Fast Cash Loans

Fast Cash Loans can act as a safety net when you’re hit with an unexpected bill.

If you find yourself short on cash, a bank might not be able to lend you the money you need quickly.

When you apply for a loan with Jacaranda, we keep things simple, so you can get your funds quickly.

Check If You Qualify

With no impact on your credit score!

Check If You Qualify with no impact on your credit score!

*Subject to lending criteria, T's and C's'

*Subject to lending criteria, T's and C's'

Fast Cash Loans can act as a safety net when you’re hit with an unexpected bill.

If you find yourself short on cash, a bank might not be able to lend you the money you need quickly.

When you apply for a loan with Jacaranda, we keep things simple, so you can get your funds quickly.

Why choose a Jacaranda Loan?

We’re a fast, reliable and fair lender that’s been helping Aussies since 2014 - here's why we think you should choose us.

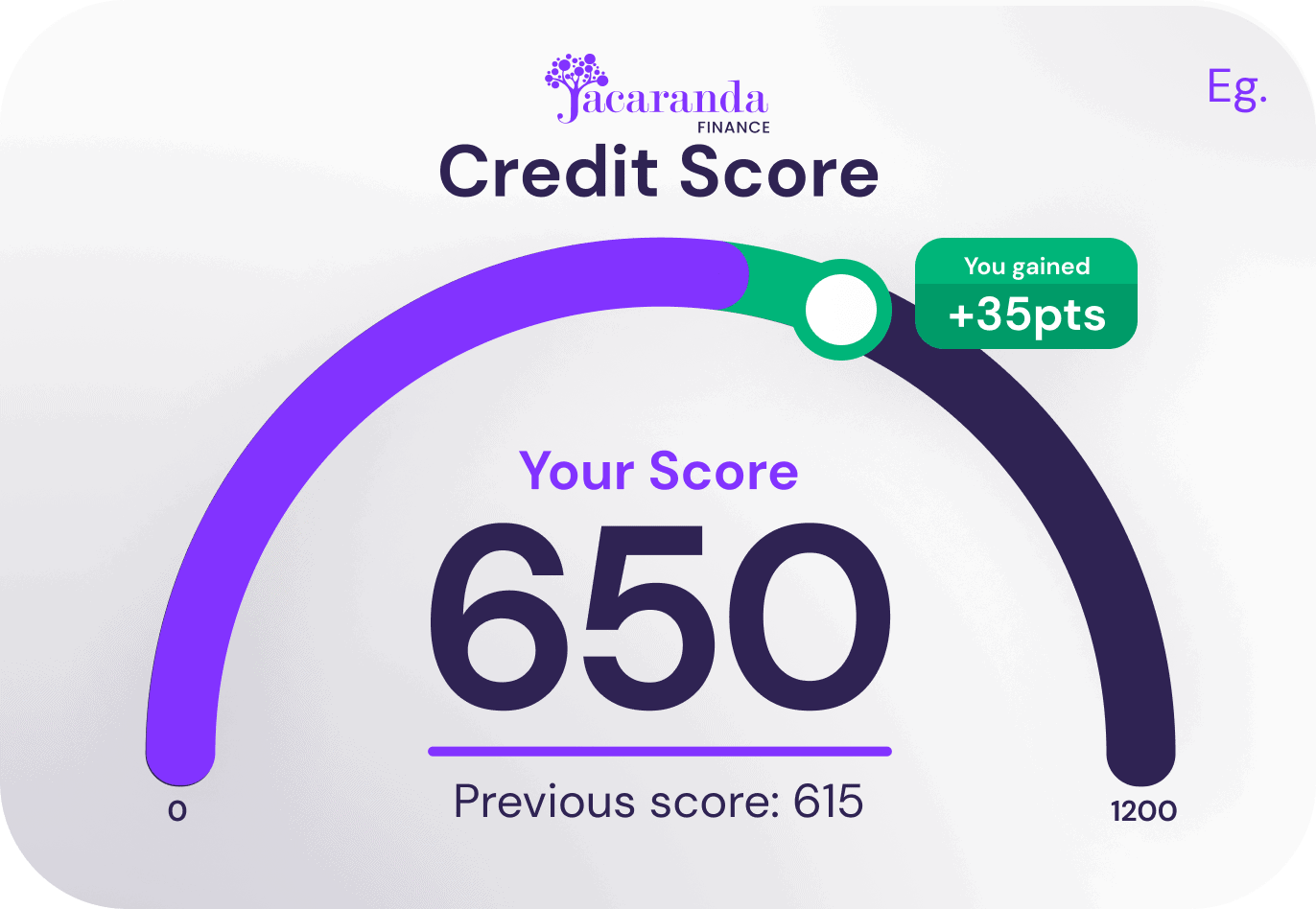

We could help your credit score improve

We’re a part of the Comprehensive Credit Reporting (CCR) regime, which makes it much easier to build your credit history and credit score. By making your loan repayments on time and in full, we can communicate this positive repayment information to the credit bureaus, which could help improve your credit score over time.

