Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

But which one should you choose? While both credit cards and personal loans provide access to credit, choosing the best one for you can take time and effort. It's essential to do thorough research before making a financial commitment.

This guide aims to clarify the differences between the two products by examining some pros and cons of credit cards and Jacaranda Finance personal loans.

On this page:

A personal loan is a set sum of money that you borrow from a lender or bank and repay with interest (fixed or variable) and potentially other fees and charges over a set period of time, often between one and seven years. A personal loan can be used for many purposes, and lenders offer a variety of options to suit your financial needs.

At Jacaranda Finance, we offer loans from $3,000 to $25,000 for many key reasons, including home improvement, travel, debt consolidation and more!

Personal loan repayments are usually fixed over a set loan term and can usually be set up on weekly, fortnightly or monthly repayment cycles. If you set the repayment up in line with your income deposit, that could assist with your budgeting and management of your loan repayment.

There are generally two types of personal loans — secured personal loans and unsecured personal loans. A secured personal loan is where an asset is required to ‘secure’ the loan, such as a car or other vehicle. On the other hand, an unsecured personal loan does not require you to provide an asset to secure the loan.

Personal loans generally come with a range of additional fees and charges, which can include any of the following:

It’s important to read the terms and conditions for any personal loan so you understand what fees you could be charged and in what circumstances they’ll apply.

According to NAB, the average personal loan debt as of December 2023 was $10,925, down from nearly $12,000 in December the year before:

| Demographic | Average outstanding personal loan balance |

|---|---|

| 18-29 | $9,538 |

| 30-49 | $12,639 |

| 50-64 | $9,479 |

| 65+ | $11,383 |

| Men | $10,233 |

| Women | $11,525 |

| Lower-income | $5,943 |

| Higher-income | $14,298 |

If you’re weighing up whether to get a personal loan, here’s a rundown of the pros and cons on offer with Jacaranda Finance:

Pros

Cons

See our Personal Loan FAQs for more info on how our loans work. It's important to keep in mind that a personal loan may not be the best choice for everyone, and it's always a good idea to carefully consider all of the options before deciding on the best financial product for your needs.

A credit card is a financial product that allows the cardholder to borrow money from the issuer to make purchases or withdraw cash. Credit cards are typically issued by banks or other financial institutions and allow the cardholder to make purchases or withdraw cash up to a certain limit called the credit limit.

When a credit card is used to make a purchase, the cardholder borrows money from the issuer and agrees to pay it back at a later date, along with any applicable interest charges. Credit cards also typically have fees for late payments, exceeding the credit limit, or other types of transactions.

Credit cards are generally more suited to daily and regular expenses, like monthly bills and grocery shopping. They may offer interest-free periods, balance transfers, and rewards programs, which can make them attractive to certain types of people.

In addition to interest charges, credit cards typically come with a variety of fees and charges. Common ones include:

The Reserve Bank of Australia (RBA) found the average annual fee charged by credit cards was $83, but some yearly fees can be upwards of $700! The RBA also states the average credit card interest rate was 19.87% p.a (per annum) at the start of 2024, while some of the more premium credit cards charge interest rates in excess of 20% p.a.

According to the RBA’s data, the average balance on each active credit card is $2,978. Of that amount, just under half—$1,363—is accruing interest, aka debt.

Whether or not a credit card is the right option for you depends on a few factors. Below, we list the pros and cons of getting a credit card:

Pros

Cons

It's important to keep in mind that a credit card may not be the best choice for everyone, and it's always a good idea to carefully consider all of the options before deciding on the best financial product for your needs.

Both personal loans and credit cards have the potential to positively and negatively impact your credit score. It depends on how you use them.

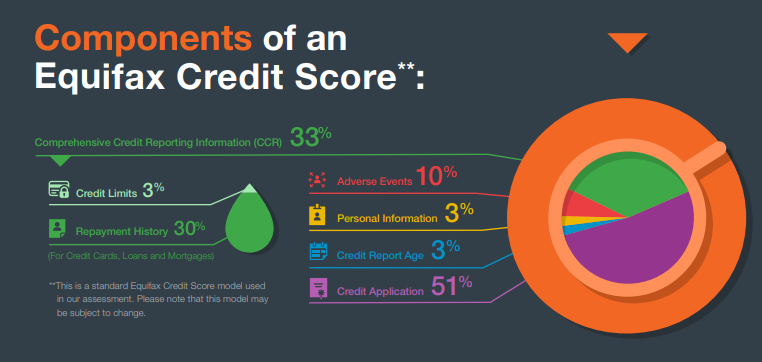

According to Equifax, credit applications (hard enquiries) have the most impact on your credit score (51%), followed by your repayments (30%), adverse events like bankruptcies (10%), credit limits (3%) and more.

This means things like making minimal applications, timely repayments, and staying within your credit limit can all help maintain and improve your credit score over time.

Conversely, missing repayments, constantly applying for loans and going above your credit limit are behaviours that commonly damage credit scores.

When deciding between a personal loan or credit card, there are a few questions you can ask yourself to help make your decision easier. Here are five key ones we’ve collated:

| What do you need the money for? | If you're looking to make a big purchase, such as travel or home improvements, then a personal loan might be a more suitable option. However, if you want ongoing access to credit, then you could consider a credit card. |

| How much do you need to borrow? | Both credit cards and personal loans offer many different credit/loan limits to suit a variety of different borrowers. Credit card limits, for example, can go from as little as $1,000 - $2,000 to $100,000 or more! Personal loans can be very similar: At Jacaranda Finance our loan limits range from $3,000 to $25,000. However, the set nature of personal loan limits means you know exactly how much you need to repay from the start. This can be a positive or a negative, depending on your preferences. |

| What kind of repayment schedule do you want? | A personal loan has an end date and a structured repayment schedule. On the other hand, a credit card allows ongoing access to money up to the credit limit. If you need more discipline with repayments, then a personal loan might be your best bet. Credit card repayments can generally be more flexible - but be wary of not meeting your payments in full. |

| What is your financial situation like? | If you're good at following a budget, both credit cards and personal loans can be the right options. But if you're prone to overspending, consider avoiding a credit card. In some cases, you may need a stronger financial position to choose between the two products, as both will have credit criteria you must meet. |

| What perks do you want? | Credit cards generally come with a range of perks, such as rewards points for spending, airline benefits, travel insurance and more. However, cards with these rewards often have higher fees and interest rates as a result, but this can be worth it for those who pay it off in full each month and spend enough that the costs are worth it. Personal loans, on the other hand, are a simpler product: you borrow a set amount and repay it in instalments with interest. With Jacaranda Finance, you can make extra repayments and pay off your loan early at no extra cost, saving money in the process! |

If you’ve decided a personal loan is an option for you, you can apply for a Jacaranda Finance Personal Loan in around 5-12 minutes1 from wherever you are! We are 100% online, which means no hefty paperwork or long queues.

You can apply for up to $25,000, and we can provide you with a same-day outcome2. Once your application has been approved, the money should be in your account within 60 seconds3 if you have an NPP-enabled bank account.

If you pay your loan on time, you could also see visible improvements in your credit score5 thanks to our Better Credit mobile app, which lets you check your score for free!