Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

Understanding personal loan fees is vital to managing your finances. By gaining this knowledge, you'll protect your pocket and take a significant step towards financial freedom.

This guide explains common personal loan fees and charges, what they are for, and how much you might expect to pay for them.

On this page:

Money in your bank account and ready to use in 60-seconds3 once approved.

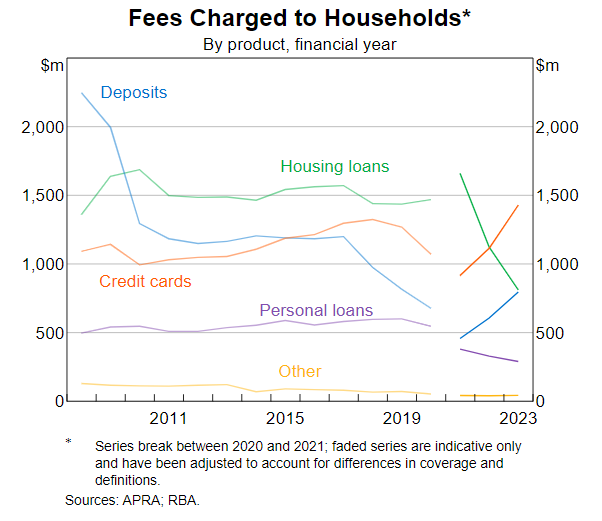

Fees on personal loans and other loans have declined over the last several years, mainly due to increased competition among banks and lenders. According to a 2024 report by the Reserve Bank of Australia (RBA), upfront personal loan fees are on the way out. Still, ongoing service fees have seen a rise, reflecting evolving lending practices and a shift to online loan processing.

The RBA’s report shows that overall personal loan fees fell by a significant 12% from 2022 to 2023, dropping from $329 million to $290 million. Compared to 2021, that’s a decline of nearly 25%.

Generally, personal loans can come with a range of additional fees and charges, which can include:

A personal loan might include many or few of these fees. This will depend on the individual lender and any other influencing factors (e.g., if you miss a repayment, a fee could apply).

Many lenders also tend to have different fee structures for different kinds of borrowers: someone with an excellent credit history might pay fewer fees than someone with an average credit history, for example.

Click on the links above to jump to each fee.

An establishment fee (or application fee) is the upfront fee a lender charges for submitting your application. This fee can be a standard rate or a percentage of the amount you are applying for.

An upfront establishment fee typically covers the costs of assessing your application and paying the staff to do so. It is generally only charged once.

Typically, the two main types of ongoing fees are monthly fees and annual fees. Other ongoing fees are uncommon but still possible, such as semi-annual and quarterly fees.

Ongoing fees cover the administration costs of managing your loan. The most common ongoing fee is a monthly fee, though some lenders don’t charge any ongoing fees at all.

This fee can add up over time, so it's essential to account for it when calculating your estimated repayments and comparing your options.

Some lenders may charge a fee if you make additional repayments on your loan beyond your minimum scheduled repayments. These are designed to compensate the lender for potential loss of interest income. However, many lenders don't charge this fee.

This fee may be charged if you pay off your loan earlier than the agreed term. Like the extra repayment fee, it compensates the lender for potential loss of interest income.

If you fail to repay a scheduled loan on time, the lender may charge a late payment or missed repayment fee. This fee serves as a penalty to encourage timely repayment.

Missed repayment fees are quite common for personal loans. While some lenders don’t charge late fees, it’s still important to prioritise making loan payments on time. If you think you won’t be able to meet your next repayment by the due date, contact your lender and let them know as soon as possible so you can work out an arrangement.

You can often get charged a documentation fee when applying for a loan. This fee represents the cost of preparing your loan documents for your application, which include:

While some lenders charge a documentation fee, many will encompass this fee into one application/establishment fee.

If you're taking out a secured loan, such as a car loan, the lender may charge a fee for checking the Register of Encumbered Vehicles (REVS) to ensure the asset (typically a car) isn't already encumbered with debt.

This is an important cost to verify because if the previous owner hasn’t paid off their car loan in full before selling to you, the lender could repossess the car from you if they default on their loan.

