Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

Explore our comprehensive guide on household debt statistics in 2024, including home loans, credit cards, personal loans, and BNPL debt.

On this page:

*Latest household debt statistics from 2021-2022.

According to the OECD, household debt is “all liabilities of households that require payments of interest or principal to creditors at fixed dates in the future. A less mouthy definition would just be loans and consumer credit accounts you still owe, such as credit cards.

Not all debts are bad for you. Debts can be separated into ‘good’ and ‘bad categories.

Good debt is typically characterised by its potential to increase your net worth or generate long-term income, with common examples being mortgages to buy a house, student loans and investment loans.

Bad debt, on the other hand, typically involves borrowing to purchase depreciating assets or consumption items that lose value quickly and do not generate long-term income. Examples of bad debt usually include credit cards, car loans and payday loans.

Good debts can also become bad debts. If you end up in mortgage stress, for example, and pay upwards of 30% of your income just on your repayments, that good debt could soon become a bad debt.

Debt is extremely common in Australia. As we’ll explain in greater detail further down, Australia has some of the highest levels of household debt in the world!

According to NAB’s latest Australian Wellbeing Survey for Q4 2023, credit card debt is still the most widely held debt by Australians, with 38% having debt on at least one credit card. Home loan debt was next most common and held by 3 in 10 (29%) Australians overall; 22% carried BNPL debt, and around 17% owed money on a personal loan.

| Type of debt | % of Australians |

|---|---|

| Credit card debt | 38% |

| Home loan | 29% |

| Buy now, pay later (BNPL) | 22% |

| Personal loan | 17% |

| Loan from family & friends | 17% |

| Investment loan | 8% |

| Payday loan | 7% |

There isn’t too much of a gender divide in terms of who holds each type of debt. Men were slightly more likely than women (41% vs 35%) to hold credit card debt; more women (30%) had an active mortgage than men (28%); and women also held more BNPL debt compared to men (24% vs 20%).

| Type of debt | % of Men | % of Women |

|---|---|---|

| Credit card debt | 41% | 35% |

| Home loan | 28% | 30% |

| Buy now, pay later (BNPL) | 20% | 24% |

| Personal loan | 16% | 18% |

| Loan from family & friends | 15% | 19% |

| Investment loan | 8% | 9% |

| Payday loan | 7% | 6% |

There are more pronounced differences in the types of debts held by different age groups. Unsurprisingly, the youngest age group (18-29-year-olds) are the least likely to have an active mortgage at just 21%. Even fewer 65+ Australians have a mortgage (11%), as they’re the most likely generation to have fully repaid their mortgages.

| Type of debt | % of 18-29 | % of 30-49s | % of 50-64s | % of 65+ |

|---|---|---|---|---|

| Credit card debt | 23% | 42% | 43% | 40% |

| Home loan | 21% | 43% | 34% | 11% |

| Buy now, pay later (BNPL) | 27% | 29% | 19% | 7% |

| Personal loan | 25% | 23% | 14% | 2% |

| Loan from family & friends | 25% | 23% | 12% | 4% |

| Investment loan | 7% | 12% | 9% | 3% |

| Payday loan | 10% | 10% | 5% | 1% |

Higher-income Australians—defined by NAB as earning $100,000 or more annually—have more ‘good debts’, with 47% having an active mortgage compared to just 11% for lower-income Australians. This makes sense when you consider the requirements banks have for servicing a mortgage when assessing an application, as well as the challenge of saving up for a deposit in the first place.

They also take out more investment loans (15% vs. 3%), and the only ‘bad debt’ they have more of is credit cards (42% vs. 28%).

| Type of debt | Lower-income | Higher income |

|---|---|---|

| Credit card debt | 28% | 42% |

| Home loan | 13% | 47% |

| Buy now, pay later (BNPL) | 23% | 22% |

| Personal loan | 13% | 22% |

| Loan from family & friends | 20% | 17% |

| Investment loan | 3% | 15% |

| Payday loan | 7% | 7% |

According to the most recent census data, roughly one-third (35%) of Australians have an active home loan, and given their size, these loans account for the majority of Australian household debt. In January 2024 alone, more than $25 billion worth of new housing loans were settled!

NAB's data shows the average home loan debt in Australia is $293,705, down from $299,000 the year before.

The table below shows how the size of the average home loan debt varies between age, gender and income:

| Demographic | Average outstanding home loan (Debt) |

|---|---|

| 18-29 | $301,201 |

| 30-49 | $340,071 |

| 50-64 | $264,247 |

| 65+ | $135,506 |

| Men | $277,351 |

| Women | $310,754 |

| Lower-income | $140,149 |

| Higher-income | $335,865 |

There’s a difference between the average home loan size and the balance owed. As you pay off a home loan over time, the outstanding balance decreases, and your equity grows. While the average outstanding home loan balance as of December 2023 may have been just under $300,000, the size of new home loans funded is much higher.

