Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

Most people will have a credit score, yet there are still so many misconceptions about them, and many people still might not know they have one or why it’s important.

In this article, we’ll explain what your credit score is; what it means, and why you should always try to improve it.

On this page:

A credit score, also known as a credit rating, is a score given to you based on your borrowing history from credit providers. When you apply for a credit product (such as a home loan, car loan or credit card), your credit score can essentially act as a numerical representation of your trustworthiness and reliability as a borrower.

Your credit score, which generally ranges from 0 to 1,200, is an extremely important number, and having a low one can make life harder in several ways.

You can access your credit score online through an online credit score provider or view your score on your credit report, which is essentially a longer, more detailed document on your credit history.

Your credit report can include any of the following depending on your past and present financial behaviours:

As you’ll see below, you can receive different credit reports from different credit agencies.

And more.

Depending on the credit agency, your score will be classed as a certain category. Here’s what these currently look like as of 2024. Note that each bureau has slightly different names for each band, so we’ve used Equifax's credit score range as a guide:

A good credit score generally means you have a history of making repayments on time and being responsible with credit, or at the very least, there is a lack of negative behaviours such as missing repayment deadlines.

As you can see above, a ‘good’ credit score can be a broad term. For Equifax, a ‘good’ score is 661 - 734, a ‘very good’ score is 735 - 852, and an ‘excellent’ score is 853 up to 1,200.

illion, however, considers a good credit score anything above 500, while Experian is similar to Equifax in that it requires at least 625 or higher to be considered a good credit score.

Generally speaking, if your credit score is over 800, you should be considered an excellent credit customer. However, your credit score is a dynamic number that can change at any time.

Credit Bureaus tend not to use ‘bad’ to describe someone’s credit score. The lowest band, as seen above, is often called ‘low’ or ‘below average’. With illion, your credit score must be less than 300 to be considered low; with Experian, it’s under 550, and under 459 with Equifax will put someone in the lowest credit rating category.

‘Bad’ credit scores can show lenders that you have a history of behaviours such as missing repayment deadlines or defaulting on loans, applying for too many credit products, taking out riskier loans like payday loans or wage advances etc.

For this reason, they might deem you a riskier borrower and either approve you at a higher interest rate or deny the application altogether.

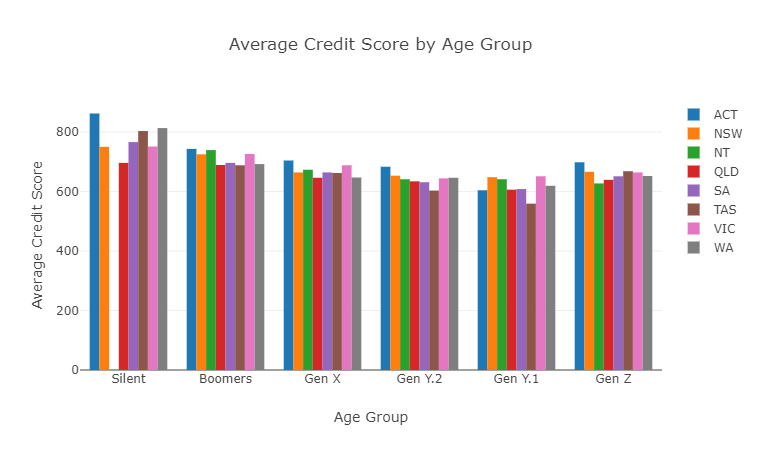

The average credit in Australia is actually not that high: according to Finty, the average credit score across all states and territories as of 2022 was about 657, which would land someone firmly in the ‘average’ range. The ACT had the highest average score at 680, while the lowest belonged to Queensland at 641.

So based on the credit score bands above, the average credit score in Australia is quite literally average!

Broken down by generation, you can also see that older generations tend to have higher credit scores:

Your credit score is important because it essentially represents to credit providers your trustworthiness as a borrower and your responsibility with money. When you apply for a loan or credit product, lenders will likely use your credit score as a factor in assessing your application.

Having a bad credit score can limit your options in many ways. It could not only lower your chances of being approved for loans you apply for, but it could also exclude you from being eligible for certain loans. Most lenders typically have minimum credit criteria for their best products, and a lower credit score might limit you to a loan with higher interest rates and fees, less flexible loan terms and more.

On the other hand, a higher credit score can improve your chances of a successful loan application for a desirable product that meets your needs, as your recent financial history suggests you’re likely to repay the loan on time.

You can receive your credit score for free as regularly as you would like from Equifax, Experian, illion and Talefin, but also from smaller, third-party services like Credit Savvy. Your credit report, however, is free for you to access every 3 months. Any more frequently and you could be charged a fee.

It’s generally pretty easy to check your credit report and score online. All you need to do is verify your identity (have your driver’s license handy) and provide other personal information if necessary.

Though access to your credit score is typically instant, depending on who you apply with, it may take one or two business days to receive your credit report online.

Did you know our customers can check their credit scores for free? If you currently have an active loan with Jacaranda, you can log in to the Better Credit mobile app or customer portal and check your credit score any time you like!

Download the app below to either sign in or apply for a loan today!

Though some people believe checking your credit score too often will lower it, Equifax rebuts this by saying checking your credit score on a regular basis will not harm it. They actually recommend checking it regularly to ensure all information is up to date.

In terms of your credit report, according to ASIC, you have a right to request a free copy of your credit report every three months, although it recommends checking it at least once a year. Smaller online credit score providers might give you one as frequently as once a month!

It’s generally a good idea to follow ASIC’s advice and check your credit report once a year or so, but you can really check it whenever suits you. For example, you may want to check your credit report:

Want to know the other myths surrounding credit scores? We’ve busted nine credit score myths to help settle things once and for all.

If your credit score is too low, there’s both good news and bad news.

The good news is that you can improve your credit score. The bad news is there’s no quick fix: it takes a while to slowly move your credit score up to a higher band and into the ‘good’ range. While defaults and serious credit infringements can remain on your credit report for several years, there are steps you can take to demonstrate that you are a responsible borrower.

Here’s a quick summary of the top tips you can use to improve your credit score. For a more detailed look into these steps, check out our article below on improving your credit score.

Don't be frustrated if you don’t see immediate changes to your credit score, as it can take time for these positive behaviours to show up. But over time, following these steps should see a steady increase in your credit score.

Did you know: At Jacaranda Finance, we may be able to help build your credit score thanks to Comprehensive Credit Reporting (CCR)? By taking out a loan and making all your repayments on time, we can report your responsible credit behaviour to the credit bureaus, which can quickly strengthen your credit profile.

At Jacaranda Finance, credit scores form just one part of our comprehensive loan assessment process. With our powerful in-house technology, we are able to take in your whole recent credit and banking history, not just your credit score. This means we look beyond just your credit score and will look at things like:

And much more.

We can do all of this in double-quick time - you can complete an application in just 5-12 minutes1 and hear back from us on the same day2, while we can transfer the money to your bank account in just 60-seconds if approved3!

If you want to learn more about how our loans might be right for you, check out our FAQs or speak to our friendly customer service team who are more than happy to chat. And if you’re ready to get started on your application, check if you qualify today!

This article was originally published on 13 May 2021.