Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

With the cost of living still weighing on our minds, it’s more important now than ever to cut down on expenses this Christmas.

In this article, we’ll run through our top 20 tips on how to save money for Christmas. We’ll also provide some handy stats on what we like to buy each festive season and just how many of us are planning on cutting back.

On this page:

Originally published by William Jolly in October 2023.

A lot. That’s the short answer. For the long answer, the Australian Retailers Association (ARA)’s data expects a $69.7 billion boost in retail sales during the six-week peak season leading up to Christmas, which is a 2.7% increase on last year’s figures.

ARA CEO Paul Zahra says Australians want to enjoy the festive season whilst managing their household budgets.

“Shoppers are being savvier than ever with their dollars,” Mr Zahra said.

“They’re looking for the best value when it comes to buying presents for their loved ones, which is why sales events like Black Friday/Cyber Monday weekend are consistently growing in popularity. We are also seeing a continued trend towards spending on little luxuries whilst some broader discretionary categories are forecasted to be in decline.”

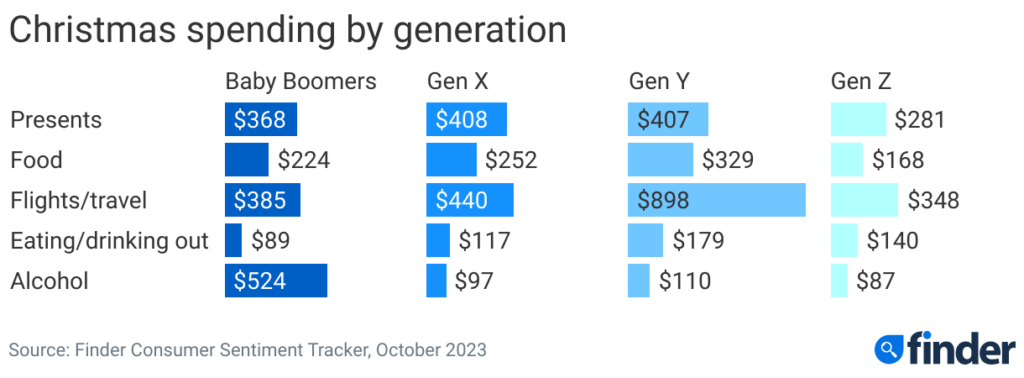

While you might think presents and food would be the two most significant Christmas expenses, it’s actually flights and travel.

That’s according to Finder’s Christmas survey in October 2023, which found the average travel spend per person at Christmas time was an estimated $533. This is closely followed by presents ($373) and food ($249).

Alcohol ($192 per person) and eating/drinking out ($133) were also significant expenses. Overall, Finder’s survey found the average Aussie will fork out $1,479 on Christmas in 2023.

This spending also varies wildly by age. Millennials are predicted to be this year’s biggest spenders at $1,924 per person, while Gen Z plan to spend the least ($1,023).