In December 2023, the average mortgage size in Australia rose 2.6% to a new record high of $624,000! The state with the highest home value in its capital - NSW - also has the highest average loan amount, with the typical borrower taking out a whopping $785,000.

The graph below shows the average mortgage size in each state as of January 2024:

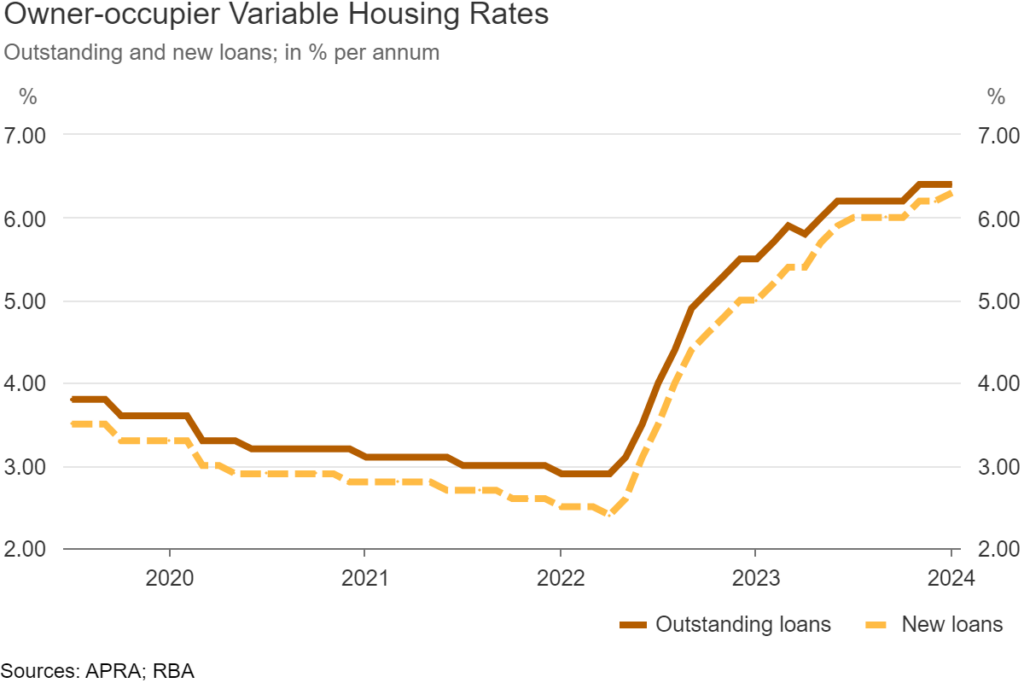

Home loan interest rates have increased significantly over the past several years in Australia, thanks to over a dozen cash rate increases by the Reserve Bank (RBA) since May 2022. In that time, the cash rate has gone from a record low of 0.10% to 4.35%, and interest rates on mortgages have followed suit.

As of January 2024, the average interest rate on outstanding owner-occupier home loans was 5.88% p.a. For new loans, the average interest rate was even higher at 6.27% p.a, while property investors paid even more (6.54% p.a).

As the graph below shows, the average owner-occupied interest rate before the cash rate began to rise in May 2022 was a mere 2.9% p.a.

As mentioned above, credit cards are the most popular type of debt in Australia, used by more than one-third of the country. However, they’re a lot less popular than they used to be.

The latest official credit card stats from the RBA show that 13.52 million active credit cards are currently in circulation. This is a noticeable 29% drop from September 2016, when the number of credit cards in circulation hit a record high of nearly 23 million. It’s also down 11% compared to the historical average of 18 million.

Comparatively, debit cards are much more popular, with nearly 47 million currently used as of January 2024.

According to the RBA’s data, the average balance on each active credit card is $2,978. Of that amount, just under half—$1,363—is accruing interest, aka debt.

NAB’s report shows similar numbers. Current balances on credit cards as of December 2023 were $3,344 on average. Average credit card balances were higher among men ($3,463) than women ($3,210), while higher-income earners were more likely to spend big on their credit cards compared to low-income earners:

| Demographic | Average outstanding credit card balance |

|---|---|

| 18-29 | $2,941 |

| 30-49 | $3,816 |

| 50-64 | $4,054 |

| 65+ | $2,422 |

| Men | $3,463 |

| Women | $3,210 |

| Lower-income | $2,469 |

| Higher-income | $4,152 |

When you put all of that personal credit card debt together, the balance accruing interest across Australia totals more than $18.2 billion!! While that is a lot, it’s much, much less than pre-covid levels. Monthly credit card debt has fallen by about one-third (33.5%) from $27.9 billion in March 2020 and has halved since 2011 ($37 billion)!

According to the RBA, interest rates on ‘standard’ and ‘low-rate’ credit cards are 20.07% p.a and 13.23% p.a, respectively, as of February 2024. Remember: credit card rates can vary significantly depending on a number of factors.

