Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

*Subject to lending criteria, T's and C's'

*Subject to lending criteria, T's and C's'

Our loans are designed to be fast, fair, and, above all, affordable, with no hidden fees. See the table below for a quick guide to our charges, or visit our fees page to learn more. For detailed information about who our products are designed for, please review our Target Market Determinations.

With $10,000, you can get quite a lot. Jacaranda's Express Personal Loan is typically suited for larger, planned expenses, thanks to our maximum loan amount of $25,000. However, with a minimum loan amount of $3,000, you can borrow for some smaller and mid-sized expenses, too.

Our customers commonly take out a Personal Loan for the following reasons:

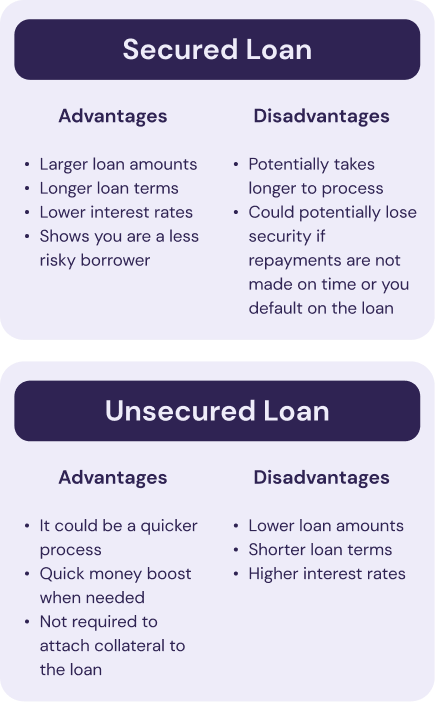

Jacaranda offers two different loan types: secured and unsecured. Our Secured Loans involve attaching something of value to your loan as security, often a car or vehicle. Unsecured Loans, on the other hand, don't require any kind of security in the loan contract.

As unsecured loans tend to carry a slightly higher level of risk, our maximum loan amount for unsecured loans is [LaccUnSecBorrowMax]. To access our maximum loan amount of $25,000, you must attach security to your loan contract.

Read more:

As a hard-working Aussie, you don’t have time to waste on needless paperwork. That’s why our loan application process has been perfected over time to be as simple and fast as possible.

With a $10k Loan from Jacaranda, you can:

What’s more, you can check if you qualify for one of our loans without impacting your credit score at all!

Before you apply for a loan, we think it's important to review your budget and be certain that you can comfortably repay it.

Once you know what you can afford in your budget, use our three-step loan repayment calculator to estimate your repayments before you apply.

Ready to Apply? You can get started now.Jacaranda Finance is reporting data under the Comprehensive Credit Reporting (CCR) regime.

With CCR, we will now provide a more detailed and comprehensive view of your credit history to credit bureaus.

This means that your credit behaviour, such as making timely repayments and managing your loans responsibly, will be reported, potentially strengthening your credit profile.

You may also have improved access to more competitive loan products, better loan terms and increased transparency in your credit information.