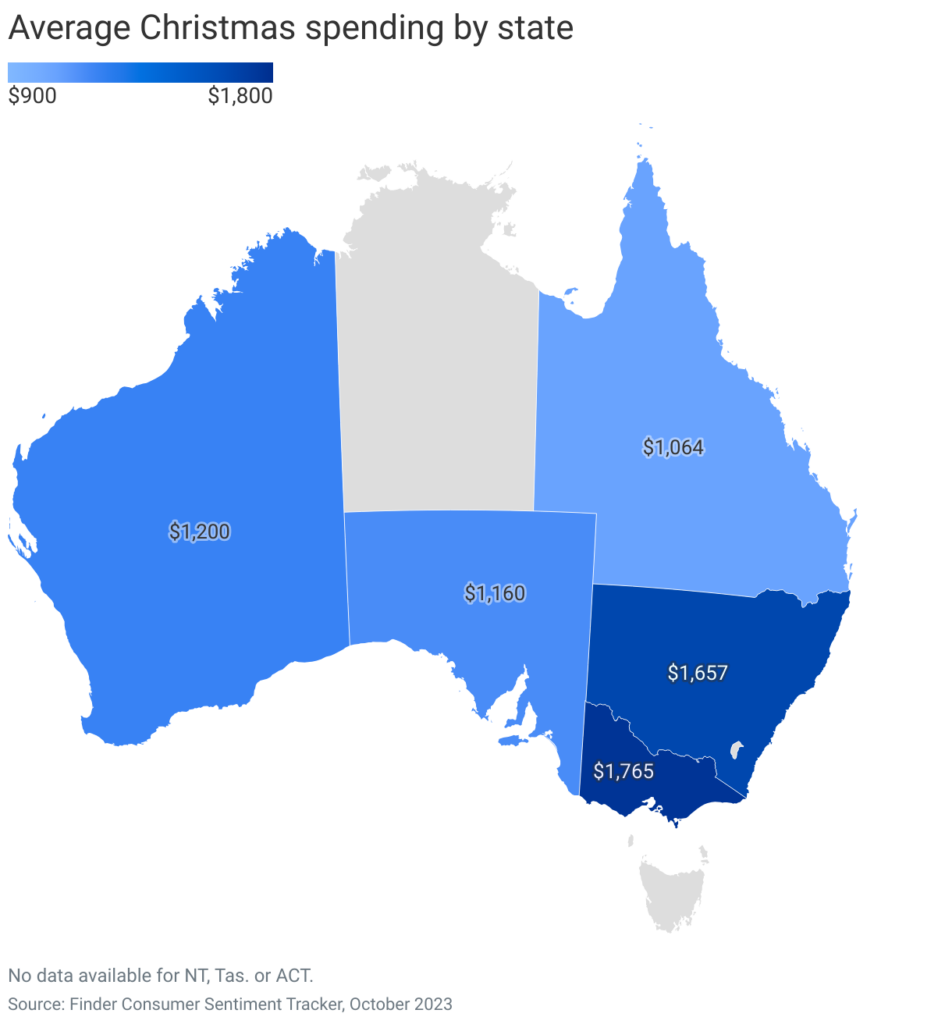

Finder’s data suggests Victorians will be the biggest spenders this Christmas at $1,765. New South Wales shoppers will be a close second, while Queenslanders are the most frugal ($1,064 per person).

With energy bills, fuel, rent and mortgage costs, groceries and just about everything else causing financial pain, many Australians plan on tightening the purse strings and cutting back on their expenses this Christmas.

A Deloitte survey discovered that three-quarters of shoppers plan on scaling back their Christmas purchases to manage stretched budgets. Finder’s research found that 69% were slashing their pre-Christmas spending to try to save.

One-fifth of the 1,000 respondents said Christmas-related spending made them worry about their financial situation, with the typical Aussie stressed about coping with the increased cost of groceries (63%), fuel (52%) and energy and utility bills (51%).

Compare the Market’s Natasha Innes said it was unsurprising that so many Australians would be watching their spending this Christmas.

“While inflation may be easing, we’re still being hit with high prices from every angle right now, and unfortunately, many people say they will cut back on spending this Christmas,” Ms Innes said.

“The reality is that the dollar isn’t going to stretch as far as it has in the past when it comes to presents. However, it’s good that Australians appear to be setting a budget for the holiday season.

“The last thing we want to see is anyone getting into debt or dipping significantly into their savings to buy presents. Making a budget (and checking it twice) is a great first step in beating rising costs this Christmas.”

Yes, everything is more expensive now, which makes it a lot more challenging to make Christmas memorable for your loved ones. But the good news is that with some strategic planning and savvy savings tips, it’s possible to enjoy an unforgettable Christmas without breaking the bank.

Here are 20 practical tips to help you save money this holiday season and in future holidays.

The earlier you start saving for Christmas, the less financial pressure you’ll feel as the holiday season approaches. Set aside a small amount of money each week or month in a dedicated Christmas savings account. This proactive approach will give you a financial cushion when it’s time to start your holiday shopping.

According to customer data from NAB, 22% of all active savings goals in the NAB App aimed to save money for Christmas shopping, with an average savings of $4,300 by Christmas Eve 2023!

A great way to boost your savings - aside from automatically transferring a set amount to a dedicated account each week - is to make sure you’re on the highest interest rate possible. By looking at comparison sites such as Canstar, we can see the difference between the lowest (0.25% p.a.) and highest (5.75% p.a.) ongoing savings account interest rate is more than 5.50% p.a.

If you started saving on January 1st and deposited $100 a fortnight into a separate account, here’s what you’d have saved by Christmas Day in those two accounts with vastly different interest rates:

The higher the interest rate and the more you save regularly, the more significant your savings will be.

Before starting holiday shopping, establish a strict budget for gifts, decorations, food and festivities. Be realistic about what you can afford and stick to this budget.

This discipline will help prevent impulse purchases, which are all too familiar at Christmas time.

Once you’ve got your budget, list all the people you need to buy gifts for and allocate a specific amount for each person. This list will serve as a roadmap for your holiday shopping, helping you stay organised and on budget.

You might find that some people are easier and less expensive to buy for than others, or you might find that you don’t actually need to buy for that person at all!

If you have a large family or many friends, consider organising a Secret Santa gift exchange. This tradition allows each person to give and receive one gift, reducing the overall number of presents you need to buy.

The four-gift rule is a popular way to manage children’s expectations and keep spending in check. The rule dictates that each child receives four gifts: something they want, something they need, something to wear, and something to read.

According to Finder's research, nearly one in five (18%) Aussies are implementing gift limits for friends and family this year to save on holiday costs.

Homemade gifts are a thoughtful and cost-effective alternative to store-bought items. If you have a particular skill, such as baking, knitting, or crafting, consider making some of your gifts this year.

Let’s face it: we’ve all received a present for Christmas or our birthday that we just absolutely hated. Some of those gifts might still be locked away in a cupboard somewhere, right up the back, so you don’t have to look at them.

As the old saying goes, "One man’s trash is another man’s treasure." So why not look at your belongings and see if there’s anything you can re-gift?

Ensure that the item is in good condition and appropriate for the recipient. Unless you don’t like them, of course.