Personal loans are on the rise in Australia. The latest ABS data for January 2024 found that the value of funded personal loans increased by nearly 14% over 12 months, with $2.46 billion loans settled in that month alone.

The total value of outstanding personal loans (that is, loans that still need to be repaid) spiked to an all-time high of $170.7 billion in July 2019.

The average personal loan debt as of December 2023 was $10,925, down from nearly $12,000 in December the year before. Here’s the average personal loan debt broken down further by age, gender and income:

| Demographic | Average outstanding personal loan balance |

|---|---|

| 18-29 | $9,538 |

| 30-49 | $12,639 |

| 50-64 | $9,479 |

| 65+ | $11,383 |

| Men | $10,233 |

| Women | $11,525 |

| Lower-income | $5,943 |

| Higher-income | $14,298 |

Payday loans are designed to provide temporary finance solutions over a shorter period and for smaller amounts, usually up to $2,000. While they aren’t allowed to charge interest, ASIC states that they commonly charge the following high fees:

The average payday loan debt as of December 2023 was $751, which is a lot given the extremely high charges these loans can come with.

Gen Zs (18 - 29) had the highest average payday loan debt at $997. Senior Australians over 65, on the other hand, owed just $250.

| Demographic | Average payday loan debt |

|---|---|

| 18-29 | $997 |

| 30-49 | $685 |

| 50-64 | $716 |

| 65+ | $250 |

| Men | $613 |

| Women | $1,029 |

| Lower-income | $413 |

| Higher-income | $678 |

If you’re struggling with money or debts, you can call the free National Debt Helpline on 1800 007 007 (Monday – Friday). Aboriginal and Torres Strait Islander peoples can also contact the free Mob Strong Debt Helpline on 1800 808 488.

ASIC MoneySmart also recommends doing the following:

Buy Now, Pay Later (BNPL) services allow you to delay the full payment of a purchase. However, unlike a credit card, each purchase will be split into four or more equal slices and repaid in instalments, often fortnightly. BNPL platforms like Afterpay or Zip also don’t tend to charge interest; instead, late payment fees for missed payments are charged, commonly around $7-$10 each time.

Mozo data shows that the average BNPL-utilising Aussie spends $2,208 annually, or $184 per month. But this isn’t considered debt if each instalment is repaid on time, which begs the question: how much BNPL debt does the average Aussie have?

According to NAB’s report, the average outstanding BNPL debt as of December 2023 was $686. Twelve months prior, in December 2022, the average BNPL debt was $770—nearly $100 higher!

Women are more prominent users of BNPL platforms than men, and this is reflected in their average balances: women carry an average BNPL debt of $740, compared to $623 for men.

While Gen Z is the biggest user of BNPL platforms compared to older age groups, millennials (Gen Y) carry the highest BNPL debts, NAB’s report shows an average BNPL debt of $824 for 30-49-year-olds, compared to just $538 for 18-29-year-olds.

Surprisingly, 50-64-year-olds owe more on their BNPL services than Gen Z ($687), while higher-income groups have a higher average debt ($749) than those on lower incomes ($681).

Average BNPL debts by demographic:

| Demographic | Average outstanding balance (Debt) |

|---|---|

| 18-29 | $538 |

| 30-49 | $824 |

| 50-64 | $687 |

| 65+ | $553 |

| Men | $623 |

| Women | $740 |

| Lower-income | $681 |

| Higher-income | $749 |

A December 2023 survey by Finder found that just under half (49.11%) of Aussies have never used a BNPL platform. Of those who have, Afterpay is the most popular, used by more than 37% of Australians.

How many Australians have used a buy now pay later service?

| Platform | % used at least once |

|---|---|

| None | 49.11% |

| Afterpay | 37.2% |

| PayPal Pay in 4 | 17.13% |

| Zip | 16.93% |

| Humm | 4.82% |

| Openpay (no longer available) | 4.23% |

| Klarna | 3.94% |

| Other | 2.66% |

| Bundll (owned by Humm) | 0.49% |

Australia has some of the highest levels of household debt in the world. As of December 2022 (ABS), the average Australian household had a debt of $261,492, which is around $2.6 trillion (with a T) nationally. That’s an increase of 7.3% from the previous year.

According to the OECD, the average household debt is 211% (or 2.1x) of net disposable income. Essentially, we owe twice as much as we earn!

Compared to the other OECD countries (aka leading economies), Australia’s household debt ratio is the third highest in the world. Only Switzerland and Norway are ahead of us, at 222% and 247% respectively.

We are also level with The Netherlands at 211% and just ahead of Denmark (208%).

Managing multiple debts across various lenders can be not only overwhelming but also financially draining. That’s why we offer debt consolidation loans to help.

By consolidating your debts into a single, manageable loan, you could not only streamline your repayments but potentially lower your overall interest rates and monthly payments as well.

Take the first step towards regaining control of your finances by exploring our debt consolidation solutions today.