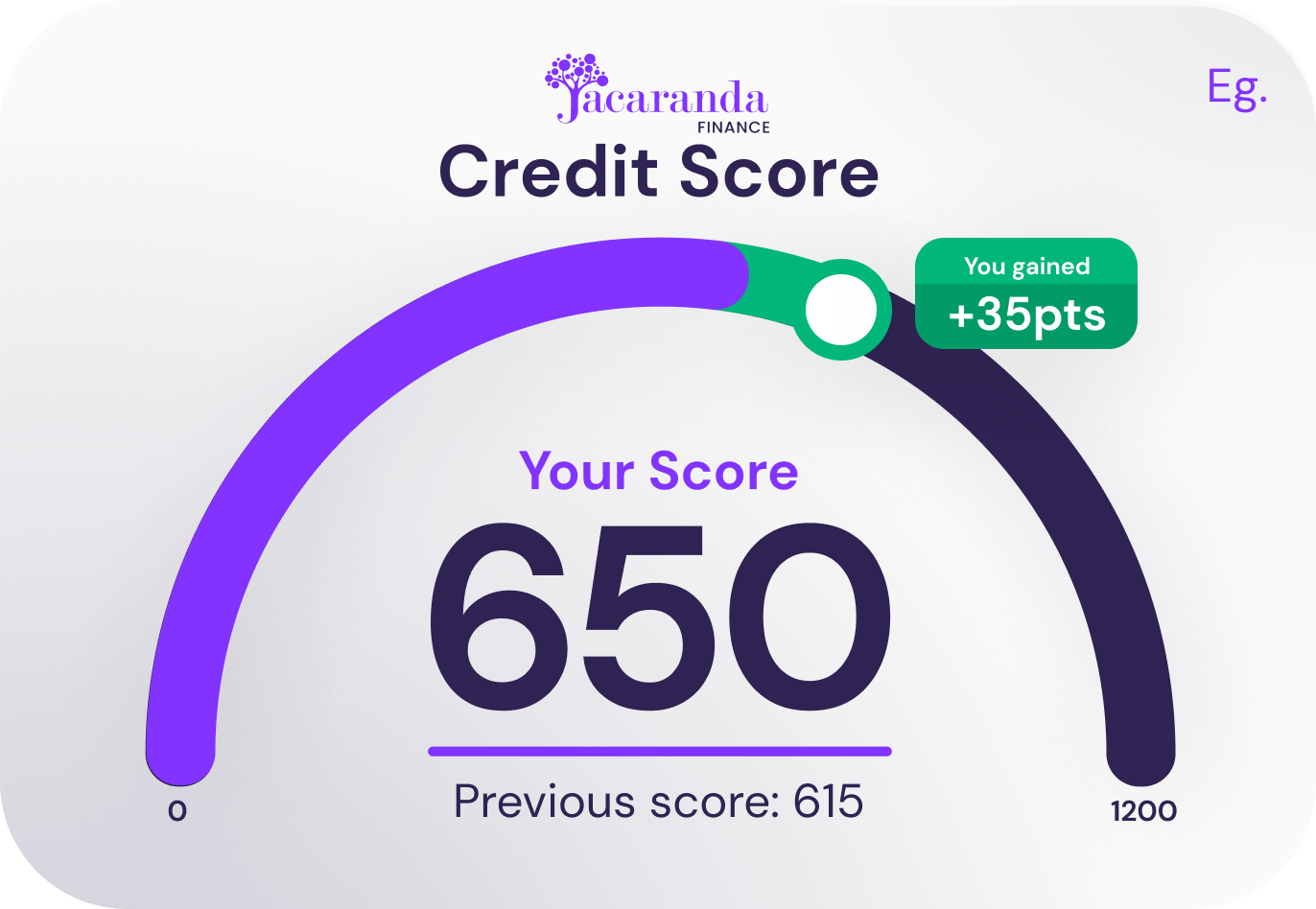

Your credit score is more than just a number—it's the key to your financial health and opportunities.

We are 100% devoted to improving the credit scores of Australians. We also want to help you understand everything you need to know about how credit works.

With the Better Credit app, you can check your credit score and monitor its progress over time for free. This could unlock new financial opportunities in the future.

Want to learn more about our Personal Loans and how they work? Find the answers to some of our FAQs here.

Yes, you can check your credit score for free with the Better Credit app. The app allows you to sign up and check your score in just a few minutes, whether you're a customer of Jacaranda Finance or not. It's designed to be an easy and secure way to monitor your financial health.

If you prefer, you can also log in to your online customer portal and check your credit score there.

Before you formally apply with Jacaranda, you can check if you qualify for a loan in a way that does not impact your credit score. We do this by performing a 'soft' credit check that is only visible to you.

If you don't meet our initial criteria, your credit score won't be affected.

Once you've checked your eligibility and we've let you know that you do qualify for a loan, you have the option to move forward with a full application.

We will perform a credit assessment during this process, which involves checking your credit report. By submitting a full application, you authorise Jacaranda Finance to obtain a copy of your full credit file, referred to as a 'hard' credit check.

Other lenders will be able to see that you applied for a loan with Jacaranda.

This might impact your credit score.

Review our Privacy Policy for more information.

Repayments on your loan are automatically set up to be deducted via direct debit from your bank account in line with your pay cycle.

You can view your repayments from either the Better Credit app or online portal and contact our friendly customer service team to request any changes that you need.

Download the app on the Google or Apple store today.

Read more: Personal Loan Repayments 101.

We only offer fixed-rate loans. See our guide to fixed vs. variable interest rates to learn the differences between the two.

Use our loan repayment estimate calculator to get a guide on what your repayments could be. To get an idea of what rates, fees and charges are associated with our loan products, visit our rates and fees page.Yes, there are a number of ways that you pay out your loan ahead of the loan term specified in your loan contract at no additional cost.

To pay out your loan early or make extra repayments, log into the Better Credit mobile app or customer portal and choose from a range of options such as debit card payment, bank transfer or direct debit.

Anyone unsatisfied with their loan for any reason can return the principal funds, including any payments made to third parties on your behalf, within a 48-hour cooling-off period and cancel their loan4.

If you purchased a vehicle or other item with your loan, Jacaranda does not require the seller to cancel the sale or release the funds back to you. Returning your purchase to the dealer, to the seller or to Jacaranda Finance doesn't qualify as a loan cancellation. The loan is only cancelled once the funds have been received and have cleared within the Jacaranda Finance bank account.

Simply call our customer service team to cancel your loan and organise the return of any money paid (including to other parties).