Fast and simple loan to make rental bonds and moving expenses simple.

-

-

-

Resources

-

Company

*Subject to lending criteria, T's and C's'

*Subject to lending criteria, T's and C's'

Whether you're a local or a first-time tourist, the Gold Coast is not a cheap place to call home. Like many other cities across Australia, the Gold Coast has a high cost of living, and has seen steady increases in rent and property prices thanks to the popularity of its beachside suburbs.

If you need extra cash to cover life's major expenses, a Jacaranda quick Cash Loan might be just the thing for you. Thanks to our state-of-the-art online technology, you can:

We’re a fast, reliable and fair lender that’s been helping Aussies since 2014 - here's why we think you should choose us.

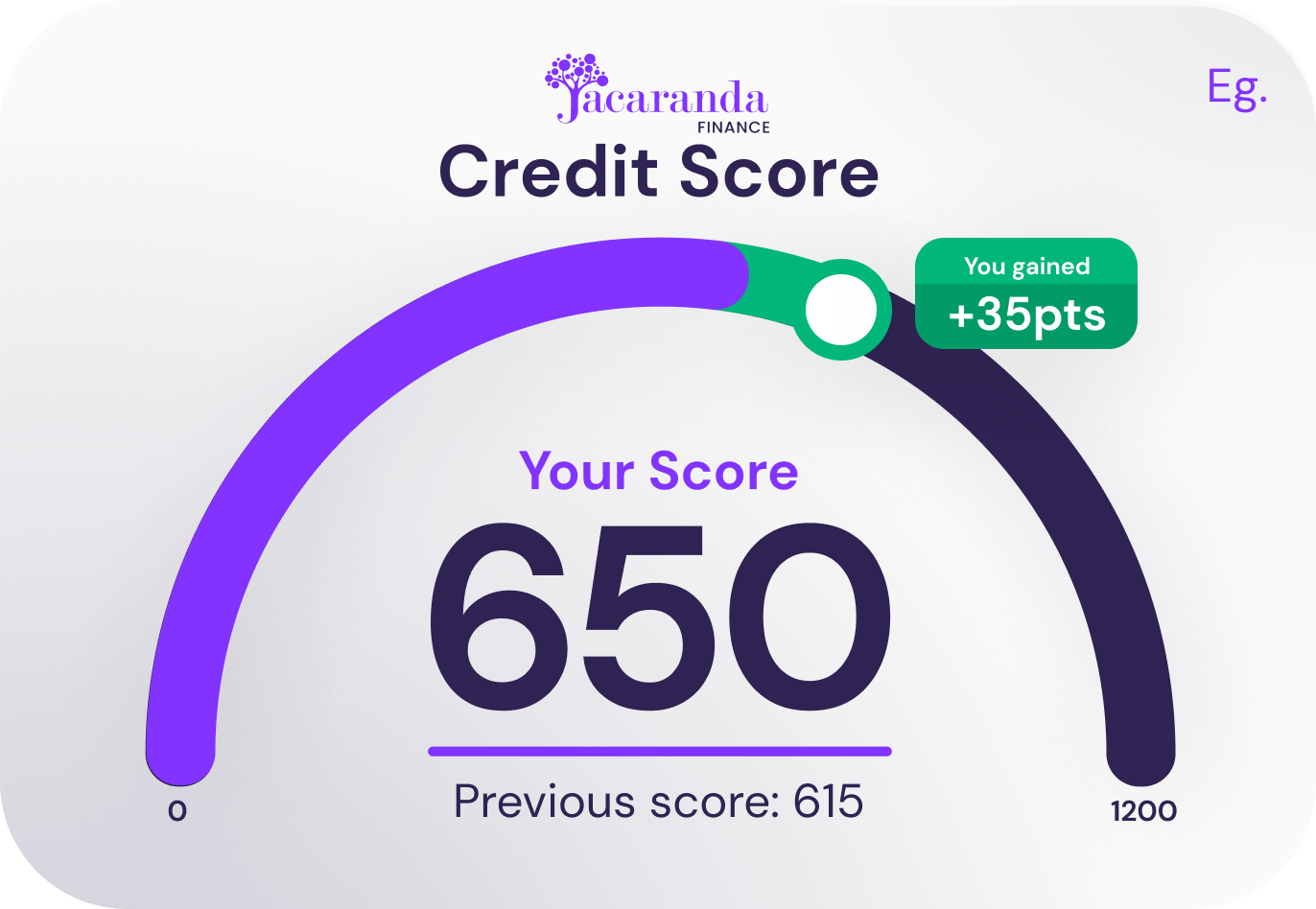

We’re a part of the Comprehensive Credit Reporting (CCR) regime, which makes it much easier to build your credit history and credit score. By making your loan repayments on time and in full, we can communicate this positive repayment information to the credit bureaus, which could help improve your credit score over time.

Find out more about how Comprehensive Credit Reporting works here.

Jacaranda's Personal Loans can help you cover a wide range of expenses for your financial situation - both the expected and unexpected. With fixed repayments and both secured and unsecured options available, here's what you can use our cash loans for on the Gold Coast and just about anywhere else in Australia.

Get in touch with us if you have any questions about whether a Personal Loan could be suitable for your needs.

| Annual Income | |

|---|---|

| $107,193 | $92,029.60 |

| Average of Gold Coast | Average of Australia |

| Monthly Cost of Living (incl rent) | |

|---|---|

| $3,394.94 | $8,347.17 |

| Average cost of living for a single person on the Gold Coast | Average cost of living for a family of four on the Gold Coast |

| $3,251.12 | $8,163.10 |

| Average cost of living for a single person in Australia | Average cost of living for a family of four in Australia |

No matter where you are in Australia, you can apply for a loan with Jacaranda entirely online!

Still have questions about how our loans work? Here are the answers to some of our most frequently asked questions.

You can apply for varying loan amounts with Jacaranda, depending on your needs:

For detailed information about who our products are designed for, please review our Target Market Determinations.

Use our loan repayment estimate calculator to get a guide on what your repayments could be. To get an idea of what rates, fees and charges are associated with our loans, visit our rates and fees page.

Our loan application process has been designed to be as simple and quick as possible, as we know how important it is to receive your funds in a timely manner. How quickly you can apply for a personal loan and receive your funds will depend on your situation.