Most lenders don’t charge this fee, however. Plus, you can easily check the encumbrance status of a vehicle yourself for as little as $2 through the Personal Property Securities Register, so there’s no need to pay a lot of money for this fee.

Also known as a credit fee or risk margin, the risk fee covers the level of risk associated with your loan. Risk fees vary based on several factors, primarily your loan amount, credit score, financial history, and more.

They could be a percentage of the loan amount or a flat fee, varying from $0 to several hundred dollars.

Early exit fees were banned on personal loans with variable interest rates in 2011 but are still common with fixed-rate loans. Early exit fees are charged when a loan is paid off in full before the agreed term ends. They differ from early repayment fees as they are charged only once when the loan is fully paid off ahead of schedule.

These costs can vary greatly from lender to lender, depending on how much you’ve already paid off and how long the agreed loan term is.

In general, the most common and expensive charge you can expect on a personal loan (and most loans, for that matter) is the interest charge. Interest is calculated as a percentage of the loan balance on a per-annum (annual) basis; the interest rate is essentially the cost of borrowing a lender’s money.

A difference in an interest rate can often save you hundreds if not thousands of dollars, and the rate you get is generally influenced by:

Not sure what your credit score is?

Based on analysis by Savings.com.au, here are the average, minimum, and maximum amounts you can expect to pay for some of the above fees.

| Fee | Average | Minimum | Maximum |

|---|---|---|---|

| Establishment fee | $270 | $0 | $600 - $1,800 |

| Annual fees | $1 | $0 | $110 |

| Monthly fees | $2 | $0 | $15 |

| Other ongoing fees | $5 | $0 | $400 |

| Extra repayment fees | $10 | $0 | $25 |

| Early repayment fees | $100 | $0 | $300 |

| Missed repayment fees | $25 | $0 | $50 |

| Documentation fees | $5 | $0 | $100 |

| Encumbrance/REV check fees | $5 | $0 | $100 |

Remember, these ranges are estimates only, and the fees can vary widely depending on the lender and your circumstances. Always check the fee schedule and the product disclosure statement (PDS) with the lender before taking out a personal loan.

The comparison rate allows you to understand the more accurate cost of taking out a loan. It is expressed as a percentage and includes the loan's interest rate plus certain key fees and charges associated with it.

Australian lenders are legally required to display the comparison rate alongside the advertised interest rate whenever an individual rate is shown. A comparison rate can make it easier to compare loans and services offered by lenders, help you choose the right one for your financial situation, and potentially save you hundreds of dollars in fees.

Remember: The loan with the lower interest rate might not necessarily be cheaper overall.

As you can see, personal loan fees can add hundreds (potentially thousands) to the overall cost of your loan if you’re not careful. Minimising personal loan fees requires a proactive approach on your behalf, but it’s very doable.

Here are several strategies you can use to reduce the cost of your personal loan:

Remember, while it's important to minimise fees and interest charges, you should also consider other factors such as the loan term, the flexibility of repayment options, the speed and convenience offered and the lender's customer service.

Making an informed decision based on all of these can save you money and stress in the long run.

Read more:

At Jacaranda, our loans include several of the fees listed above, mainly:

We do not charge any fees for extra or early loan repayments.

The interest rate, fees, and charges applicable will vary depending on which of our loan products you choose and the loan amount and term you qualify for. These costs will also depend on your individual circumstances and the information verified during the loan application assessment.

Use our loan repayment estimate calculator to get a guide on what your repayments could be based on our fees and interest charges, or get in touch with our customer service team if you have any questions.

We’re an award-winning online lender specialising in providing fast, fair and flexible loans up to $25,000 to the everyday Australian. Not only are our loans affordable based on your circumstances, they’re also seriously speedy.

We were one of the first lenders in Australia to provide a 60-second loan transfer to approved applicants3, while our state-of-the-art proprietary loan processing technology also means our customers can:

You can also check your credit score in our Better Credit app for free, updated monthly, and thanks to Comprehensive Credit Reporting (CCR), you could improve your credit score quite quickly if you pay back your loan on time, every time.