Did you know that people are much more likely to overspend when using credit instead of money they already have? Multiple studies back this up: one classic study by the Massachusetts Institute of Technology found people who paid via credit card were willing to pay up to twice as much for the same item as people who used plain old cash!

Other studies by Dun & Bradstreet (illion in Australia) and The Federal Reserve Bank of Boston found this disparity to be between 12% - 18%.

This preference for buying things on debt becomes more of a problem at Christmas time. Finder research from 2024 revealed that 38% of Australians racked up Christmas debt, with 15% taking up to five months to pay it all off.

Credit cards can also charge very high interest rates. To avoid accruing credit card debt, use a debit card (or cash) instead of a credit card for your Christmas spending.

As many as one in six Australians plan to use BNPL services like Afterpay for their Christmas shopping. While these services aren’t all that bad if used properly, they can charge late fees and result in black marks on your credit report if you miss any repayments.BNPL schemes can also easily lead to overspending. If you choose to use BNPL, make sure you understand the terms and are confident you can make the repayments on time. You should also be aware of how these products can impact future loan applications.

Buy now, pay later can sometimes be helpful, but the same is rarely said of high-cost debts like payday (short-term) loans and wage advances. Due to their high fees and interest charges, these products can lead to a cycle of debt that’s difficult to escape.

If possible, avoid these types of loans at all costs and look for more sustainable ways to finance your holiday spending.

Black Friday and Cyber Monday are two of the biggest sales events of the year, taking place on the last Friday and Monday of November. In 2023, over $6.7 billion was spent during these four days alone!

Take advantage of sales events such as these to get the best deals on gifts and holiday items in the lead-up to Christmas. According to CPM Australia, 60% of people are planning to do their Christmas shopping on Black Friday.

Aussies have billions of dollars worth of points saved up from the likes of Frequent Flyer and store loyalty programs. NAB’s data reveals a 120% jump in people choosing to cash in their points for a gift card since pre-Christmas 2023.

If you have accumulated points or rewards from loyalty programs, Christmas is one of the best times to use them. These programs can provide significant savings on your holiday shopping.

If you’re hosting Christmas lunch with relatives or are just having a boozy get-together with mates, make sure you ask if everyone is happy to chip some cash in or split the bill for the total food and drink cost. You can also ask everyone to bring a plate, bottle of wine, or even some Christmas crackers for the table.

This approach can reduce the financial burden on any one person. By using bill-splitting apps like Beem or Splitwise, you can also avoid any inevitable arguments over who owes who and how much.

Be open to switching to more affordable brands and shopping around for specials. There are often great deals to be had if you’re willing to look for them.

Websites like CHOICE are great resources for comparing products from different brands to find which ones represent better value.

If you’re taking a trip before or after Christmas Day, you’d be well advised to stock up on a few jerry cans worth of fuel beforehand. Fuel prices around Christmas generally tend to be higher most years due to increased demand, and this year is no exception.

In September, with average petrol prices hitting just shy of $2 per litre nationwide, the odds of the usual Christmas spike are high, so be sure to fill up before the Christmas break if possible.

According to NAB, almost two-thirds (65%) of Aussies with intentions to travel over the next 12 months have had to cancel or postpone their plans due to cost, with 66% believing travel has become too expensive.

They’re not wrong to be wary, as travelling during the holiday season is usually expensive. If it’s possible, consider staying home and enjoying local festivities instead.

If you must travel or have already made plans to, see some of the following articles we’ve written to help cut down on costs.

Since holidays are so expensive, there are lots of savings opportunities!

While decorations and gift wrapping are beloved parts of the holiday season, they can also be expensive. Instead, consider using fabrics such as tea towels, bags, recycled paper, and homemade name tags for your presents. Or just dump it all in a sack and hand it out like a lazy Santa!

Online shopping can offer convenience and savings, but it’s essential to be smart about it. Many retailers offer a 10% –20% discount for first-time customers who sign up online, and plugins like Honey can find you the best available discount at the checkout.

Look for free shipping options and be wary of online scams, too.

Shipping costs can add up quickly when shopping online. Look for free shipping options, or consider shopping in-store to avoid these fees. Alternatively, many stores now offer click-and-collect for free, offering you the best of both worlds.

If you’re struggling to save money in the lead-up to Christmas or have left it too late to snag the best deals, you could still make some extra money by selling things around the house! According to The Australian Circular Economy Hub, Gumtree found as many as 86% of Australians have unwanted or unused items lying around the house, which could be worth as much as $7,000!

Take the opportunity to declutter your home and make some extra cash.

While the best time to start saving for Christmas is the day after, it’s never too late. No matter the year or how close to Christmas you’re reading this, the 20 tips we’ve mentioned above can all make a difference to your Christmas budget.

You can also check out our latest articles for a whole host of fantastic savings guides, such as:

And much more!

Ultimately, if you find yourself stretched financially this Christmas, don’t fret. We can help you out thanks to the manageable fixed-term repayments on our loans.

Whether it’s a Debt Consolidation Personal Loan to help manage some post-Christmas debts or a Holiday Personal Loan to fund that dream getaway with the family, Jacaranda could have the solution for you.