Applying for a loan with Jacaranda Finance takes most people 5-12 minutes1, but it could take longer depending on a number of factors such as but not limited to how fast you are at typing or if you have all the required information on hand.

After applying, most customers get an outcome on their loan application on the same day during normal business hours once we have received all of the supporting information we require. We do not guarantee same-day outcomes for all customers.2

Once an applicant has been approved and they have signed a contract, we automatically attempt to release the money to the applicant's bank account. Most customers have a New Payments Platform (NPP) bank account and receive the money in their bank account within 60 seconds. For other customers, the money will be available overnight on weekdays and overnight the following business day if approved on a weekend or public holiday.3

Before you formally apply with Jacaranda, you can check if you qualify for a loan in a way that does not impact your credit score. We do this by performing a 'soft' credit check that is only visible to you.

If you don't meet our initial criteria, your credit score won't be affected.

Once you've checked your eligibility and we've let you know that you do qualify for a loan, you have the option to move forward with a full application.

We will perform a credit assessment during this process, which involves checking your credit report. By submitting a full application, you authorise Jacaranda Finance to obtain a copy of your full credit file, referred to as a 'hard' credit check.

Other lenders will be able to see that you applied for a loan with Jacaranda.

This might impact your credit score.

Review our Privacy Policy for more information.

Anyone unsatisfied with their loan for any reason can return the principal funds, including any payments made to third parties on your behalf, within a 48-hour cooling-off period and cancel their loan4.

If you purchased a vehicle or other item with your loan, Jacaranda does not require the seller to cancel the sale or release the funds back to you. Returning your purchase to the dealer, to the seller or to Jacaranda Finance doesn't qualify as a loan cancellation. The loan is only cancelled once the funds have been received and have cleared within the Jacaranda Finance bank account.

Simply call our customer service team to cancel your loan and organise the return of any money paid (including to other parties).

If you are unsure whether you're eligible, you can check if you qualify initially. This will not impact your credit score.

We accept a wider range of credit history than a bank or a prime lender, but we do not recommend submitting an application if: