Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

With high interest rates, fees, and a seemingly endless repayment cycle, it’s easy to feel trapped by big credit card bills. But breaking free from credit card debt IS possible with the right strategies and a clear understanding of how they work.

In this guide, we’ll cover everything from the basics of credit card interest to practical repayment strategies so you can regain control of your finances and start your journey toward a debt-free life.

On this page:

Money in your bank account and ready to use in 60-seconds3 once approved.

Typically issued by banks or other financial institutions, credit cards are a type of financial product that allows the cardholder to make purchases or withdraw cash up to a certain limit.

When a credit card is used to make a purchase, the cardholder borrows money from the issuer and agrees to pay it back at a later date, along with any applicable interest charges. Credit cards also typically have fees for late payments, exceeding the credit limit, or other types of transactions.

Below, we’ll explain each of the main components of how a credit card works.

Think of your credit limit as a spending boundary the bank sets for you. It’s the maximum amount you can borrow at any one time. You generally can’t exceed your credit limit, but you can request that your bank raise or lower it if necessary.

Maxing out your card can hurt your credit score and leave you struggling to pay it all back. It’s a good idea to stay well below your limit and keep your debt under control.

Interest rates on credit cards work differently than loan products. In most cases, credit cards come with relatively high interest rates, but you can avoid being charged interest entirely if you pay back your balance every month. At the end of every statement period, you’re charged interest on whatever you still owe.

According to the Reserve Bank of Australia (RBA), the average credit card interest rate at the time of writing (July 2024) is 20.57% p.a, with lower-rate cards having an average rate of 13.69% p.a.

Credit cards come with fees that can sneak up on you if you’re not careful. Annual fees, late payment fees, and even cash advance fees – they’re all potential costs to watch out for.

The Reserve Bank of Australia (RBA) found the average annual fee charged by credit cards was $83, but some yearly fees can be upwards of $700!

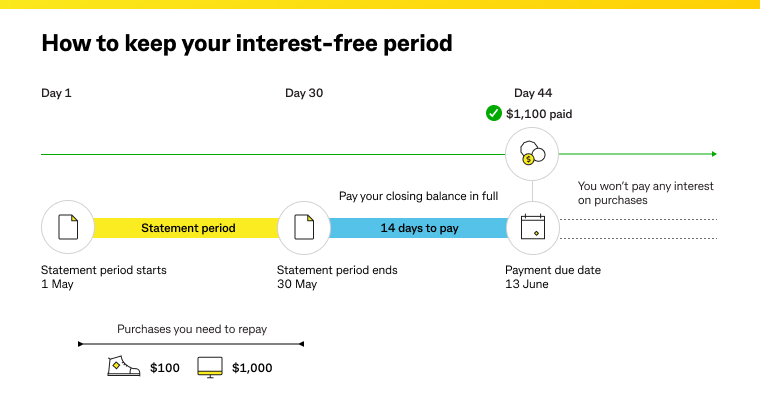

Interest-free periods are the grace periods where you won’t be charged interest on new purchases – but only if you pay off your balance in full by the due date. Missing that deadline means interest will be applied to your whole balance.

It’s like a ticking clock – if you can pay off what you owe in time, you avoid extra costs. Interest-free periods are commonly around 44 - 55 days but can be longer or shorter in some cases.

Stay on top of your payments to take full advantage of these periods.

Confused about how this works? Here’s a handy example, courtesy of Commonwealth Bank:

A credit card statement is a monthly summary of all your credit card transactions. It includes key information like the total amount you owe, your minimum payment due, the due date for your payment, any fees or interest charges, and details of every purchase or payment you've made during the billing cycle.

Pay attention to your credit card statements when they arrive!

The latest RBA data for June 2024 shows the total balance spent on Aussie credit cards is $41.3 billion. Of those billions, $18.2 billion is accruing interest. Per person, that’s an average balance of just over $3,000 and an average debt of $1,364.

At its peak, credit card debt in Australia reached as high as $37 billion in October 2011, more than twice as much as it is now!

Credit card debt can build up quickly due to the nature of how they work. If you aren’t careful and miss a full repayment on your balance, that debt can become uncomfortably large very quickly.

Credit cards aren’t like personal loans or home loans, where you borrow a set amount and repay that amount over a pre-determined period of time with interest. The actual cost of your credit card varies, as you are only required to pay a minimum amount each statement period.

This minimum amount is typically between 2-3% of your total outstanding balance or a fixed amount of $20 - whichever is higher. For example, if you owe $1,000 and your minimum repayment is 2.5%, you would need to pay $25. But ideally, you’d pay the whole $1,000 and be done with it.

However, by only paying the minimum, that initial $1,000 debt could become several times larger and take years to pay off.

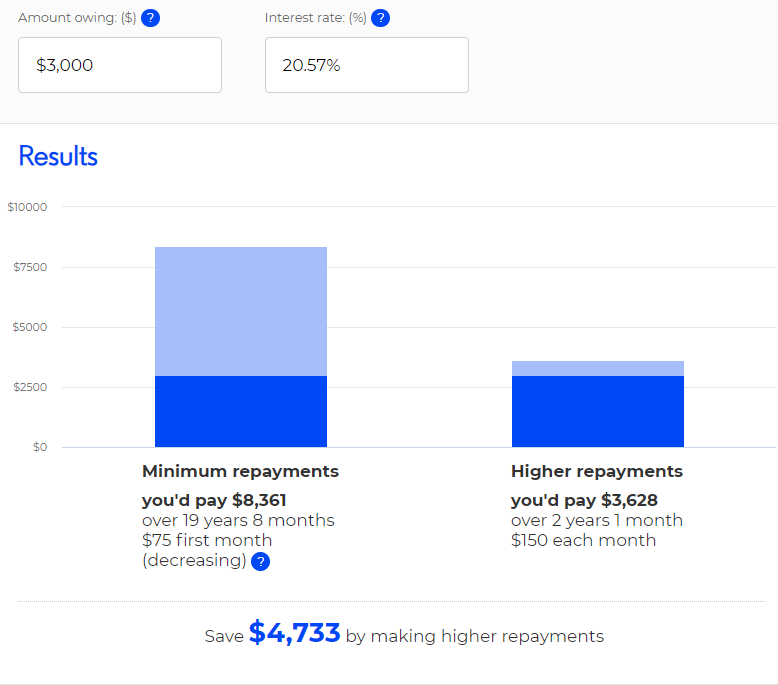

Let’s take a look at how this works using ASIC’s MoneySmart Credit Card Calculator.

Let’s use the average debt and interest rate figures from before here: in this scenario, you owe $3,000 and have a card with an interest rate of 20.57% p.a.

You paid only the minimum amount required, $75 (2.5% of $3,000). Interest was charged on the remaining $2,925.

If you only paid the minimum every month, you would end up paying $8,361 in total over a period of 19 years and 8 months!

That’s not an exaggeration. You’d really be turning a $3,000 debt into nearly triple that, and you’d stretch it out into almost 20 years!

However, if you paid double the minimum repayment each month ($150), you’d end up being charged $3,628 over just 25 months. That’s an overall saving of nearly $5,000!

The more you repay, the less you owe overall with a credit card.

Owing money on credit cards can be stressful, and you’re not alone if you’re in that position currently. Finder research from July 2023 found 16% of Aussie credit card users were unable to meet their repayments in full. One in ten couldn’t even make the minimum required repayment.

Thankfully, there are several proven strategies to help tackle credit card debt more efficiently, which we’ll explain below:

We went over this one just before, but to recap, paying more than your minimum is crucial to reducing both the principal and the amount of interest you’ll pay over time and to help prevent your debt from spiralling out of control.

Even just allocating a little bit each month towards your credit card debt can make a big difference. Using the example above, the following table will show you the difference extra repayments can make, bit by bit:

| How Higher Repayments Help With Credit Card Debt | |||

| Higher Repayment | $100 | $200 | $300 |

| Total Cost | $4,144 | $3,429 | $3,258 |

| Money Saved | $4,216 | $4,932 | $5,103 |

| Time To Repay | 3 years 6 months | 1 year 6 months | 11 months |

| Time Saved | 16 years! | 17 years & 2 months! | 18 years & 7 months! |

The snowball strategy is a common way of paying off credit card debts. It takes advantage of human psychology: We’re empowered by ‘wins’, no matter how small, and this encourages us to keep going.

The positive feedback loop helps you build momentum, like a snowball. For example, if you had a $500 Afterpay debt and a $4,000 credit card debt, you could pay the Afterpay debt off first. Now, you’ve built some momentum and also have extra funds to put towards your credit card.

The avalanche strategy is the opposite of the snowball strategy, and involves targeting your highest interest or most expensive credit card debt first. By paying off the most expensive debt first, you’re minimising the impact of compound interest on your debts, freeing up more money later on to tackle others.

This strategy can be harder than the snowball approach but is less expensive overall if you’re successful.

Make your credit card payments a priority. Cut unnecessary expenses temporarily and channel the saved funds toward clearing your debt. You should also avoid using the troublesome card as much as possible until you’ve brought your balance back down.

A balance transfer is exactly what it sounds like: you transfer your balance from one card to another. Some credit cards offer promotional balance transfer rates as low as 0% for a fixed period, which can give you a break from high interest.

However, it’s important to avoid new spending during this period and focus solely on debt repayment. Balance transfers often come with high revert rates at the conclusion of the low-interest period, and any balance you haven’t paid off in full will automatically be charged this higher rate.

Debt consolidation is a process where you eliminate multiple debt repayments by bringing some or all of your existing debts together into one loan. A debt consolidation loan, like those offered by Jacaranda, can help you absorb your credit card debts into a personal loan, so you’ll have one set of repayments instead of two or more.

If you're juggling multiple repayments of debts such as credit cards, have a look at our Debt Consolidation Loans to see how we could help.

Avoiding credit card interest altogether is the best approach to keeping your finances on track. Try doing the following (if you haven’t already) in order to prevent building up credit card debt in the future:

If you’re struggling with money or debts, you can call the free National Debt Helpline at 1800 007 007 (Monday – Friday). Aboriginal and Torres Strait Islander peoples can also contact the free Mob Strong Debt Helpline at 1800 808 488.

ASIC MoneySmart also recommends doing the following:

If you’re struggling with credit card debts to the point where it’s affecting your ability to repay other loans, you could potentially be eligible for financial hardship assistance.

When you’re in financial hardship, your bank, lender, credit card provider, insurer, etc., can offer you a temporary alternative arrangement to help you get back on track and resume regular repayments.

It’s in their best interests to help get you back on track with your finances, and they should have a financial hardship team to assist you. Standard hardship arrangements made by banks and lenders include, but are not limited to:

Banks/lenders don’t have to say yes to any hardship request, but they are required by law to respond to it within a reasonable timeframe.

If you’ve had trouble with a credit card or two in the past, you might want to consider a personal loan instead for your next big purchase.

A personal loan has an end date and a structured repayment schedule, suiting the type of borrower who needs some forced repayments to avoid going over their limit.

If you’ve decided a personal loan is an option for you, you can apply for a Jacaranda Finance Personal Loan in around 5-12 minutes1 from wherever you are! We are 100% online, which means no hefty paperwork or long queues.

You can apply for up to $25,000, and we can provide you with a same-day outcome2. Once your application has been approved, the money should be in your account within 60 seconds3 if you have an NPP-enabled bank account.