it will be recorded on your credit report. If lenders see that you are applying for multiple loans, especially in a short period of time, they could assume that you are a high-risk borrower and end up declining your credit application.

At Jacaranda Finance, you can check if you qualify for one of our loans first without impacting your credit score at all. If we find that you don’t meet our initial criteria, no harm done!

You can request a free copy of your credit report every three months from a credit bureau. Accessing it more frequently than three months may result in a small fee. As for your credit score, you can access it for free at any time and how frequently you want to for free from a range of credit scoring services.

You can actually check your credit score for free with Jacaranda Finance. See here to learn more.

Improving your credit may sound like a big job, especially if your credit score is not as good as it could be. And make no mistake, it won’t be easy. However, there are ways that you can achieve such a feat and, over time, build and maintain a better credit score. Such methods include:

And more. See our article on credit score recovery for more details and even more tips!

Before we get to number 10, here are a few other myths we’ve seen floating around that deserve a spot in this article, too.

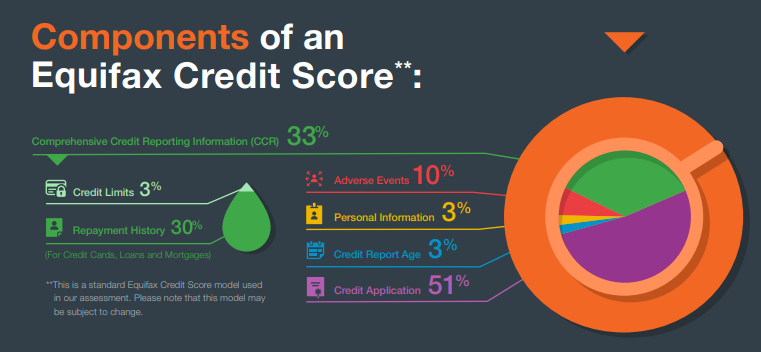

The only personal information that can have any impact on your credit score is basic stuff like your address. And even then, Equifax states this is only a tiny 3% of your total score.

Credit bureaus in Australia can only hold data that is permitted under the Privacy Act. This means that things like race, religion, gender and sexuality cannot be used to calculate your credit score. Other things that credit bureaus can’t collect use include:

Sticking with Equifax for now as we move onto another commonly held belief: that repayments - timely or otherwise - have the biggest influence on your credit score.

While they do account for a large part of it - 30%, in fact, according to Equifax - repayments don’t have the most significant impact on your credit score.

That honour goes to credit inquiries, aka applications, which are more than half (51%) of the typical Equifax credit score!

While there can sometimes be indirect effects related to these things, having a high or low credit score generally has no impact on rental applications, job prospects or insurance premiums.

You might’ve seen a lot of content saying the opposite. This is usually from American-based websites, where credit scores can have much broader impacts on day-to-day life.

But in Australia, real estate agents and landlords are expressly excluded from accessing a copy of your credit report. While they can access some limited information (known as public record information), they must ask for your express written consent before doing so. This public information includes things like bankruptcies or court judgements.

You can choose to include your credit score in things like rental applications, which can help, but there’s nothing lost if you choose not to, and a low credit score won’t affect your chances.

False! Most Aussies have a minimum of three credit scores, one from each of the main credit reporting bodies (Equifax, Experian, illion).

Depending on the credit agency, your score will be classed in a particular category, and in these categories, credit scores usually range from 0 to 1,200.

Here’s what these credit score ranges currently look like, based on Equifax’s names as of 2024:

| Equifax | Experian | illion | |

|---|---|---|---|

| Below Average | 0 - 459 | 0 - 549 | 1 - 299 |

| Average | 460 - 660 | 550 - 624 | 300 - 499 |

| Good | 661 - 734 | 625 - 699 | 500 - 699 |

| Very good | 735 - 852 | 700 - 799 | 700 - 799 |

| Excellent | 853 - 1,200 | 800 - 1,000 | 800 - 1,000 |

Wrong! You can download the Better Credit app (or use our online platform), sign in/create an account, and opt-in to check your credit score in mere minutes! And the best part is, it’s entirely free.

Your credit score is more than just a number—it's the key to your financial health and opportunities. Checking your credit score with Jacaranda Finance won’t impact it and can give you a much better idea of where you stand.