Find out more about how Comprehensive Credit Reporting works here.

We Make Applying Easy

We know how important it is to receive your funds in a timely manner. As a hard-working Australian, you don’t have time to waste on needless paperwork.

That’s why our loan application process has been perfected over time to be as simple and quick as possible.

Am I eligible for a Fast Cash Loan?

Eligibility requirements

The basic eligibility criteria you must meet before submitting an application:- Be at least 19 years of age.

- Be employed on a permanent or casual basis.

- Have a consistent income going into your own bank account for the last 90 days.

- Be in control of your finances and be handling existing financial commitments comfortably.

- Be an Australian citizen or permanent resident with a fixed address.

- Have an active email address, phone number, and online banking account in your name that belongs to you.

We accept a wider range of credit history than a bank or a prime lender, but we do not recommend submitting an application if:

- You are currently or recently bankrupt (you must be three years discharged and in control of your finances)

- You are not comfortably repaying your existing financial obligations

What can you use a Fast Cash Loan for?

Our customers commonly take out a Fast Loan for some of the following reasons:

Car repairs

When your car breaks down or is damaged in an accident, getting it fixed can be very expensive. Our car repair loans can help you get back on the road in no time.

Vet bills

Whether you need money to pay for an emergency vet bill or to buy a new pet, Jacaranda Finance could have a vet bills loan to suit you.

Medical bills

Some medical procedures can cost hundreds if not thousands of dollars! You can turn to Jacaranda for a personal loan to help pay for any large medical bills.

White goods & furniture

Applying for a white goods loan with us can take the stress of a key appliance breaking down: you could receive your money on the same day and hop online to shop for a new one.

Rental bonds & moving costs

A Jacaranda rental bond loan can help you manage medium expenses such as bonds and with removalists and lets you take some of the stress out of moving.

Holidays

Personal loans can also be used for flights, accommodation, and other costs that come with booking a holiday. Check out our holiday loans today!

Home repairs

Whether it's cracked tiles or a leaky roof, a home improvement loan can help you sort out those much-needed repairs you’ve been putting off.

Home renovations & installations

You can use our home renovation loans to improve your home via renovations, remodelling, installing tech like solar panels, landscaping, and much more!

Debt consolidation

If you're juggling multiple loan & credit card repayments, you can consolidate them into one easier-to-manage debt consolidation loan with Jacaranda, provided all other repayments are up to date and on time.

Weddings

Whether it's for the ring, the dress or the venue, let Jacaranda alleviate some of that wedding stress and help you pay for your special day with a wedding loan.

Rates & Fees

Trusted by 1,000s

Fast Cash Loan FAQs

Want to learn more about our Cash Loans and how they work? Find out all the answers to our most frequently asked questions here.

Fast Cash Loans are a loan option available in Australia. They allow you to get cash quickly and easily. They’re especially handy if you’re hit with an unexpected or emergency expense. Many online lenders have technology that allows them to process applications quickly. Fast Cash Loans can usually be accessed within a day, and in some cases, in just a few hours.

Jacaranda Finance offers fast cash loans up to $25,000 with flexible loan terms and repayment options. All you have to do is fill in our quick online application form today and our team will make sure you get a fast outcome.

It's possible to receive a loan offer from us if you have 'bad credit'. We offer fast and reliable personal loans for applicants with varying credit histories. If you're in a good financial position and handling your existing financial commitments comfortably, check if you're eligible and submit an application.

We accept a wider range of credit history than a bank or a prime lender. But we do not recommend submitting an application if you're currently or recently bankrupt (you must be three years discharged and in control of your finances) or if you are not comfortably repaying your existing financial obligations.

Once you've been approved and have accepted our offer by signing your digital contract, we automatically attempt to release the money to your bank account. Most customers have a New Payments Platform (NPP) bank account and receive the money within 60 seconds.3

You must have an NPP-enabled bank account. For customers without an NPP-enabled bank account (or the instant payment fails), the money will be available overnight on weekdays and overnight the following business day if approved on a weekend or public holiday.

We require bank statements from you to get an insight into your spending habits and to verify your income and expenses. We want to ensure that you can comfortably afford our loan repayments.